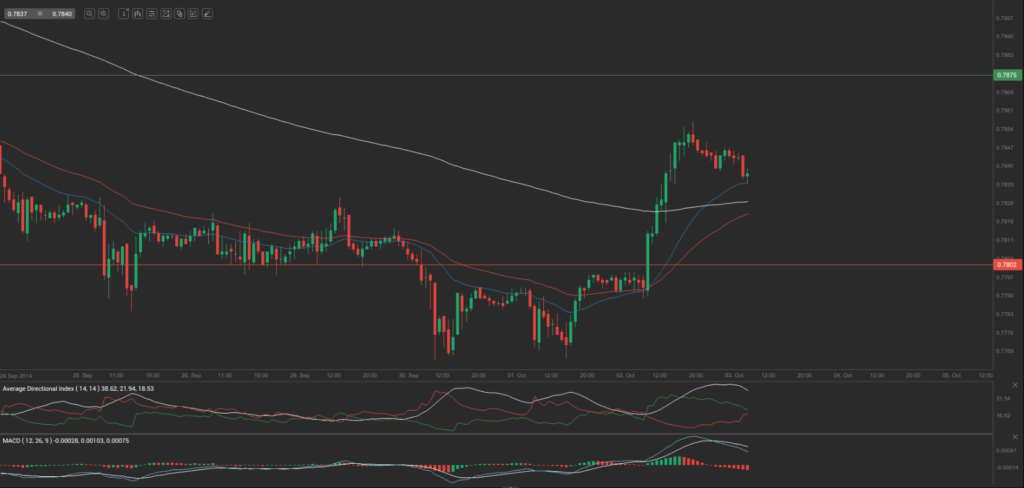

Yesterday’s trade saw EUR/GBP within the range of 0.7786-0.7859. The pair closed at 0.7847, gaining 0.60% on a daily basis.

Yesterday’s trade saw EUR/GBP within the range of 0.7786-0.7859. The pair closed at 0.7847, gaining 0.60% on a daily basis.

At 6:46 GMT today EUR/GBP was down 0.10% for the day to trade at 0.7839. The pair touched a daily low at 0.7834 at 6:10 GMT.

Fundamental view

Euro zone

Services PMI data by Markit

Activity in Italys sector of services probably remained little changed in September, with the corresponding PMI coming in at a reading of 49.5, as expected by experts, from 49.8 in the prior month. If so, this would be the lowest PMI reading since March. Values below the key level of 50.0 indicate diminished activity. Markit Economics is expected to release the official data at 7:45 GMT.

Frances final services PMI probably remained in the zone of contraction during September, while confirming the preliminary PMI reading of 49.4, which was reported on September 23rd. If confirmed, this would be the lowest value of the index since June. In August the services PMI was estimated at 50.3. The official reading is due out at 7:50 GMT.

The final reading of German services PMI probably confirmed the preliminary value for September, with the index coming in at 55.4, up from 54.9 in August. The index is based on data collected from a representative panel of more than 500 companies, operating in Germanys services sector. Markit will release the official reading at 7:55 GMT.

The final services PMI in the Euro zone probably also confirmed the preliminary value for September, with the index remaining at 52.8, down from 53.1 in August. If so, this would be the lowest PMI reading since June. The PMI is based on a monthly survey, encompassing a sample of approximately 2 000 business entities, which represents private sector conditions in terms of new orders, output, employment, prices etc. National services data are included for Germany, France, Italy, Spain and the Republic of Ireland. Lower than expected readings would lead to a sell-off in the common currency. The official reading is scheduled to be released at 8:00 GMT.

Euro area retail sales

Annualized retail sales in the Euro region as a whole probably rose 0.5% in August, according to the median forecast by experts, after in July sales climbed 0.8%. In monthly terms, retail sales probably increased 0.1% during August. This is a short-term indicator, which provides key information about consumption on a national scale. In case the index of retail sales rose at a faster than projected pace, this would have a bullish effect on the euro. Eurostat is expected to publish the official data at 9:00 GMT.

United Kingdom

Activity in United Kingdom’s sector of services probably slowed down in September, with the corresponding PMI coming in at 59.1, down from 60.5 in the prior month. Augusts PMI reading has been the highest since October 2013. The index is based on a survey, encompassing managers of companies, that operate in sectors such as transportation, communications, IT, financial intermediation, tourism. They are asked about their estimate regarding current business conditions (new orders, output, employment, demand in the future). Values above the key level of 50.0 signify that activity in the sector has expanded. Larger than projected fall in the index value would certainly lower the appeal of the pound. The Chartered Institute of Purchasing and Supply (CIPS) is to announce the official reading at 8:30 GMT.

Yesterday UKs construction PMI was reported to have climbed to 64.2 in September, from 64.0 in August, reaching the highest reading in nine months. Analysts had expected a fall to 63.5.

Technical view

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 0.7831. In case EUR/GBP manages to breach the first resistance level at 0.7875, it will probably continue up to test 0.7904. In case the second key resistance is broken, the pair will probably attempt to advance to 0.7948.

If EUR/GBP manages to breach the first key support at 0.7802, it will probably continue to slide and test 0.7758. With this second key support broken, the movement to the downside will probably continue to 0.7729.

The mid-Pivot levels for today are as follows: M1 – 0.7744, M2 – 0.7780, M3 – 0.7817, M4 – 0.7853, M5 – 0.7890, M6 – 0.7926.

In weekly terms, the central pivot point is at 0.7827. The three key resistance levels are as follows: R1 – 0.7871, R2 – 0.7935, R3 – 0.7979. The three key support levels are: S1 – 0.7763, S2 – 0.7719, S3 – 0.7655.