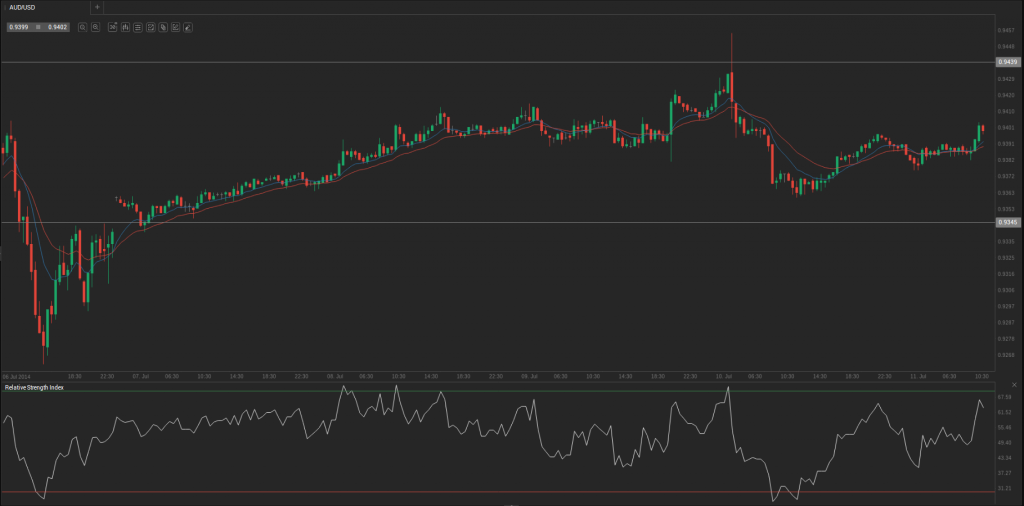

During yesterday’s trading session AUD/USD traded within the range of 0.9362-0.9456 and closed at 0.9384.

At 8:40 GMT AUD/USD traded at 0.9400, gaining 0.06% for the day. The pair touched a daily high at 0.9406 at 8:25 GMT.

Fundamental view

The US Federal Budget Balance probably turned to surplus of $79 billion last month, after a $129.97 billion deficit in May.

The monthly newsletter on revenue and expenditure of the United States Government (MTS) is prepared by the Office of Financial Management at the Ministry of Finance after approval by the Assistant Secretary of the Treasury. The newsletter covers the financial activities of the Federal Government and non- budgetary activities carried out in accordance with the budget of the U.S. government, ie. revenue and expenditure of funds, deficit or surplus, which means cover the deficit or surplus allocation. The main information sources include accounting data reported by federal sources, tax and regional structures of Fed.

A higher than projected surplus would heighten greenbacks appeal. The US Department of the Treasury will publish its report at 18:00 GMT.

Technical view

According to Binary Tribune’s daily analysis, in case AUD/USD manages to breach the first resistance level at 0.9439, it will probably continue up to test 0.9495. In case the second key resistance is broken, the pair will probably attempt to advance to 0.9533.

If AUD/USD manages to breach the first key support at 0.9345, it will probably continue to slide and test 0.9307. With this second key support broken, the movement to the downside will probably continue to 0.9251.