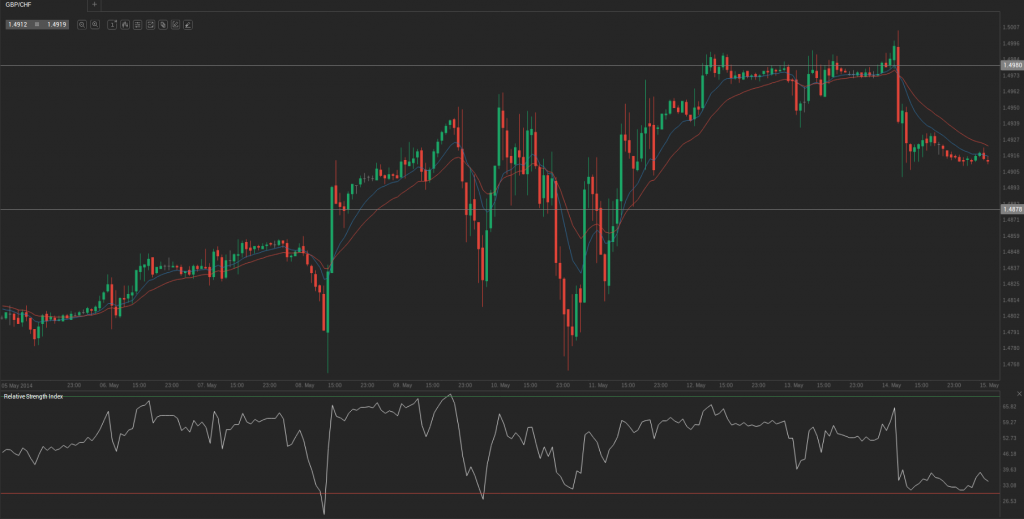

During yesterday’s trading session GBP/CHF traded within the range of 1.4906-1.5008 and closed at 1.4915.

At 6:12 GMT today GBP/CHF was losing 0.02% for the day to trade at 1.4916. The pair touched a daily low at 1.4912 at 1:30 GMT.

Fundamental view

The index of producer and import prices in Switzerland probably declined 0.8% in April from a year ago, according to the median experts’ estimate. The index consists of two sub-indexes, the producer price index (PPI) and the index of import prices (IIP). The PPI refers to goods produced and sold domestically or exported by Swiss companies. Goods includes raw materials, starting materials, semi-finished and finished products. Prices of goods are measured at the first marketing step in the production of the good, prices FOB or EXW as the VAT is not included, as opposed to indirect taxes. The IIP has a similar structure to that of producer prices, reflecting the prices of imported goods (price, before duty, VAT ). The combined index of producer and import prices generally reflects changes in both indexes, by summing up their values . This is the percentage change from the same month a year ago.

The Swiss Federal Statistical Office is scheduled to release the official figures at 07:15 GMT. Higher-than-expected readings will certainly heighten the appeal of the Swiss franc.

Technical view

According to Binary Tribune’s daily analysis, in case GBP/CHF manages to breach the first resistance level at 1.4980, it will probably continue up to test 1.5045. In case the second key resistance is broken, the pair will probably attempt to advance to 1.5082.

If GBP/CHF manages to breach the first key support at 1.4878, it will probably continue to slide and test 1.4841. With this second key support broken, the movement to the downside will probably continue to 1.4776.