On Wednesday British pound remained mainly higher against the US dollar, while additional support was received by upbeat labour market data from the United Kingdom.

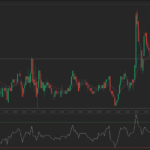

GBP/USD hit 1.5682 during European morning trade, currently the session high and highest since February 13th, after which consolidation followed at 1.5670. Support was expected in the 1.5600-1.5635 range, while resistance was to be encountered in the 1.5690-1.5710 zone.

Minutes ago, official data showed Jobless Claims in the United Kingdom registered a sharper than projected decline in May, 8 600, compared to 5 000. The number of people, seeking unemployment assistance, dropped by 7 300 during April.

Claimant Count Rate in UK remained unchanged at 4.5% during May, in line with expectations.

Another report showed that Average Earnings Including Bonuses increased by 1.3% during the first three months until April this year, as the indicator recorded a 0.6% increase during the three months until March. Remuneration level was higher due to the fact companies paid bonuses to employees during April, while last year bonuses were paid in March. However, UK earnings including bonuses rose at a historically slow rate during the three-month period until April, posing a threat to fragile economic recovery, while nations purchasing power still remained low.

Additionally, the International Labour Organization said Unemployment Rate remained stable at 7.8% during the first three months until April this year, compared to the three months until March. This indicator also matched exactly preliminary estimates.

Meanwhile, market sentiment was dominated by ongoing speculation whether the Federal Reserve Bank of the United States will begin to unwind its bond purchases later this year.

The pound extended its expansion against the euro as well, with EUR/GBP down by 0.38% to 0.8476.

The euro zone was expected to release official report on Industrial Production later today.