Yesterday’s trade saw EUR/CHF within the range of 1.2046-1.2079. The pair closed at 1.2057, losing 0.06% on a daily basis.

At 6:22 GMT today EUR/CHF was down 0.01% for the day to trade at 1.2058. The pair touched a daily low at 1.2056 during early Asian trade.

Fundamentals

Euro zone

Italian Business Confidence

Confidence among manufacturing companies in Italy probably remained almost unchanged, with the corresponding index coming in at 94.9 in October, from 95.1 in September, as the latter has been the lowest index reading since August 2013, when the indicator stood at 92.9.

The Manufacturing Confidence survey features 4 000 Italian companies. Respondents give their opinion regarding the current trend of order books, production and inventories, short-term forecasts on order books, production, prices and the general economic situation.

The index of business confidence is seasonally adjusted and has a base year of 2005. Readings of 100.0 signify neutrality in business sentiment. Values exceeding 100.0 imply improving confidence, while values below 100.0 are related with low expectations. Lower than anticipated values may have a limited bearish effect on the common currency. The official reading by Istat is due out at 9:00 GMT.

ECB bond purchases

It became clear that the European Central Bank has begun purchasing covered bonds on October 20th. Last week the central bank purchased bonds at the amount of EUR 1.704 billion in an attempt to cope with deflation and revitalize economy in the Euro region. This is the third time in the past six years, when the ECB entered the bond market.

Switzerland

At 7:00 GMT UBS is to report on private consumption tendency in Switzerland during September. Its Consumption indicator came in at a reading of 1.35 in August, down from 1.67 in the prior month. This index is comprised by five components – new car sales, business activity in the retail sector, the number of domestic hotel overnights by Swiss nationals, the consumer sentiment index and credit card transactions via UBS points of sale in the country. As consumption is a key component of nations Gross Domestic Product, in case the indicator tends to show higher readings, this usually provides a certain support to the Swiss franc.

Pivot Points

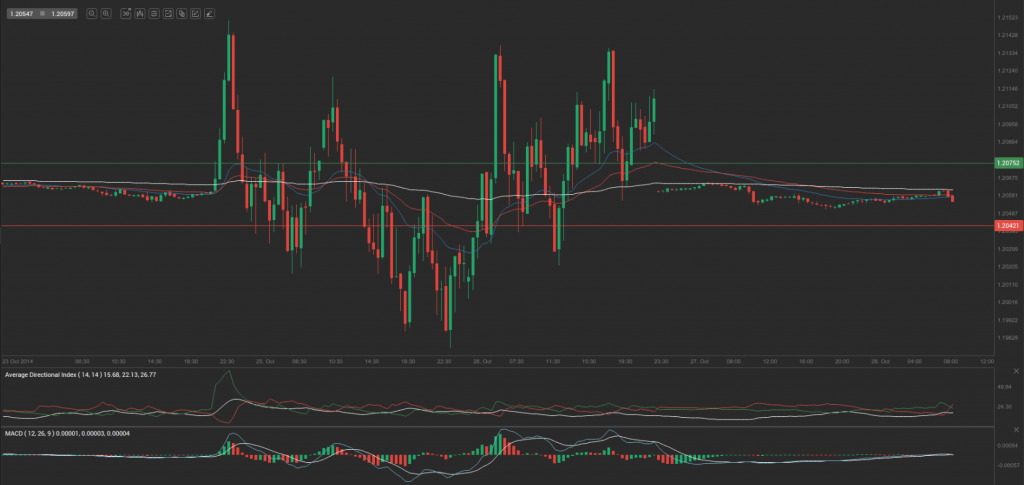

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 1.2061. In case EUR/CHF manages to breach the first resistance level at 1.2075, it will probably continue up to test 1.2094. In case the second key resistance is broken, the pair will probably attempt to advance to 1.2108.

If EUR/CHF manages to breach the first key support at 1.2042, it will probably continue to slide and test 1.2028. With this second key support broken, the movement to the downside will probably continue to 1.2009.

The mid-Pivot levels for today are as follows: M1 – 1.2019, M2 – 1.2035, M3 – 1.2052, M4 – 1.2068, M5 – 1.2085, M6 – 1.2101.

In weekly terms, the central pivot point is at 1.2060. The three key resistance levels are as follows: R1 – 1.2087, R2 – 1.2112, R3 – 1.2139. The three key support levels are: S1 – 1.2035, S2 – 1.2008, S3 – 1.2000.