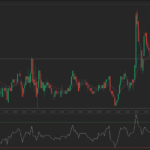

George Soros, billionaire investor, joined Northern Trust Corp. and BlackRock Inc. in lowering investments in gold backed ETPs. That happened before the market went bearish last month, followed by the deepest plunge in history April 15 and thus erasing $42 billion from the value of ETP assets this year, according to data compiled by Bloomberg. Soros cut his investment in the SPDR Gold trust, worlds biggest such fund, by 12% to 530 900 shares as of March 31 according to a SEC report published yesterday. Many other investors also lost faith in the precious metal as a safe haven of wealth preservation attracted by the rising value of equities and the failure of the monetary stimulus policies to spur inflation.

Michael Gayed, co-portfolio manager of ATAC Inflation Rotation Fund at New York-based Pension Partners LLC said for Bloomberg: “It’s a very nasty time for gold investors as prices are dropping while stocks keep raging ahead”.

Northern Trust cut its SPDR holdings by 57% to 6,9 million shares according to a May 1 filing. BlackRock, the worlds biggest money manager, took the same action and reduced its investment by 50% to 4,1 million shares, says an April 12 filing.

Global ETP holdings have dropped 16% in 2013 following constant annual rise since the product was first listed in 2003, according to data compiled by Bloomberg. An earlier finding showed that Soros Fund Management LLC cut its holdings in SPDR by 55% in the last three months of 2012. It is expected that a further drop in ETP holdings will lead to additional price plunges.

Warren Buffet said last year in his annual letter to shareholders that investors should avoid gold and he wouldnt buy even if it goes to $800.