Yesterday’s trade saw GBP/SEK within the range of 11.4319-11.6448. The pair closed at 11.4443, losing 1.66% on a daily basis.

At 7:11 GMT today GBP/SEK was up 0.16% for the day to trade at 11.4590. The pair touched a daily high at 11.4685 during early Asian trade.

Fundamental view

United Kingdom

The cost of living in the United Kingdom was probably reduced, with the CPI being at 1.4% in September from a year ago, according to the median estimate by experts. In August the annualized consumer inflation was reported at 1.5%, down from 1.6% in July. The largest downward contributions to the change in the CPI 12-month rate between July and August this year came from food and non-alcoholic beverages, with prices falling 0.2% between July and August this year. Prices of food and non-alcoholic drinks rose 0.5% between the same two months a year ago. According to data by the Office for National Statistics (ONS), the largest upward contributions to the change in the CPI 12-month rate between July and August 2014 came from clothing and footwear, as prices climbed 2.6% between July and August this year in comparison with a more modest increase of 2.0% between the same two months in 2013.

The CPI is the main measure of inflation in the UK for macroeconomic purposes and forms the basis of the inflation target set by the government. Every month about 120 000 samples are made, examining the change in prices of about 650 products. They represent the “market basket” of goods and services, on which the index is based.

Key categories in the consumer price index are Transport (accounting for 16.2% of the total weight) and Housing, Water, Electricity, Gas and Other fuels with a 14.4% share. Recreation and Culture accounts for 13.4%, Restaurants and Hotels – 11.4% and Food and Non-alcoholic Beverages – 11.2%. The CPI also encompasses Miscellaneous Goods and Services (9.6%), Clothing and Footwear (6.5%), Furniture, Household Equipment and Maintenance (6.1%). Alcoholic Beverages and Tobacco, Health, Communication and Education comprise the remaining 11.2% of the total weight.

The Core consumer price index probably dipped to 1.8% in September compared to the same month a year ago, from 1.9% in August. The core CPI measures the change in prices of goods and services purchased by consumers, without taking into account volatile components such as food, energy products, alcohol and tobacco.

The Office for National Statistics (ONS) will publish the official CPI report at 8:30 GMT. Lower-than-expected annualized CPI, especially if distancing from the inflation objective of 2.0%, usually has a bearish effect on the sterling.

Sweden

Sweden’s annualized index of consumer prices (CPI) probably improved to -0.1% in September, according to expectations, from -0.2% in August, as the latter has been the lowest annual level since May. The index measures the change in price levels of a basket of goods and services from consumer’s perspective and also reflects purchasing trends. Nation’s annualized core CPI probably advanced to 0.6% last month from 0.5% in August. Higher than expected CPI would certainly provide support to the krone. Statistics Sweden is to release the official report at 7:30 GMT.

Technical view

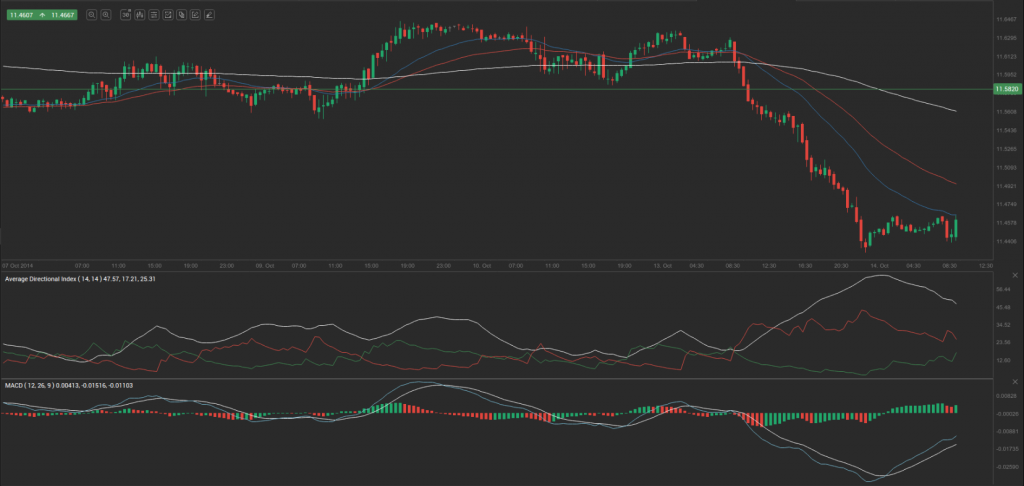

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 11.5070. In case GBP/SEK manages to breach the first resistance level at 11.5820, it will probably continue up to test 11.7199. In case the second key resistance is broken, the pair will probably attempt to advance to 11.7950.

If GBP/SEK manages to breach the first key support at 11.3692, it will probably continue to slide and test 11.2941. With this second key support broken, the movement to the downside will probably continue to 11.1563.

The mid-Pivot levels for today are as follows: M1 – 11.2252, M2 – 11.3317, M3 – 11.4381, M4 – 11.5446, M5 – 11.6510, M6 – 11.7575.

In weekly terms, the central pivot point is at 11.6032. The three key resistance levels are as follows: R1 – 11.6747, R2 – 11.7224, R3 – 11.7939. The three key support levels are: S1 – 11.5555, S2 – 11.4840, S3 – 11.4363.