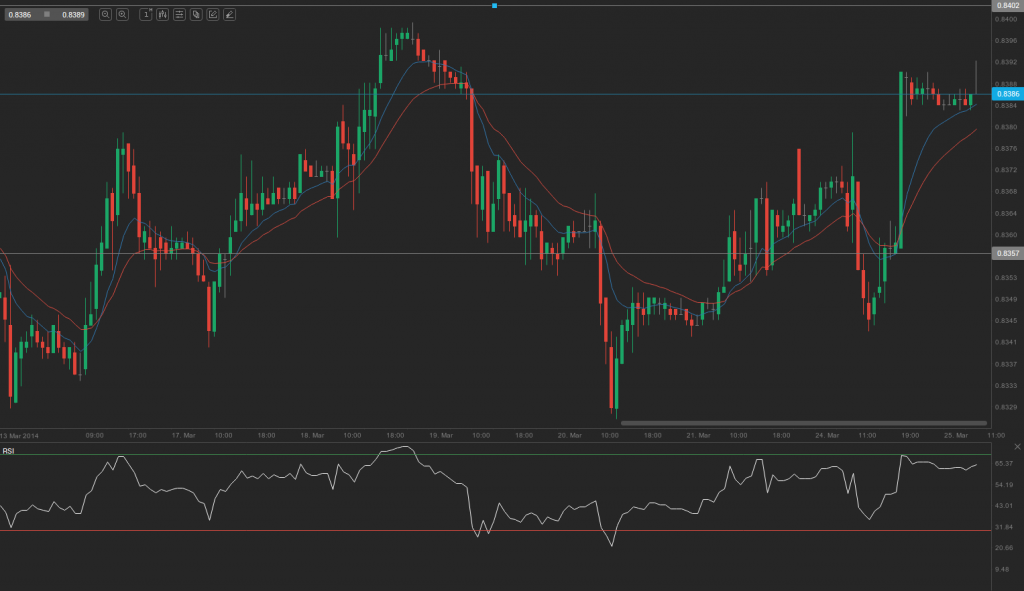

During yesterday’s trading session EUR/GBP traded within the range of 0.8344-0.8391 and closed at 0.8387.

At 7:14 GMT today EUR/GBP was gaining 0.02% for the day to trade at 0.8390. The pair touched a daily high at 0.8394 at 7:05 GMT.

Fundamental view

The index of business climate in Germany probably dropped to 110.9 in March, according to the median estimate by analysts, from a reading of 111.3 during the preceding month. It is based on a survey, encompassing almost 7 000 companies operating in manufacturing, construction, retail and wholesale trade.

The IFO gauge of business climate represents an average of the index of expectations and the index of current assessment. Both indexes are equally-weighted. Values above 100.0 are indicative of a greater number of positive forecasts. The more readings distance from this key level, the stronger the confidence of the entities surveyed is. A higher than projected reading will provide a boost to euros demand.

The IFO gauge of expectations, reflecting economic expectations of German companies during the upcoming six months, probably slowed down to 107.7 during March from 108.3 in the preceding month.

The IFO gauge of current assessment for Germany, reflecting economic conditions at present, probably improved to 114.6 in March from 114.4 in February. The Ifo Institute for Economic Research is expected to release the official figures at 9:00 GMT.

The annualized index of consumer prices in the United Kingdom probably slowed down to 1.7% in February, according to the median estimate by experts, from a rate of 1.9% in January. In monthly terms, consumer prices probably rose 0.5% last month, following a 0.6% drop in January. In case consumer inflation accelerates more than anticipated, this would provide support to British pound.

The annualized core consumer price index (CPI), which excludes volatile components such as food, energy, alcohol and tobacco, probably was at 1.6% in February, the same as in January.

At the same time, the number of approved loans for house purchase in the country probably increased to 50 000 during January from 49 972 in the preceding month. The British Bankers Association will release the official figure at 9:30 GMT.

Technical view

According to Binary Tribune’s daily analysis, in case EUR/GBP manages to breach the first resistance level at 0.8402, it will probably continue up to test 0.8421. In case the second key resistance is broken, the pair will probably attempt to advance to 0.8451.

If EUR/GBP manages to breach the first key support at 0.8357, it will probably continue to slide and test 0.8327. With this second key support broken, the movement to the downside will probably continue to 0.8310.