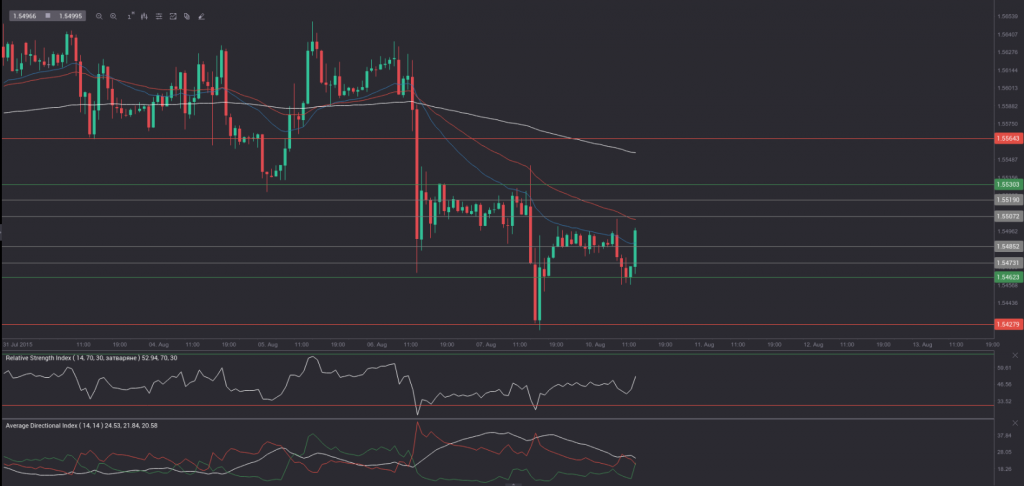

Friday’s trade saw GBP/USD within the range of 1.5422-1.5545. The pair closed at 1.5496, down 0.10% on a daily basis, while extending losses from the prior trading day. The daily low has also been the lowest level since July 10th, when the cross registered a low of 1.5361. In weekly terms, GBP/USD plunged 0.82% last week, which has been the steepest weekly slump since the week, which began on June 28th, when the pair fell 1.15%.

At 10:00 GMT today GBP/USD was down 0.17% for the day to trade at 1.5461. The pair tested the range support level (S3), as it touched a daily low at 1.5458 at 8:45 GMT.

No relevant macroeconomic reports are to be released from both the United States and the United Kingdom today.

Correlation with other Majors

Taking into account the week ended on August 9th and the daily closing levels of the major currency pairs, we come to the following conclusions in regard to the strength of relationship:

GBP/USD to USD/CAD (0.7604, or strong)

GBP/USD to USD/JPY (0.1193, or weak)

GBP/USD to EUR/USD (-0.4551, or moderate)

GBP/USD to AUD/USD (-0.5960, or strong)

GBP/USD to USD/CHF (-0.6833, or strong)

GBP/USD to NZD/USD (-0.7613, or strong)

1. During the examined period GBP/USD moved strongly in one and the same direction with USD/CAD.

2. GBP/USD moved strongly in the opposite direction compared to AUD/USD, USD/CHF and NZD/USD during the past week. The strongest negative correlation was observed between GBP/USD and NZD/USD.

3. The correlation between GBP/USD and USD/JPY was insignificant during the period in question.

4. GBP/USD moved to a moderate extent in the opposite direction compared to EUR/USD.

Bond Yield Spread

The yield on UK 2-year government bonds went as high as 0.632% on August 7th, after which it slid to 0.587% at the close to lose 1.9 basis points (0.019 percentage point) on a daily basis, while marking a second consecutive day of decrease.

The yield on US 2-year government bonds climbed as high as 0.749% on August 7th, or the highest level since August 5th (0.760%), after which it fell to 0.721% at the close to gain 1.2 basis points (0.012 percentage point) for the day. It has been the first gain in the past three trading days.

The spread between 2-year US and 2-year UK bond yields, which reflects the flow of funds in a short term, widened to 0.134% on August 7th from 0.103% during the prior day. The August 7th yield spread has been the most notable one since August 4th, when the difference was 0.155%.

Meanwhile, the yield on UK 10-year government bonds soared as high as 1.951% on August 7th, after which it slid to 1.848% at the close to lose 7.2 basis points (0.072 percentage point) compared to August 6th, while marking a second straight day of decline.

The yield on US 10-year government bonds climbed as high as 2.254% on August 7th, after which it slipped to 2.166% at the close to lose 6.1 basis points (0.061 percentage point) on a daily basis, while marking a second consecutive day of decline.

The spread between 10-year US and 10-year UK bond yields widened to 0.318% on August 7th from 0.307% during the prior day. The August 7th yield difference has been the largest one since August 4th, when the spread was 0.353%.

Daily and Weekly Pivot Levels

By employing the Camarilla calculation method, the daily pivot levels for GBP/USD are presented as follows:

R1 – 1.5507

R2 – 1.5519

R3 (range resistance – green on the 1-hour chart) – 1.5530

R4 (range breakout – red on the 1-hour chart) – 1.5564

S1 – 1.5485

S2 – 1.5473

S3 (range support – green on the 1-hour chart) – 1.5462

S4 (range breakout – red on the 1-hour chart) – 1.5428

By using the traditional method of calculation, the weekly pivot levels for GBP/USD are presented as follows:

Central Pivot Point – 1.5523

R1 – 1.5625

R2 – 1.5753

R3 – 1.5855

S1 – 1.5395

S2 – 1.5293

S3 – 1.5165