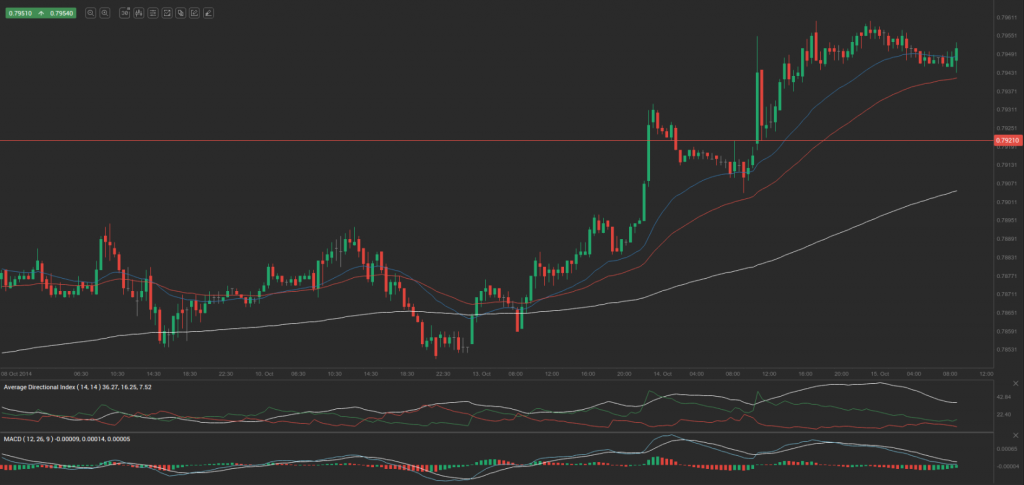

Yesterday’s trade saw EUR/GBP within the range of 0.7902-0.7962. The pair closed at 0.7960, gaining 0.39% on a daily basis.

Yesterday’s trade saw EUR/GBP within the range of 0.7902-0.7962. The pair closed at 0.7960, gaining 0.39% on a daily basis.

At 6:48 GMT today EUR/GBP was down 0.14% for the day to trade at 0.7949. The pair touched a daily low at 0.7945 at 6:46 GMT.

Fundamentals

Euro zone

Spains current account probably produced a deficit of 0.3 billion EUR in July, according to market expectations. In June the country had a surplus at the amount of 0.517 billion EUR, which followed five consecutive months with a deficit.

The current account reflects the difference between savings and investments in the country. It is the sum of the balance of trade, net current transfers (cash transfers) and net income from abroad (earnings from investments made abroad plus money sent by individuals working abroad to their families back home, minus payments made to foreign investors).

A current account surplus indicates that the net foreign assets of the country have increased by the respective amount, while a deficit suggests the opposite. A nation with a surplus on its current account is considered as a net lender to the rest of the world, while a current account deficit puts it in the position of a net borrower. A net lender is consuming less than it is producing, which means it is saving and those savings are being invested abroad, or foreign assets are created. A net borrower is consuming more than it is producing, which means that other countries are lending it their savings, or foreign liabilities are created. A larger than projected deficit on Spains current account might have a limited bearish effect on the euro.

The Bank of Spain is expected to release the official data at 8:00 GMT.

United Kingdom

The number of jobless claims in the United Kingdom probably dropped by 35 000 in September, according to expectations, following another drop by 37 200 in August. At the same time, the claimant count rate, which represents the percentage change of jobless claims compared to the entire work force, probably fell to 2.8% in September from 2.9% during the previous month.

The rate of unemployment in the UK, estimated in accordance with ILO (International Labour Organization) standards, probably dropped to 6.1% during the three months to August compared to the same period a year ago, from 6.2% in the three months to July. If so, this would be the lowest level since the fall of 2008.

During the period May-July there were 2.02 million unemployed people, or 146 000 fewer compared to February-April and 468 000 fewer compared to May-July 2013. This has been the most significant annual drop in unemployment since 1988. There were 30.61 million people in work, or 74 000 more compared to the period February-April 2014. This has been the smallest quarterly increase since the period April-June 2013.

In May to July there were 8.93 million people aged between 16 and 64, who were out of work and not seeking or available for employment, according to data by the Office for National Statistics (ONS). This represented an increase by 114 000 in comparison with the period February to April, but was also a fall by 31 000 compared to May-July last year.

The rate of unemployment refers to the percentage of economically active people, who are currently unemployed. According to the ILO approach, people who are considered as unemployed are either: 1) out of work, but are actively searching for employment, or 2) out of work and are waiting to be hired again during the next two weeks.

The ILO Unemployment Rate is based on a monthly survey, known as the Labour Force Survey in the United Kingdom, with approximately 40 000 individuals being interviewed every month. This indicator reflects overall economic state in the country, as there is a strong correlation between consumer spending levels and labor market conditions. Low rates of unemployment are accompanied by higher spending, which causes a favorable effect on corporate profits and also accelerates overall growth. In case the rate of unemployment fell more than projected, this would certainly have a bullish effect on the sterling. The official report by the ONS is due out at 8:30 GMT.

Pivot Points

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 0.7941. In case EUR/GBP manages to breach the first resistance level at 0.7981, it will probably continue up to test 0.8001. In case the second key resistance is broken, the pair will probably attempt to advance to 0.8041.

If EUR/GBP manages to breach the first key support at 0.7921, it will probably continue to slide and test 0.7881. With this second key support broken, the movement to the downside will probably continue to 0.7861.

The mid-Pivot levels for today are as follows: M1 – 0.7871, M2 – 0.7901, M3 – 0.7931, M4 – 0.7961, M5 – 0.7991, M6 – 0.8021.

In weekly terms, the central pivot point is at 0.7862. The three key resistance levels are as follows: R1 – 0.7898, R2 – 0.7942, R3 – 0.7978. The three key support levels are: S1 – 0.7818, S2 – 0.7782, S3 – 0.7738.