During yesterday’s trading session EUR/CHF traded within the range of 1.2134-1.2148 and closed at 1.2142.

At 7:29 GMT today EUR/CHF was losing 0.01% for the day to trade at 1.2140. The pair touched a daily low at 1.2139 at 6:30 GMT.

Fundamental view

Euro zone

The final GDP estimate in the Euro zone for Q1 probably confirmed the revised estimate of 0.2%, which was reported on June 4th. The final GDP estimate during the first quarter of the year compared to Q1 2013 probably also confirmed the revised estimate of 0.9%, according to the median forecast by experts. The GDP represents the total monetary value of all goods and services produced by one nation over a specific period of time. What is more, it is the widest indicator of a countrys economic activity.

The report on GDP holds a lot of weight for traders, operating in the Foreign Exchange Market. It serves as evidence of growth in a productive economy, or as evidence of contraction in an unproductive one. As a result, currency traders will look for higher rates of growth as a sign that interest rates will follow the same direction. Higher interest rates will attract more investors, willing to purchase assets in the country, while, at the same time, this will increase demand for the national currency. If an economy is experiencing a robust rate of growth, the benefits will eventually affect the end consumer, because of the increased likelihood of spending, while through increased consumer expenditures economy has the potential to expand even further. Therefore, in case growth in the common currency zone exceeded expectations, this would provide support to the euro. Eurostat is expected to release the official GDP report at 9:00 GMT.

Technical view

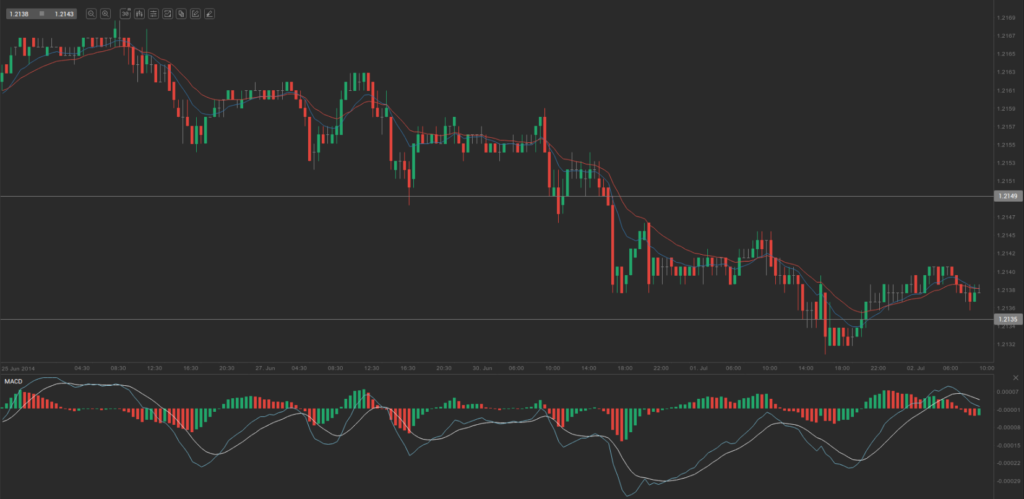

According to Binary Tribune’s daily analysis, in case EUR/CHF manages to breach the first resistance level at 1.2149, it will probably continue up to test 1.2155. In case the second key resistance is broken, the pair will probably attempt to advance to 1.2163.

If EUR/CHF manages to breach the first key support at 1.2135, it will probably continue to slide and test 1.2127. With this second key support broken, the movement to the downside will probably continue to 1.2121.