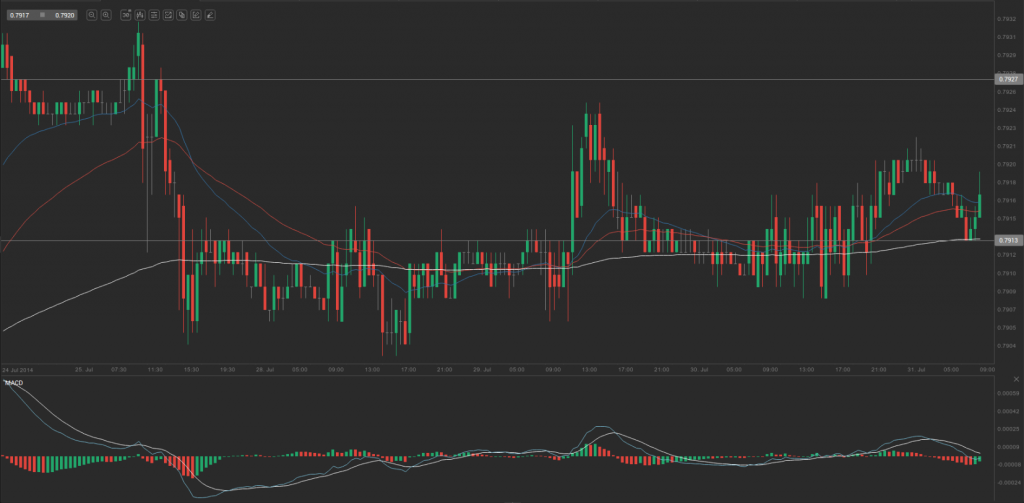

During yesterday’s trading session EUR/GBP traded within the range of 0.7910-0.7924 and closed at 0.7922, gaining 0.11% on a daily basis.

At 6:13 GMT today EUR/GBP was down 0.04% for the day to trade at 0.7918. The pair touched a daily low at 0.7914 at 4:55 GMT.

Fundamental view

Euro zone

Consumer spending in France probably rose 0.1% in June compared to May, according to market expectations, following a 1.0% increase in May compared to April. The annualized index of consumer spending probably gained 0.5% in June. This indicator reflects the change in the overall value of inflation-adjusted consumer expenditures and provides a short-term view of consumer behavior in the country. Levels of spending usually indicate how strong consumer confidence is. Higher than expected rates of increase would provide a certain support to the euro. The National Institute of Statistics and Economic Studies is to release the official data at 6:45 GMT.

The number of the unemployed people in Germany probably dropped by 5 000 in July, according to the median forecast by experts, after an increase by 9 000 during June. A possible decrease is indicative of a more active consumer spending, while the latter is tightly related to economic growth.

At the same time, the seasonally adjusted rate of unemployment in the country probably remained unchanged at 6.7% in July. The rate represents the percentage of the eligible work force that is unemployed, but is actively seeking employment. Those persons must be able to accept any job proposal by the labor agency and must be of age under 65 years. In case the number of the unemployed decreased more than projected and the unemployment rate dropped, this would have a bullish effect on the common currency. Germanys Statistics Office will release the official numbers at 7:55 GMT.

The rate of unemployment in Italy probably remained unchanged at 12.6% in June. The National Institute of Statistics will publish the report on unemployment at 8:00 GMT.

The annualized preliminary consumer price index in Italy probably remained at 0.3% in July, matching the final CPI for June. Nations annualized preliminary CPI for July, evaluated in accordance with the harmonized methodology, probably accelerated to 0.3%. The final HICP in June was reported at 0.2%. The National Institute of Statistics is to release the official CPI data at 9:00 GMT.

The annualized preliminary consumer price index in the Euro zone, evaluated in accordance with Eurostat’s harmonized methodology, probably remained unchanged at 0.5% in July, according to the median estimate by experts. The index shows the change in price levels of a basket of goods and services from consumer’s perspective and also reflects purchasing trends. The HICP is used to evaluate and compare inflation rates between Member States, according to Art. 121 of the Amsterdam’s Agreement and directives by the European Central Bank (ECB), in order the latter to achieve price stability and the implementation of monetary policy. In case the HICP slowed down more than anticipated, thus, distancing from the 2% inflation objective set by the ECB, this would mount selling pressure on the euro, because of the greater possibility of introducing additional monetary policy measures to stimulate economy.

The annualized preliminary Core HICP for July probably matched the final HICP in June, reported at 0.8%. This index excludes volatile categories such as food, energy, alcohol and tobacco. Eurostat is scheduled to release the official data at 9:00 GMT.

At the same hour, Eurostat will announce the rate of unemployment in the Euro region for June. It probably remained without change at 11.6%. Unemployed are considered to be all persons aged between 15 and 74, who have not been hired during the survey period, have been actively seeking employment during the past four weeks and are able to accept any job proposition right away or in two weeks time. A larger than expected drop in unemployment would support the single currency.

Technical view

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 0.7919. In case EUR/GBP manages to breach the first resistance level at 0.7927, it will probably continue up to test 0.7933. In case the second key resistance is broken, the pair will probably attempt to advance to 0.7941.

If EUR/GBP manages to breach the first key support at 0.7913, it will probably continue to slide and test 0.7905. With this second key support broken, the movement to the downside will probably continue to 0.7899.

The mid-Pivot levels for today are as follows: M1 – 0.7902, M2 – 0.7909, M3 – 0.7916, M4 – 0.7923, M5 – 0.7930, M6 – 0.7937.

In weekly terms, the central pivot point is at 0.7908. The three key resistance levels are as follows: R1 – 0.7943, R2 – 0.7973, R3 – 0.8008. The three key support levels are: S1 – 0.7878, S2 – 0.7843, S3 – 0.7813.