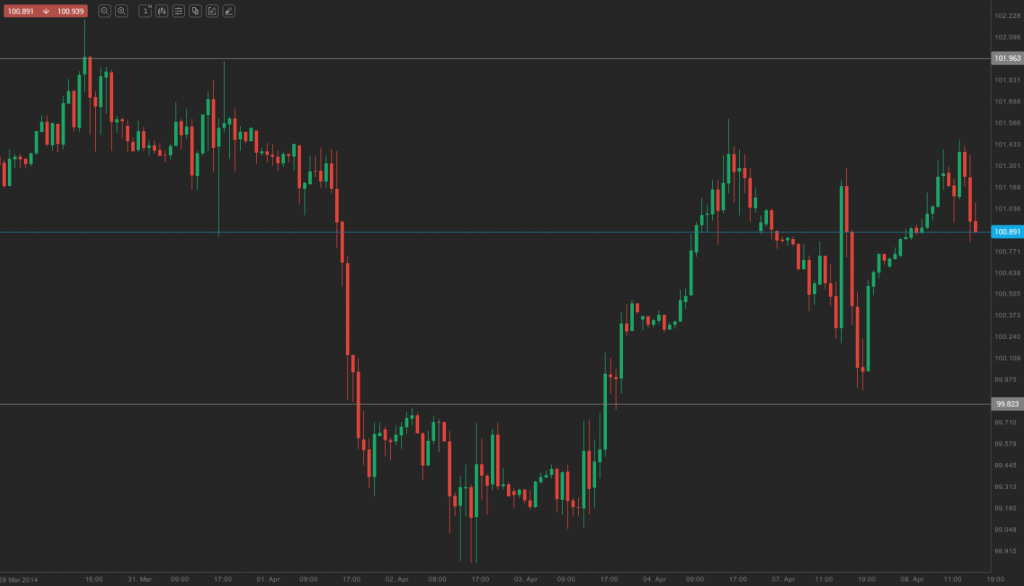

During Monday’s trading session WTI futures for delivery in May traded within the range $99.92-$101.32 and closed at $100.44 per barrel.

At 14:34 GMT today WTI futures for settlement in May traded at $100.93 per barrel, adding 0.49% for the day. The contract breached the first resistance level of $101.20 a barrel, touching a daily high at $101.48 per barrel at 11:40 GMT.

Fundamental view

A government report, due tomorrow may show US motor gasoline inventories fell for a seventh straight week, even as refiners ramp up runs after seasonal maintenance. According to a Bloomberg News survey of eight analysts ahead of government data tomorrow, motor gasoline inventories are expected to have declined by 1 million barrels in the week ended April 4th, while distillate fuel stockpiles, which include diesel and heating oil, were probably unchanged. Crude oil inventories are projected to have gained 1.4 million barrels to 381.5 million.

If inventories rise more than projected, this will put downward pressure on prices.

Technical view

According to Binary Tribune’s daily analysis, in case WTI futures price manages to breach the first resistance level at $101.20 a barrel, it will probably continue up to test $101.96. In case the second key resistance is broken, the energy source will probably attempt to advance to $102.60 per barrel.

If WTI futures price manages to breach the first key support at $99.80 a barrel, it will probably continue to slide and test $99.16. With this second key support broken, the movement to the downside will probably continue to $98.40 per barrel.