Gold erased earlier daily losses and rose to positive territory as a broadly weaker greenback allowed dollar-denominated commodities to extend positions. Platinum also reversed movement, while silver and palladium trimmed prior losses.

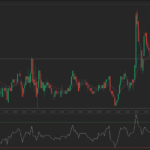

On the Comex division of the New York Mercantile Exchange, gold futures for December delivery traded at $1 370.00 per troy ounce at 13:54 GMT, up 0.27% on the day. Prices ranged between days high of $1 372.50, near Mondays two-month high, while days low stood at $1 351.90 an ounce. The precious metal slipped 0.68% on Monday, snapping three days of gains, and trimmed current week’s decline to 0.4%.

Gold extended positions on Tuesday amid a broadly weaker U.S. dollar. The greenback tends to trend inversely to dollar-priced commodities. Strengthening of the dollar makes raw materials more expensive for foreign currency holders and limits their appeal as an alternative investment. The dollar index, which measures the greenbacks performance against six major counterparts, traded at 80.83 at 13:54 GMT, down 0.56% on the day. The September contract fluctuated between days low of 80.78, the lowest since June 18, while days high stood at 81.38. The U.S. currency gauge slipped 0.06% on Monday, extending current weeks decline to 0.6%

The dollar was pressured and allowed for raw materials to pick up as market players continued to speculate whether tomorrows FOMC July meeting minutes will point to deceleration of Feds Quantitative Easing program in September. According to a Bloomberg survey of economists, 65% of the participants expected that the Federal Reserve will start trimming its $85 billion per month bond purchases after FOMC’s September meeting.

David Govett, head of precious metals at Marex Spectron Group in London, said for Bloomberg: “It feels as though the market has run out of ideas for the time being after the rally. We will have to wait for the FOMC minutes on Wednesday evening for fresh impetus.”

The precious metal has largely been tracking shifting expectations for an earlier-than-expected deceleration of the central bank’s bond purchases. An exit from Quantitative Easing would deliver a heavy blow to dollar-priced raw materials as it will strengthen the dollar, thus making commodities more expensive for foreign currency holders and limiting their appeal as an alternative investment. At the same time, gold is mainly used as a hedge against inflation, which tends to arise as central banks ease money supply, therefore stimulus tapering would cripple demand for the precious metal.

Apart from Wednesday’s Fed minutes, market players will also be looking ahead at the upcoming U.S. data to gauge the strength of the U.S. economy. On Wednesday, Julys Existing Home Sales are expected to have risen to 5.13 million, up from June’s 5.08 million. On Thursday, last week’s Initial Jobless Claims likely rose by 10 000 to 330 000, while the Markit Flash U.S. Manufacturing PMI for August is projected to have advanced to 54.0 from July’s 53.7. On Friday, July’s New Home Sales are expected to have declined to 0.490 million houses sold, down from 0.497 million in the preceding month.

Elsewhere on the precious metals market, platinum rose back to positive territory, while silver and palladium remained on the red side but trimmed daily losses. Silver for delivery in September traded at $23.123 per ounce at 13:49 GMT, down 0.19% on the day. The precious metal rebounded more than 2% from a days low of $22.295, while days high stood at $23.240 an ounce. Platinum October futures rose to $1 518.65 per ounce, marking a 0.64% advance. Futures ranged between days high of $1 520.90 and low of $1 497.15. Meanwhile, palladium for delivery in September rose to $751.30 an ounce from a low of $743.90, trimming its daily decline to 0.21%. Days high was touched at $753.60 per ounce.