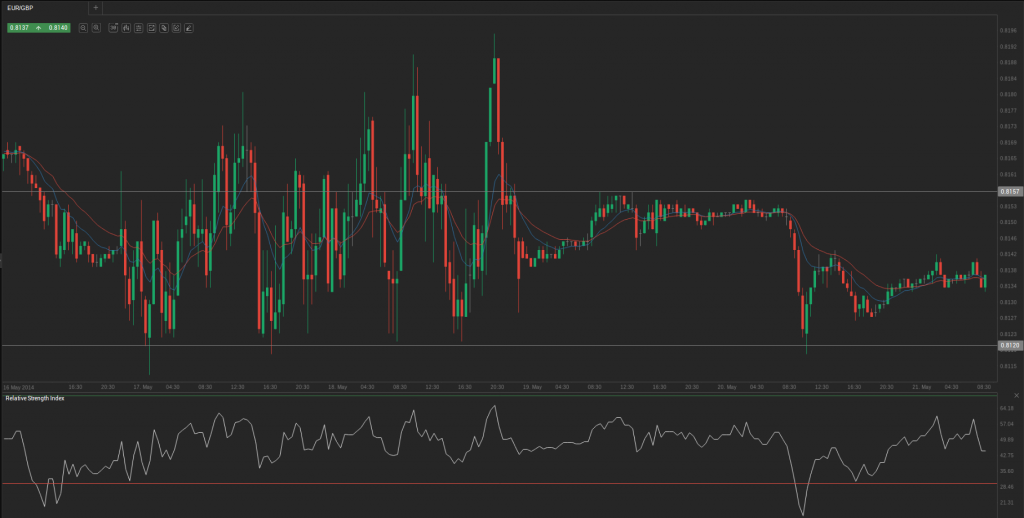

During yesterday’s trading session EUR/GBP traded within the range of 0.8120-0.8157 and closed at 0.8139.

At 6:32 GMT today EUR/GBP was losing 0.01% for the day to trade at 0.8135. The pair touched a daily low at 0.8135 at 6:31 GMT.

Fundamental view

Euro zone

The surplus on Euro zone’s seasonally adjusted current account probably widened to 24.2 billion EUR in March, according to the median estimate of experts. In February the surplus figure was 21.9 billion EUR. The official data is to be released at 8:00 GMT.

In addition, the preliminary value of the compound index of economic sentiment (ESI) for the Euro zone probably improved to a reading of -8.0 during the current month from -8.6 in April. The European Commission is expected to publish the preliminary data at 14:00 GMT. This survey precedes the final reading by two weeks. A larger than projected improvement in the index would provide support to the single currency.

United Kingdom

The minutes of Bank of England will probably show that central bank’s policy makers were unanimous in keeping the interest rate unchanged at record low 0.5% at their last policy meeting on May 8.

The Bank of England was given the responsibility of determining the basic interest rates in 1998, in order to meet the challenges posted by the government inflation target. Decisions are taken by the Monetary Policy Committee of the central bank. The Committee consists of nine members and meets monthly. Minutes are usually published on Wednesday, two weeks after the policy meeting. The format of voting is number of members that voted for an increase of borrowing costs, number of members that wanted a reduction and the total number of members, that have voting rights.

If the minutes reveal the members weren’t unanimous in taking the decision, this would heighten the appeal of the pound as it can be an early indication that borrowing costs may be raised sooner-than-projected.

Bank of England is scheduled to release the minutes from its last meeting at 08:30 GMT.

In addition, Retail Sales in the UK probably rose 0.4% in April, according to the median analysts estimate. In March retail sales rose 0.1%.

The indicator measures the change in the volume of sales made by retailers in the UK. The information is derived from a monthly survey among major retailers. Higher volumes of retail sales mean greater consumer demand, higher production and economic growth. This is the percentage change in the index from the previous month.

On year-over-year basis, retail sales probably jumped 5.1% last month, following a 4.2% gain in March.

The Office for National Statistics is scheduled to release an official report at 8:30 GMT. Higher-than-expected readings will certainly heighten the appeal of the pound.

Technical view

According to Binary Tribune’s daily analysis, in case EUR/GBP manages to breach the first resistance level at 0.8157, it will probably continue up to test 0.8176. In case the second key resistance is broken, the pair will probably attempt to advance to 0.8194.

If EUR/GBP manages to breach the first key support at 0.8120, it will probably continue to slide and test 0.8102. With this second key support broken, the movement to the downside will probably continue to 0.8083.