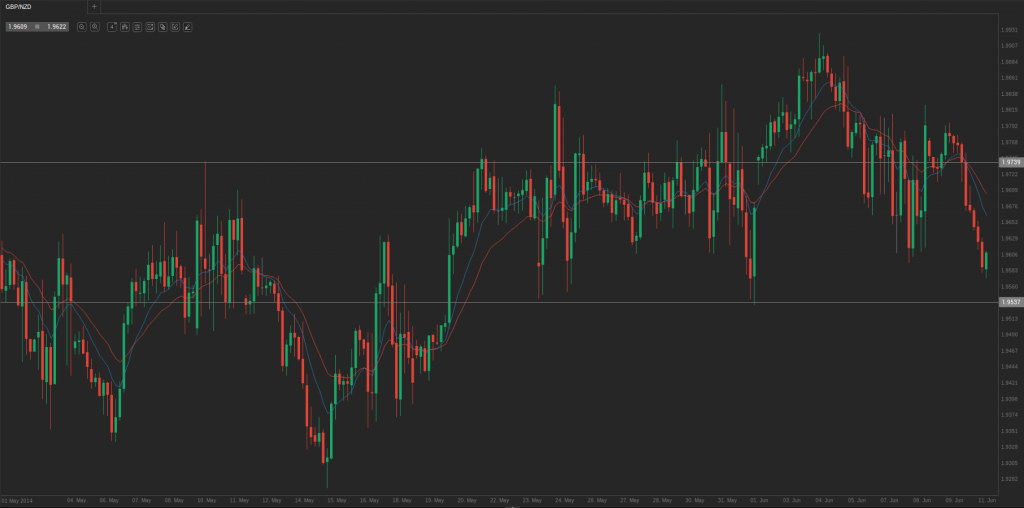

During yesterday’s trading session GBP/NZD traded within the range of 1.9634-1.9786 and closed at 1.9640.

At 6:48 GMT today GBP/NZD was losing 0.21% for the day to trade at 1.9612. The pair touched a daily low at 1.9578 at 6:15 GMT, breaching the first key support.

Fundamental view

The ILO unemployment rate in the UK probably fell to 6.7% in the three months through April from 6.8% in the previous month, according to analysts’ projections. The indicator measures the number of unemployed people who are willing to work, are available and and are actively looking to be hired. The index is measured according to the ILO (International Labour Organization) standards, which are accepted internationally, which allows the labor market in different countries to be compared. The unemployment rate is calculated using information from a special study of the workforce.

In addition, the jobless claims probably declined by 25 000 in May, according to the median analyst’ forecast, following a 25 100 decline in the previous month. The jobless claims change indicator calculates the number of applications for unemployment in Britain, measured in thousands. It is taken from administrative records kept by the Centre for jobs service (formerly Employment Service). If the number of applications falls more than expected, demand for the British pound would certainly be supported.

At the same time, the claimant count rate probably decreased to 3.2% last month from 3.3% in April, according to the median expert’ estimate. The claimant count rate is an index that is calculated based on the number of claims submitted for unemployment benefits in the UK. It is resented as a change in the number of claims and as a percentage change from the workforce. Data for the number of applications for unemployment benefits is taken from the administrative records of the labor centres.

The Office for National Statistics will release the official data at 08:30 GMT. Higher-than-projected readings would have a bullish effect on the pound.

Technical view

According to Binary Tribune’s daily analysis, in case GBP/NZD manages to breach the first resistance level at 1.9739, it will probably continue up to test 1.9839. In case the second key resistance is broken, the pair will probably attempt to advance to 1.9891.

If GBP/NZD manages to breach the first key support at 1.9587, it will probably continue to slide and test 1.9537. With this second key support broken, the movement to the downside will probably continue to 1.9435.