Yesterday’s trade saw EUR/GBP within the range of 0.7899-0.7993. The pair closed at 0.7926, losing 0.78% on a daily basis.

At 6:15 GMT today EUR/GBP was up 0.01% for the day to trade at 0.7928. The pair touched a daily high at 0.7939 during early Asian trade.

Fundamental view

Euro zone

The second (revised) estimate of the Gross Domestic Product in the Euro zone probably pointed to zero growth during the second quarter compared to Q1, according to expectations and also matching the preliminary GDP estimate, reported on August 14th.

Growth rates in Spain and Netherlands were not enough in order to offset shrinking growth in Germany and Italy and the stall in France. Cypriot economy shrank at the largest rate – 0.3%, followed by Germany and Italy, where a 0.2% contraction was registered. Expansion was reported in Netherlands (0.5%), Spain (0.6%), Belgium (0.1%), Portugal (0.6%), Austria (0.2%), Estonia (0.5%), Slovakia (0.6%) and Finland (0.1%), according to preliminary data by Eurostat.

Euro zones GDP grew 0.2% in the first quarter, according to final data.

The revised GDP during the second quarter of the year compared to Q2 2013 probably showed a 0.7% expansion, also confirming the preliminary value, after a 0.9% increase in Q1.

The GDP represents the total monetary value of all goods and services produced by one nation over a specific period of time. What is more, it is the widest indicator of economic activity in the region. The report on GDP holds a lot of weight for traders, operating in the Foreign Exchange Market, because it serves as evidence of growth in a productive economy, or as evidence of contraction in an unproductive one. As a result, currency traders will look for higher rates of growth as a sign that interest rates will follow the same direction. Higher interest rates will usually attract more investors, willing to purchase assets in the Euro area, while, at the same time, this will increase demand for the common currency. Therefore, in case growth in the single currency zone exceeded expectations, this would provide support to the euro. Eurostat is expected to release the second GDP estimate at 9:00 GMT.

Yesterday the European Central Bank reduced its benchmark interest rate to a new record low level of 0.05%, which came as a surprise to global markets, as most analysts projected that the rate will be kept on hold at 0.15%. The central bank also cut its deposit facility rate to -0.20% from the prior -0.10% and its marginal lending rate to 0.30% from 0.40% previously. EUR/USD lost 1.76%, falling to 1.2918 at 15:55 GMT on Thursday, which has been the pairs lowest level since July 10th 2013.

United Kingdom

A survey by Halifax Bank of Scotland (HBOS), the largest mortgage lender in the United Kingdom, may show that home values rose at an annualized pace of 9.9% last month, according to preliminary estimates. In July prices of homes, purchased with loans from the bank, climbed 10.2%. In monthly terms, prices probably rose 0.1% in August, following another 1.4% increase in July. A higher than projected rate of increase would be considered as a bullish signal for the sterling. The official values will be released at 7:00 GMT.

Technical view

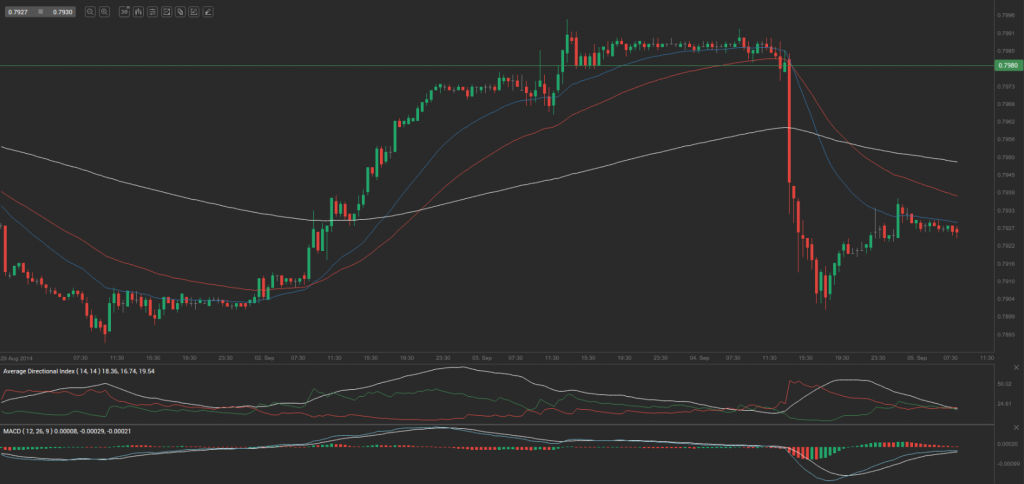

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 0.7939. In case EUR/GBP manages to breach the first resistance level at 0.7980, it will probably continue up to test 0.8033. In case the second key resistance is broken, the pair will probably attempt to advance to 0.8074.

If EUR/GBP manages to breach the first key support at 0.7886, it will probably continue to slide and test 0.7845. With this second key support broken, the movement to the downside will probably continue to 0.7792.

The mid-Pivot levels for today are as follows: M1 – 0.7819, M2 – 0.7866, M3 – 0.7913, M4 – 0.7960, M5 – 0.8007, M6 – 0.8054.

In weekly terms, the central pivot point is at 0.7937. The three key resistance levels are as follows: R1 – 0.7965, R2 – 0.8019, R3 – 0.8047. The three key support levels are: S1 – 0.7883, S2 – 0.7855, S3 – 0.7801.