The euro declined against the US dollar on Tuesday, following a report that showed German economic sentiment unexpectedly decreased this month.

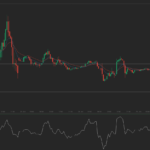

EUR/USD touched a session low at 1.3525 at 10:00 GMT, after which consolidation followed at 1.3536, losing 0.12% for the day. Support was likely to be received at January 20th low, 1.3508, also the pairs lowest since November 25th, while resistance was to be encountered at January 20th high, 1.3568.

The euro came under selling pressure after official data showed the economic sentiment in Germany, the largest euro zone economy, unexpectedly declined in January.

The ZEW Centre for Economic Research reported today that its German index of economic sentiment declined to 61.7 in January from 62.0 in the previous month. According to the median analyst forecast the index should have increased to 64.0 this month.

However, the German current conditions index improved to 41.2 in January from 32.4 in the preceding month, exceeding analysts expectations of an advance to 34.1.

In addition, the euro zone economic sentiment also improved to 73.3 in January from 68.3 in the previous month. Analysts had predicted the index to reach 70.2 this month.

A level above 0.0 on the index is indicative of optimism, while a level beneath 0.0 reflects pessimistic expectations.

Meanwhile, greenbacks demand continued to be supported by a recent series of overall upbeat reports.

Data showed on Friday that US home construction slowed less than analysts had projected, while industrial output expanded for a fifth consecutive month. Only the consumer sentiment came at a lower-than-expected reading in January, but this was not enough to change the overall market consensus that Fed will continue tapering throughout 2014.

A report by the US Commerce Department, showed that housing starts decreased 9.8% to 999 000 annualized rate in December, after they have been revised to 1.11 million pace in the previous month, the strongest figure since November 2007. Analysts had expected that housing starts will decline to 985 000 in December. Building permits fell by 3% to a 986 000 pace.

Last year, builders began constructing 923 400 homes, which is 18.3% higher than a year ago and is the largest number since 2007, when 1.36 million houses were constructed.

At the same time, industrial production in the United States rose 0.3% in December on a monthly basis, in line with expectations, supported by overall recovery in manufacturing and mining sectors. On annual basis, industrial output expanded 3.7% in December, or 0.9% higher than the peak registered before the global recession. November’s result has been revised down to a 1.0% increase from 1.1% gain previously. In October and September, however, nation’s industrial production has been moderately revised up.

The release of worse-than-expected consumer sentiment data in January, slightly pressured the greenback’s demand. January’s preliminary reading of the Thomson Reuters/University of Michigan consumer sentiment index registered at 80.4, defying analysts’ projections for an advance to 83.5 from December’s final reading of 82.5.

Overall, the reports provided support to greenback’s demand, as they favored the view that the Federal Reserve Bank may continue tapering during the year. Central bank’s policy makers said on December 18th that they will reduce monthly asset purchases to $75 billion from $85 billion, underscoring improving labor market conditions.

The bank will probably continue to pare stimulus by $10 billion at each policy meeting before exiting the program in December, according to a Bloomberg News survey of 41 economists, conducted on January 10th. The Federal Open Market Committee is scheduled to meet next on January 28-29.

Elsewhere, AUD/USD touched a daily high at 0.8838 at 2:00 GMT, after which consolidation followed at 0.8822, up 0.11% for the day. Support was likely to be received at January 20th low, 0.8757, also the lowest point since July 22nd 2010, while resistance was to be met at January 16th high, 0.8906.