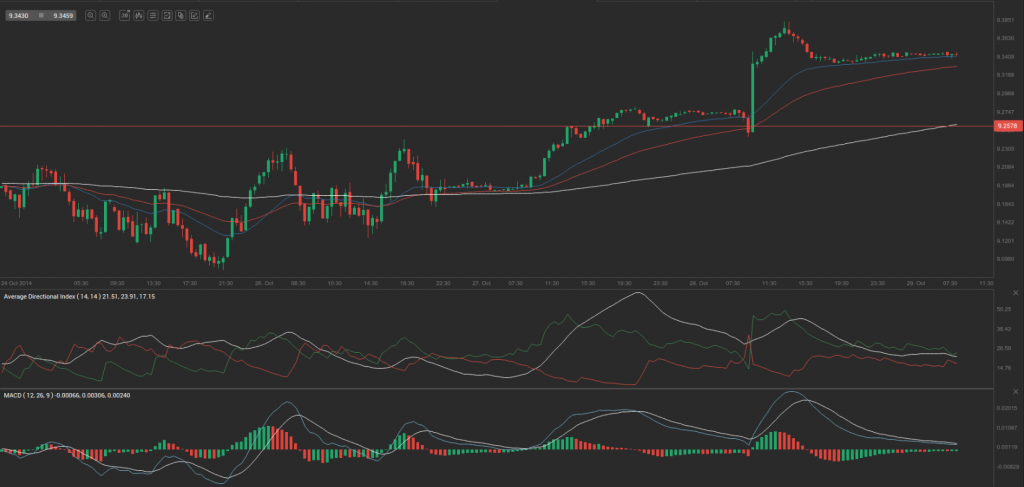

Yesterday’s trade saw EUR/SEK within the range of 9.2423-9.3925. The pair closed at 9.3407, gaining 0.79% on a daily basis.

At 7:16 GMT today EUR/SEK was up 0.04% for the day to trade at 9.3468. The pair touched a daily high at 9.3485 at 1:30 GMT.

Fundamentals

Euro zone

French Consumer confidence

Confidence among consumers in France probably remained unchanged, with the respective index coming in at a reading of 86.0 in October, according to the median forecast by experts. In August the index stood at 85.8, while in July – at 86.3.

The index of consumer confidence is based on a survey, encompassing about 2 000 households. Respondents give their opinion regarding past and future economic situation in France, past and future personal financial situation, unemployment, intention to make major purchases, current savings capacity and expected savings capacity.

The indicator is calculated using factor analysis technique. The index is then calculated in a way to measure the current confidence compared to the historic index values during the period 1987-2011. If the gauge shows a reading over 110, this suggests that optimism is higher than normal. If the index shows a reading under 90, this implies that pessimism is higher than normal. Readings of 100.0 signify neutrality.

Improving confidence is related with greater willingness to spend, therefore, higher than projected values may provide support to the euro. The National Institute of Statistics and Economic Studies (INSEE) is to publish the official data at 7:45 GMT.

Spanish retail sales

Annualized retail sales in Spain probably rose at a pace of 0.6% in September, according to the median estimate by experts, following another 0.4% gain in August. If so, this would be the fastest annual rate of increase since May. This indicator reflects the change in the total value of inflation-adjusted sales by retailers in the country and provides key information regarding consumer spending trend in a shorter term, while the latter is a key driving force behind economic growth. Companies, operating in the retail sector, provide monthly data regarding 4 main categories: food, personal equipment, household appliances and additional information in regard to other types of consumer goods. In case the retail sales index increased at a faster than expected pace, this would have a certain bullish effect on the euro. The National Institute of Statistics (INE) is expected to release the official report at 8:00 GMT.

Sweden

Consumer confidence

Confidence among consumers in Sweden probably worsened in October, with the corresponding gauge coming in at a reading of 101.0, according to the median estimate by experts. In September the index of confidence was reported at 102.4, which has been the highest level since January.

The Consumer Confidence Indicator (CCI) signifies what households plans to purchase durable goods are and what the level of consumer sentiment on the economic situation in Sweden, personal finances, inflation and savings is. The survey encompasses a sample of 1 500 households, interviewed on a monthly basis. The indicator represents the difference between respondents, who gave a positive opinion, and those, who gave a negative opinion. Readings between 90 and 100 indicate weaker than normal confidence, while readings between 100 and 110 indicate stronger than normal confidence. Any drop in the gauge of sentiment, which exceeds market expectations, usually mounts selling pressure on the krone.

Swedens National Institute of Economic Research is expected to release the official data at 8:00 GMT.

Pivot Points

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 9.3252. In case EUR/SEK manages to breach the first resistance level at 9.4080, it will probably continue up to test 9.4754. In case the second key resistance is broken, the pair will probably attempt to advance to 9.5582.

If EUR/SEK manages to breach the first key support at 9.2578, it will probably continue to slide and test 9.1750. With this second key support broken, the movement to the downside will probably continue to 9.1076.

The mid-Pivot levels for today are as follows: M1 – 9.1413, M2 – 9.2164, M3 – 9.2915, M4 – 9.3666, M5 – 9.4417, M6 – 9.5168.

In weekly terms, the central pivot point is at 9.1903. The three key resistance levels are as follows: R1 – 9.2301, R2 – 9.2717, R3 – 9.3115. The three key support levels are: S1 – 9.1487, S2 – 9.1089, S3 – 9.0673.