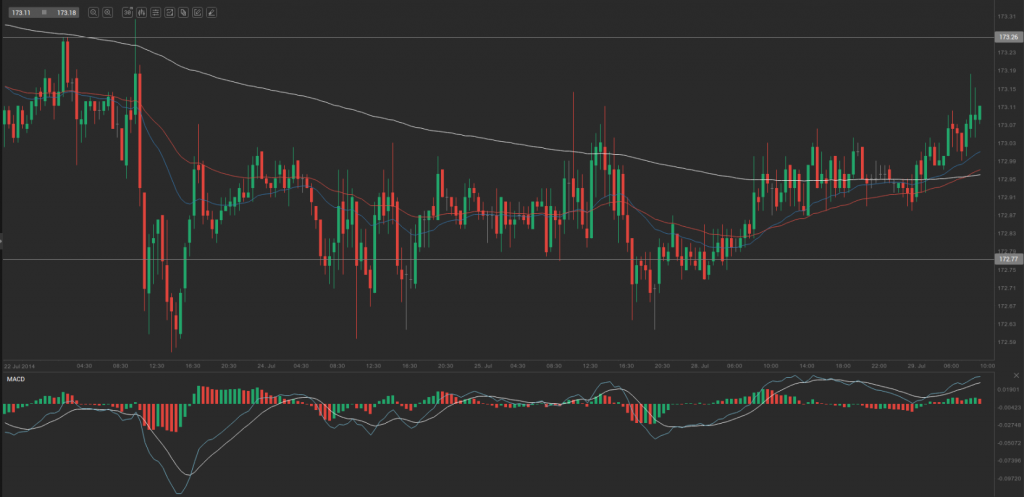

During yesterday’s trading session GBP/JPY traded within the range of 172.76-173.09 and closed at 172.94, gaining 0.09% for the day.

At 7:04 GMT today GBP/JPY was up 0.07% for the day to trade at 173.12. The pair broke the first key resistance and touched a daily high at 173.21 at 6:20 GMT.

Fundamental view

United Kingdom

The number of mortgage approvals in the United Kingdom probably increased to 62 600 in June, according to experts’ expectations, from 61 707 during the prior month. Mortgage approvals are considered as a leading indicator, reflecting the health of country’s housing market. In case the number of mortgage approvals increases more than anticipated, this implies housing sector strength and a positive impulse for the entire economy. Therefore, the national currency would also be supported. Bank of England will release the official numbers at 8:30 GMT.

Net lending secured on dwellings in the United Kingdom, which include bridging loans made by banks and other lenders, probably was at the amount of 1.90 billion GBP in June, according to the median forecast by experts. A month ago mortgage lending amounted to 1.99 billion GBP.

Consumer credit in the country probably expanded to 0.800 billion GBP in June from 0.740 billion GBP in May. It represents borrowing by the UK personal sector (individuals only) to fund current expenditures on goods and services, which are a driving force behind economic growth. In case lending to individuals expanded more than expected, this would have a bullish effect on the pound. Bank of England is to release the official data at 8:30 GMT.

Japan

Japans annualized industrial production probably expanded 5.2% in June, according to the median forecast by experts, following a 1.0% increase in the prior month. In monthly terms, nation’s industrial production index probably dropped 1.2% in June. The index reflects the change in overall inflation-adjusted value of output in sectors such as manufacturing, mining and utilities. It is based on the Current Survey of Production, which encompasses 530 different industrial goods. In case industrial output expanded more than anticipated, this would provide a boost to yens demand. The official report is to be released at 23:50 GMT.

Technical view

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 172.93. In case GBP/JPY manages to breach the first resistance level at 173.10, it will probably continue up to test 173.26. In case the second key resistance is broken, the pair will probably attempt to advance to 173.43.

If GBP/JPY manages to breach the first key support at 172.77, it will probably continue to slide and test 172.60. With this second key support broken, the movement to the downside will probably continue to 172.44.

The mid-Pivot levels for today are as follows: M1 – 172.52, M2 – 172.69, M3 – 172.85, M4 – 173.02, M5 – 173.18, M6 – 173.35.

In weekly terms, the central pivot point is at 172.99. The three key resistance levels are as follows: R1 – 173.36, R2 – 173.86, R3 – 174.23. The three key support levels are: S1 – 172.49, S2 – 172.12, S3 – 171.62.