Futures on US West Texas Intermediate Crude Oil extended gains from the prior two trading days on Thursday, while hitting highs not seen since late February 2020, after the unilateral decision by Saudi Arabia to slash production during the upcoming two months. Additional support to prices came after a weekly report showed a drop in US crude oil inventories.

Saudi Arabia, the largest oil exporter worldwide, announced that it would voluntarily slash 1 million barrels per day of oil output in February and March, following an OPEC+ meeting earlier this week.

Meanwhile, a report by the US Energy Information Administration (EIA) showed on Wednesday that crude oil inventories had dropped by 8.01 million barrels during the week ended January 1st, marking a fourth consecutive period of decrease. In comparison, analysts on average had expected a 2.133 million drop in inventories last week.

Oil prices have also drawn support from a weaker US Dollar.

“WTI crude seems poised to rise higher as the Biden administration will clamp down on U.S. crude production, the Saudis tentatively alleviated oversupply concerns with their 1-million bpd cut present, and as the dollar’s days seem numbered,” Edward Moya, senior market analyst at OANDA, was quoted as saying by Reuters.

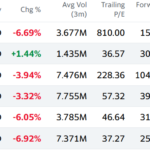

As of 10:07 GMT on Thursday WTI Crude Oil Futures were edging up 0.49% to trade at $50.88 per barrel, after earlier touching an intraday high of $51.28, or its strongest level since February 25th 2020 ($52.02 per barrel). WTI Crude Oil Futures have risen 4.86% so far in January, following another 7.01% surge in December.

Brent Oil Futures were edging up 0.59% on the day to trade at $54.48 per barrel, after earlier touching an intraday high of $54.88, or its strongest level since February 26th 2020 ($55.42 per barrel). Brent Oil Futures have risen 5.49% so far in January, following another 8.52% surge in December.

Daily Pivot Levels (traditional method of calculation) – WTI Crude Oil Futures

Central Pivot – $50.35

R1 – $51.22

R2 – $51.81

R3 – $52.68

R4 – $53.55

S1 – $49.76

S2 – $48.89

S3 – $48.30

S4 – $47.71

Daily Pivot Levels (traditional method of calculation) – Brent Oil Futures

Central Pivot – $53.99

R1 – $54.87

R2 – $55.57

R3 – $56.45

R4 – $57.32

S1 – $53.29

S2 – $52.41

S3 – $51.71

S4 – $51.00