Yesterday’s trade saw EUR/GBP within the range of 0.7944-0.7980. The pair closed at 0.7953, losing 0.26% on a daily basis.

At 6:16 GMT today EUR/GBP was down 0.06% for the day to trade at 0.7948. The pair touched a daily low at 0.7946 at 6:10 GMT.

Fundamental view

Euro zone

French annualized final index of consumer prices for July probably confirmed the preliminary CPI of 0.5%, according to the median forecast by experts. The index measures the change in price levels of a basket of goods and services from consumer’s perspective and also reflects purchasing trends.

Nations annualized final CPI for July, evaluated in accordance with Eurostat’s harmonized methodology, probably also met the preliminary CPI of 0.6%. In case the CPI accelerated more than projected, this would have a bullish effect on the euro. The National Institute for Statistics and Economic Studies will release the official report at 6:45 GMT.

Spain’s annualized final index of consumer prices (CPI) in July probably matched the preliminary CPI of -0.3%, which was released on July 30th. The final annualized CPI for July, evaluated in accordance with Eurostat’s harmonized methodology, probably also confirmed the preliminary CPI estimate of -0.3%. The National Institute of Statistics is to release its official report at 7:00 GMT.

The seasonally adjusted index of industrial production in the Euro zone probably expanded 0.3% in June compared to a month ago, following a 1.1% drop in May. Annualized output probably increased at a pace of 0.2% in June. The index, reflecting business cycle, measures the change in overall inflation-adjusted value of output in sectors such as manufacturing, mining and utilities. In case industrial output expanded more than anticipated, this would support demand for the euro. Eurostat is to publish the official data at 9:00 GMT.

United Kingdom

The number of people, who applied for unemployment assistance, in the United Kingdom probably decreased by 30 000 in July, following another drop by 36 300 during the prior month. The claimant count rate probably fell to 3.0% last month from 3.1% in June. It represents the number of jobless claims as a percentage from the entire work force in the country.

The rate of unemployment in the UK, estimated in accordance with ILO (International Labour Organization) standards, probably dropped to 6.4% during the three months through June compared to the same period a year ago, from 6.5% in the three months through May. This indicator refers to the percentage of economically active people, who are currently unemployed. According to the ILO approach, people who are considered as unemployed are either: 1) Out of work, but are actively searching for employment, or 2) Out of work and are waiting to be hired again during the next two weeks.

The ILO Unemployment Rate is based on a monthly survey, known as the Labour Force Survey in the United Kingdom, with approximately 40 000 individuals being interviewed every month. This indicator reflects overall economic state in the country, as there is a strong correlation between consumer spending levels and labor market conditions. High rates of unemployment are accompanied by lesser spending, which causes an adverse effect on corporate profits and also slows down overall growth. In case, however, the rate of unemployment fell more than projected, this would have a bullish effect on the sterling. The official report is due out at 8:30 GMT.

At 9:30 GMT Bank of England is scheduled to publish its quarterly report, containing inflation rate and economic growth projections in regard to the next two years. In case the report outlines a hawkish outlook, this usually provides support to the national currency, while a dovish outlook usually has a bearish effect on the pound.

Technical view

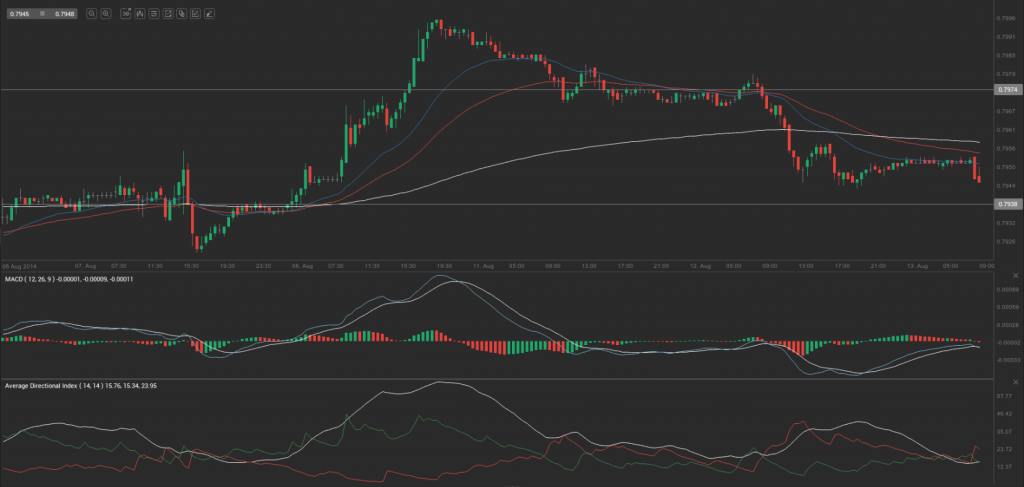

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 0.7959. In case EUR/GBP manages to breach the first resistance level at 0.7974, it will probably continue up to test 0.7995. In case the second key resistance is broken, the pair will probably attempt to advance to 0.8010.

If EUR/GBP manages to breach the first key support at 0.7938, it will probably continue to slide and test 0.7923. With this second key support broken, the movement to the downside will probably continue to 0.7902.

The mid-Pivot levels for today are as follows: M1 – 0.7913, M2 – 0.7931, M3 – 0.7949, M4 – 0.7967, M5 – 0.7985, M6 – 0.8003.

In weekly terms, the central pivot point is at 0.7970. The three key resistance levels are as follows: R1 – 0.8024, R2 – 0.8052, R3 – 0.8106. The three key support levels are: S1 – 0.7942, S2 – 0.7888, S3 – 0.7860.