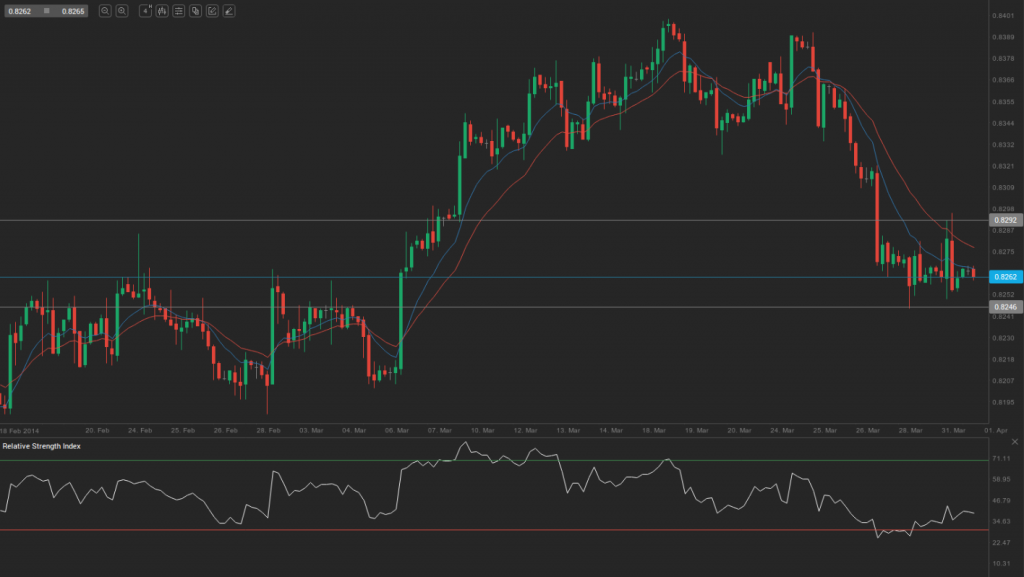

During yesterday’s trading session EUR/GBP traded within the range of 0.8252-0.8298 and closed at 0.8266.

At 6:58 GMT today EUR/GBP was gaining 0.01% for the day to trade at 0.8265. The pair touched a daily high at 0.8269 at 6:25 GMT.

Fundamental view

Single Currency Zone

The final reading of Spanish manufacturing PMI probably advanced to 52.9 in March from 52.5 in the prior month. Values above the key level of 50.0 are indicative of expansion in the sector. Markit Economics is to release the official reading at 8:13 GMT.

The same indicator for Italy probably fell to a reading of 52.2 last month from 52.3 in February. Markit will publish the official data at 8:43 GMT.

Frances final manufacturing PMI for March probably met the preliminary reading at 51.9, which was reported on March 24th. The official reading is expected at 8:48 GMT.

Germanys final manufacturing PMI probably also met the preliminary reading at 53.8 in March. The official result is to be announced at 8:53 GMT. Higher than anticipated readings would certainly bolster demand for the euro.

The number of jobless people in Germany probably decreased by 9 000 in March, according to the median estimate by experts, after another drop by 14 000 in February. A greater than projected drop would have a bullish effect on the single currency. At the same time, the rate of unemployment in the country probably remained steady at 6.8% in March. The Federal Statistical Office is expected to release the official rate at 8:55 GMT.

Euro zones final manufacturing PMI for March probably met the preliminary reading at 53.0, which was announced on March 24th. In case market expectations are exceeded, the euro will receive support. Markit Economics is to release the official result at 8:58 GMT.

The rate of unemployment in Italy probably remained unchanged at 12.9% in February. Istat will release its monthly report at 9:00 GMT.

The jobless rate in the Euro zone as a whole probably remained steady at 12.0% in February. The official rate is due to be released at 10:00 GMT by Eurostat. Lower than expected unemployment would be supportive for the euro.

United Kingdom

Manufacturing activity in the United Kingdom probably slowed down in March, with the corresponding PMI falling to 56.6, according to the median forecast by analysts. In February the index came in at a reading of 56.9. Higher than expected values would provide a boost for the sterling. The Chartered Institute of Purchasing and Supply (CIPS) is to announce the results from its monthly survey at 9:30 GMT.

Technical view

According to Binary Tribune’s daily analysis, in case EUR/GBP manages to breach the first resistance level at 0.8292, it will probably continue up to test 0.8318. In case the second key resistance is broken, the pair will probably attempt to advance to 0.8338.

If EUR/GBP manages to breach the first key support at 0.8246, it will probably continue to slide and test 0.8226. With this second key support broken, the movement to the downside will probably continue to 0.8200.