US dollar slid against its US counterpart on Friday, following a survey by the Richard Ivey School of Business and Purchasing Management Association showed that Canadian business activity improved in September.

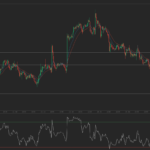

USD/CAD fell to a session low at 1.0298 at 14:40 GMT, after which consolidation followed at 1.0304, still down 0.28% for the day. Support was likely to be received at October 1st low, 1.0288, while resistance was to be met at October 2nd high, 1.0356.

Earlier today it became clear that the Ivey PMI for Canada increased to a seasonally adjusted reading of 51.9 in the month of September, while in August the index stood at 51.0. Results suggested that business activity has expanded. The survey encompasses managers of companies in all sectors of Canadian economy.

Meanwhile, the US dollar was under continuous pressure amid uncertainty over the possible implications on US economic recovery after the partial US government shutdown. President Barack Obama said that there was only “one way out” of this situation for Republican House Speaker John Boehner – to allow a vote on a stopgap spending bill without conditions.

In addition, no data on the US non-farm payrolls and rate of unemployment has been released by the Labor Department today due to the partial government shutdown. Fed President for Atlanta Dennis Lockhart said yesterday that the insufficient economic data would tend to introduce caution among Fed policymakers whether to reduce the pace of monthly asset purchases.

International Monetary Fund head Christine Lagarde said overnight that a failure to lift the US debt limit could threaten the global economy and also warned that US economic growth could fall below 2% in 2013.

“The overall growth impact of the U.S. government shutdown is a factor” for the Canadian dollar, Camilla Sutton, head of currency strategy at Bank of Nova Scotia, said by phone from Toronto, cited by Bloomberg. “The pricing of oil has moved against the Canadian dollar. Not so much because of the level of WTI, but because there’s been a widening in the spread between Brent and Western Canadian Select.”

Elsewhere, the loonie, as Canadian dollar is also known, moved higher against the euro, with EUR/CAD cross decreasing 0.38% on a daily basis to trade at 1.4022 at 15:15 GMT.