Yesterday’s trade saw EUR/SEK within the range of 9.0514-9.1522. The pair closed at 9.0736, losing 0.74% on a daily basis.

At 6:53 GMT today EUR/SEK was down 0.14% for the day to trade at 9.0590. The pair broke the first key weekly support and touched a daily low at 9.0559 at 6:55 GMT.

Fundamental view

Euro zone

Italian consumer inflation – final

Italys final annualized index of consumer prices (CPI) probably remained steady at -0.1% in August, matching the preliminary CPI, reported on September 30th. If so, this would be the second month in 55 years, when Italian consumer inflation was in negative territory. According to provisional estimates, the drop in consumer prices was mostly driven by lower prices of non-regulated energy products (a 2.8% annual drop in September), followed by a 0.9% decrease in the cost of unprocessed food.

Key categories, included in Italys Consumer Price Index, are food and non-alcoholic beverages (accounting for 16% of total weight), transport (15%), restaurants and hotels (11%) and housing, water, electricity and other fuels (10%). Other categories are clothing and footwear (9%), furnishing and household equipment (8%), recreation and culture (8%) and health (also 8%). Communication, education, alcoholic beverages, tobacco and other goods and services comprise the remaining 15% of the index.

Nations final annualized CPI, evaluated in accordance with the harmonized methodology, probably matched the preliminary HICP estimate of -0.2% in September, which was released on September 30th. The National Institute of Statistics (ISTAT) is to publish the official CPI report at 8:00 GMT.

Germany and Euro zone Economic Sentiment by the ZEW Institute

The gauge of economic sentiment in Germany probably continued to fall, reaching 1.0 in October, according to the median forecast by experts. In September the index came in at 6.9. The indicator has been falling since December 2013, when it stood at 62.0. Geopolitical situation probably continued to have an adverse influence on economic expectations.

The ZEW (Zentrum für Europäische Wirtschaftsforschung) economic expectations index is published monthly. The study encompasses up to 350 financial and economic analysts. The indicator reflects the difference between the share of analysts, that are optimistic and those, that are pessimistic about the expected economic development in Germany over the next six months. A positive value indicates that the proportion of optimists is larger than that of pessimists. A ZEW reading of -100 suggests that all analysts are pessimistic about the current developments and expect economic conditions to deteriorate. A ZEW reading of 100 implies that all analysts are optimistic about the current situation and expect conditions to improve. A ZEW reading of 0 indicates neutrality.

The index of current assessment in Germany probably dropped to 18.4 in October from 25.4 in the prior month.

The ZEW Economic Sentiment index in the Euro zone probably fell to 2.5 this month from 14.2 during September.

Lower-than-projected readings would certainly cause a negative impact on the single currency. The official data is scheduled to be released at 9:00 GMT.

Euro zone industrial production

The seasonally adjusted index of industrial production in the Euro zone probably dropped 1.8% in August compared to a month ago, following a 1.0% increase in July, as the latter has been the most considerable monthly gain since October 2013. Annualized output probably contracted at a pace of 0.9% in August. The index, reflecting the business cycle, measures the change in overall inflation-adjusted value of output in sectors such as manufacturing, mining and utilities. In case industrial output shrank more than anticipated, this would mount selling pressure on the euro. Eurostat is to publish the official data at 9:00 GMT.

Sweden

Sweden’s annualized index of consumer prices (CPI) probably improved to -0.1% in September, according to expectations, from -0.2% in August, as the latter has been the lowest annual level since May. The index measures the change in price levels of a basket of goods and services from consumer’s perspective and also reflects purchasing trends. Nation’s annualized core CPI probably advanced to 0.6% last month from 0.5% in August. Higher than expected CPI would certainly provide support to the krone. Statistics Sweden is to release the official report at 7:30 GMT.

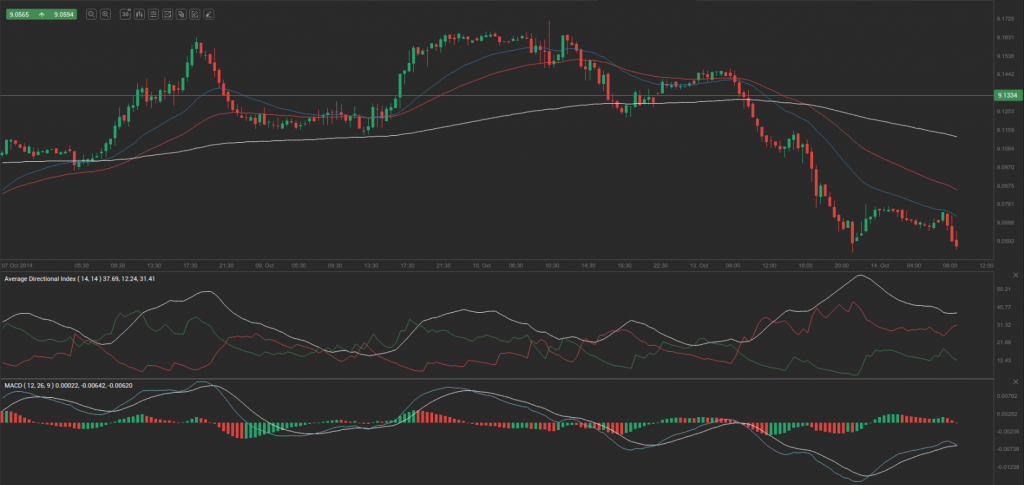

Technical view

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 9.0924. In case EUR/SEK manages to breach the first resistance level at 9.1334, it will probably continue up to test 9.1932. In case the second key resistance is broken, the pair will probably attempt to advance to 9.2342.

If EUR/SEK manages to breach the first key support at 9.0326, it will probably continue to slide and test 8.9916. With this second key support broken, the movement to the downside will probably continue to 8.9318.

The mid-Pivot levels for today are as follows: M1 – 8.9617, M2 – 9.0121, M3 – 9.0625, M4 – 9.1129, M5 – 9.1633, M6 – 9.2137.

In weekly terms, the central pivot point is at 9.1203. The three key resistance levels are as follows: R1 – 9.1902, R2 – 9.2482, R3 – 9.3181. The three key support levels are: S1 – 9.0623, S2 – 8.9924, S3 – 8.9344.