US stocks declined, driving the Standard & Poor’s 500 Index to a smaller weekly gain, after benchmark indexes rallied to all-time highs yesterday amid optimism over the economic recovery. Despite the drop US stocks rose for a second straight week, as data from durable goods to housing and employment fueled optimism that the world’s largest economy is strengthening.

The S&P 500 fell less than 0.1% to 1,841.40 at the Friday close in New York. The Dow Jones Industrial Average slipped 1.47 points, or less than 0.1%, to 16,478.41. Both measures posted their second weekly gain. Volume has been lower-than-average amid the Christmas holiday this week.

The Standard & Poor’s 500 Index climbed 1.3% to 1,841.40 in the holiday-shortened week, setting a record on December 26. The Dow Jones Industrial Average added 257.27 points, or 1.6%, to 16,478.41.

“The data by and large has been better,” Derek Hamilton, a global economist at Waddell & Reed Financial Inc. in Overland Park, Kansas, said in a phone interview for Bloomberg. His firm manages $114 billion. “It supports the Fed’s view that the economy in general is getting better and is strong enough to withstand tapering.”

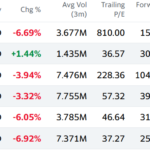

In corporate world, 9 of 10 main industries in the S&P 500 gained as commodity and telephone companies increased more than 2% for the best performance in the benchmark index. Utility stocks fell 0.2% for the only loss.

Apple advanced 2% to $560.09. The company, ending six years of negotiations, struck a deal that will give both the U.S. phone maker and China Mobile a means to fight declining share in the market of 1.2 billion wireless subscribers. China Mobile will sell the iPhone 5s and 5c models in its stores from January 17, the companies said in a statement that provided no financial terms.

Twitter, the microblogging service that held its initial public offering last month, jumped 6.2% to $63.75. The stock has surged 145% since going public at $26 on November 6, as investors bet Twitter can attract more ad dollars as companies seek to market their wares through wireless devices and tie-ins with television programming. However, companys shares pulled back 13% on Friday.

Textron rose 1.1% on Friday, to $36.61. The company, seeking to counter a slump in business-jet sales, agreed to buy Beechcraft to boost its lineup of propeller-driven aircraft.

General Motors slipped 1.4% after the auto maker and its Chinese partner said it would recall more than 1.46 million Buick and Chevrolet cars because of defective fuel-pump brackets.