During yesterday’s trading session EUR/CHF traded within the range of 1.2140-1.2162 and closed at 1.2143.

At 7:07 GMT today EUR/CHF was gaining 0.03% for the day to trade at 1.2147. The pair touched a daily high at 1.2148 at 6:57 GMT.

Fundamental view

Euro zone

Activity in Italys sector of manufacturing probably expanded in June, with the corresponding PMI coming in at a reading of 53.5, as expected by experts, from 53.2 in May. Values above the key level of 50.0 indicate increased activity. Markit Economics is expected to release the official data at 7:45 GMT.

Frances final manufacturing PMI probably remained in the zone of contraction during June, while confirming the preliminary PMI reading of 47.8, which was reported on June 23rd. The official reading is due out at 7:50 GMT.

The final reading of German manufacturing PMI probably confirmed the preliminary value for June, with the index coming in at 52.4. Markit will release the official reading at 7:55 GMT.

The final manufacturing PMI in the Euro zone probably also confirmed the preliminary value in June, with the index remaining at 51.9. The official reading is scheduled to be released at 8:00 GMT. The PMI is based on a monthly survey, encompassing a sample of business entities, which represents private sector conditions in terms of new orders, output, employment, prices etc. Higher than expected readings would provide support to the common currency.

The number of the unemployed people in Germany probably dropped by 10 000 in June, according to the median forecast by experts, after an increase by 24 000 during May. A possible decrease is indicative of a more active consumer spending, while the latter is tightly related to economic growth. At the same time, the seasonally adjusted rate of unemployment in the country probably remained unchanged at 6.7% in June. In case the number of the unemployed decreased more than projected and the unemployment rate dropped, this would have a bullish effect on the euro. Germanys Statistics Office will release the official data at 7:55 GMT.

The rate of unemployment in the single currency bloc probably remained unchanged at 11.7% during May. It is considered as a key indicator of labor market conditions and represents the percentage of the total labor force, which is currently unemployed, but actively seeking employment. Eurostat is to release the official figure at 9:00 GMT.

Switzerland

Activity in Switzerland’s manufacturing sector probably slowed down during June. The SVME Manufacturing Purchasing Managers Index (PMI) probably fell to a reading of 51.3 last month, according to the median forecast by experts, from 52.5 in May. This indicator provides clues over growth of production in the country. Values above 50.0 are indicative of expansion in the sector. Therefore, higher than expected PMI readings would support the franc. The SVME (Schweizerischer Verband für Materialwirtschaft und Einkauf) in cooperation with Credit Suisse will release the official data at 7:30 GMT.

Technical view

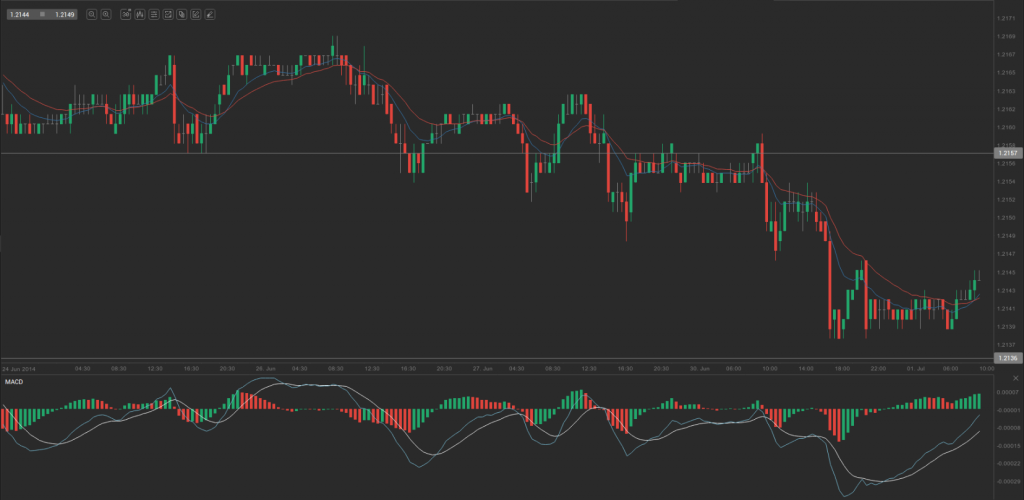

According to Binary Tribune’s daily analysis, in case EUR/CHF manages to breach the first resistance level at 1.2157, it will probably continue up to test 1.2170. In case the second key resistance is broken, the pair will probably attempt to advance to 1.2180.

If EUR/CHF manages to breach the first key support at 1.2136, it will probably continue to slide and test 1.2126. With this second key support broken, the movement to the downside will probably continue to 1.2113.