Friday’s trade saw GBP/CAD within the range of 1.7937-1.8042. The pair closed at 1.7950, losing 0.34% on a daily basis.

At 8:12 GMT today GBP/CAD was down 0.15% for the day to trade at 1.7938. The pair touched a daily low at 1.7916 at 7:30 GMT.

Fundamental view

United Kingdom

Home values in the UK are poised to drop 0.8% in 2015, following an increase by 7.8% in 2014, according to a statement by the Centre for Economics and Business Research (CEBR). It would be the first annualized decrease since 2011. Home values dropped for the first time in almost a year and a half during September, as reported by the Nationwide Building Society last week.

Canada

Activity among purchasing managers in Canada probably increased in September, with the corresponding PMI coming in at a seasonally adjusted value of 53.0. In August the index stood at 50.9. This indicator is based on a survey sponsored by Richard Ivey School of Business and Canadian Purchasing Management Association. It encompasses 175 respondents in both public and the private sector, selected in accordance with their geographic location and activity, so that the entire economy is covered. Activity among purchasing managers is closely watched by market players, as managers usually have an early access to data regarding performance of their companies, which could be used as a leading indicator of overall economic activity. Readings above the key level of 50.0 are indicative of expansion in activity. Higher than expected readings of the PMI would bolster demand for the loonie. The official value is due out at 14:00 GMT.

Technical view

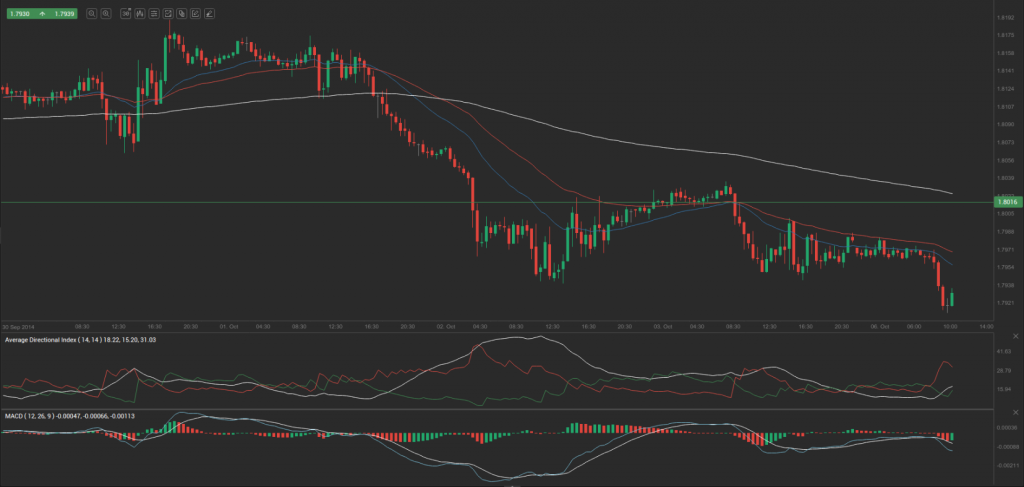

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 1.7976. In case GBP/CAD manages to breach the first resistance level at 1.8016, it will probably continue up to test 1.8081. In case the second key resistance is broken, the pair will probably attempt to advance to 1.8121.

If GBP/CAD manages to breach the first key support at 1.7911, it will probably continue to slide and test 1.7871. With this second key support broken, the movement to the downside will probably continue to 1.7806.

The mid-Pivot levels for today are as follows: M1 – 1.7839, M2 – 1.7891, M3 – 1.7944, M4 – 1.7996, M5 – 1.8049, M6 – 1.8101.

In weekly terms, the central pivot point is at 1.8027. The three key resistance levels are as follows: R1 – 1.8120, R2 – 1.8291, R3 – 1.8384. The three key support levels are: S1 – 1.7856, S2 – 1.7763, S3 – 1.7592.