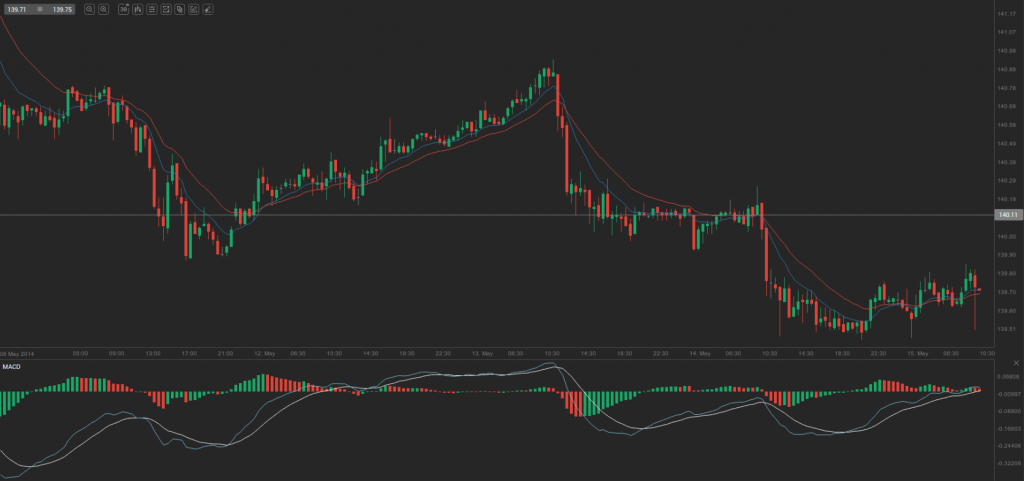

During yesterday’s trading session EUR/JPY traded within the range of 139.47-140.28 and closed at 139.62.

At 7:33 GMT today EUR/JPY was losing 0.01% for the day to trade at 139.73. The pair touched a daily low at 139.48 during the early phase of Asian trade.

Fundamental view

Euro zone’s preliminary annualized Gross Domestic Product probably expanded 0.4% during the first quarter of 2014, following a 0.2% gain in the previous quarter. The quarterly GDP in the region probably rose 1.1% in Q1, after a 0.5% increase in the final three months of 2013. In case region’s economy expands more than expected, the single currency would receive support. Eurostat is to publish the official report at 9:00 GMT.

The final annualized reading of the harmonized index of consumer prices (HICP) in the Euro zone probably rose 0.7 % in April, matching the preliminary reading estimated on April 30. The HICP is used to measure and compare inflation between Member States. It is used for further evaluation of inflation, according to Art . 121 of the Amsterdam’s Agreement and directives of the European Central Bank to achieve price stability and the implementation of monetary policy. HICP is calculated based on international harmonized standards adopted by Member States. This is the percentage change compared to the corresponding month of the previous year.

Eurostat is scheduled to release the official report at 09:00 GMT. A weaker-than-expected reading may prompt the ECB to ease monetary policy at their next meeting in June, in order to avoid risks of deflation. However, higher-than-expected reading will probably relieve pressure on central bank’s officials and they will not need to take imminent actions.

Technical view

According to Binary Tribune’s daily analysis, in case EUR/JPY manages to breach the first resistance level at 140.11, it will probably continue up to test 140.60. In case the second key resistance is broken, the pair will probably attempt to advance to 140.92.

If EUR/JPY manages to breach the first key support at 139.30, it will probably continue to slide and test 138.98. With this second key support broken, the movement to the downside will probably continue to 138.49.