Natural gas fluctuated on Monday, swinging between gains and losses. The fuel, like all other dollar-priced commodities, was pressured by the stronger greenback. However, natural gas drew support by forecasting models, which projected warmer weather throughout the week before cooling down in the beginning of July.

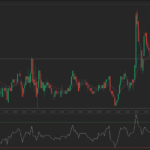

On the New York Mercantile Exchange, natural gas for August delivery traded at $3.809 per million British thermal units, up 0.42% on the day. Prices ranged between daily high and low at $3.843 and $3.745 per mBtu.

Gas prices tend to rise during the summer season as increased electricity demand to power air-conditioning calls for more supply of the fuel, which is used for a quarter of the U.S. electricity generation.

The latest EIA report said Natural gas inventories rose generally in line with expectations of 90 billion cubic feet during the week ending June 14. The Natural Gas Storage Indicator rose by 91 billion cubic feet to 2 438 billion, up from the preceding week’s 2 347. Natural gas stockpiles up to June 14 were 18.7% below last year’s reading of 2 997 billion cubic feet and 1.9% below the five-year average 2 485 billion.

Early injection estimates for this week’s inventories data are supposed to vary between 75 billion cubic feet and 95 billion cubic feet, compared to a 58 billion cubic feet increase during the same week a year earlier. The report is due on Thursday at 12:30 GMT.

Elsewhere on the New York Mercantile Exchange, WTI crude erased earlier losses. Light, sweet crude for August delivery traded at $93.67 per barrel at 15:00 GMT, losing the minor 0.03% on the day. Prices varied between days high and low at $93.90 and $92.74 respectively.

Meanwhile, Brent oil August futures marked a 0.73% daily loss. The European benchmark traded at $100.18 per barrel, ranging between days high at $101.09 and $99.78.