After a breakdown of the press conference and the FOMC statement, it turns out that a considerable amount of members are prone to tightening of the easy liquidity in 2022. Nine out of 18 governors in the Committee are set for an interest rate increase in 2022, by contrast of June statements for a pending increase in 2023. The Fed has also updated its inflation forecast to 4.2% from the 3.5% just recently stated, which is somehow uncomfortable, doubling the target inflation rate. Base inflation, which excludes energy and food price fluctuations, is set to 3.7% versus the 3% previously forecasted. The inflation is looking less and less “transitory”. Nevertheless, there is tolerance to the higher inflation digit, as long as the unemployment rate is set to reach record low pre-pandemic levels of 3.5%. The Committee is also satisfied with most of the economic indicators, despite the adverse impact of the pandemic resurgence on some sectors.

The market is joyed by not tapering the USD 120B monthly asset purchases program, despite the high inflation figures, and of course the asset management companies, the investment and commercial banking institutions are seen as the biggest beneficiaries of this feast. The 120B is split into USD 80B Treasury securities and USD 40B MBS. Moreover, the repetitive asset buyout from the Fed in open market operations will be doubled from the current USD 80B to 160B! In the Press Conference Powell said that “we have achieved considerable success in both inflation and employment targets”. The rally continues, as the risk from stopping the buyout program before November is now nowhere to be seen – the next meeting is set for November 2nd or 3rd. JPM, BAC, WFG, C add respectively 3.38%, 3.87%, 1.61% and 3.79% to their market value an hour before the end trading session. As it can be seen, on Sept 23rd the financial sector is the greenest of the greener.

Considering the economic indicators in Europe, the German Flash Manufacturing and Services PMIs were much lower than expected. These indicators are considered truly important for general market sentiment in trading EU stocks, but they rarely render a deep impact on the US market. The Flash Manufacturing PMI for the US is close to expected and the Services PMI is at 54.4, below the market consensus of 55.1. Unemployment claims are also higher than expected but these transitory and highly volatile figures are not able to cushion the favorable sentiment from the ongoing Fed loose monetary policy. The market /measured with the Dow Jones/ and the technological Nasdaq Composite are respectively 1.72% and 1.15% on positive territory an hour before the end of the trading session.

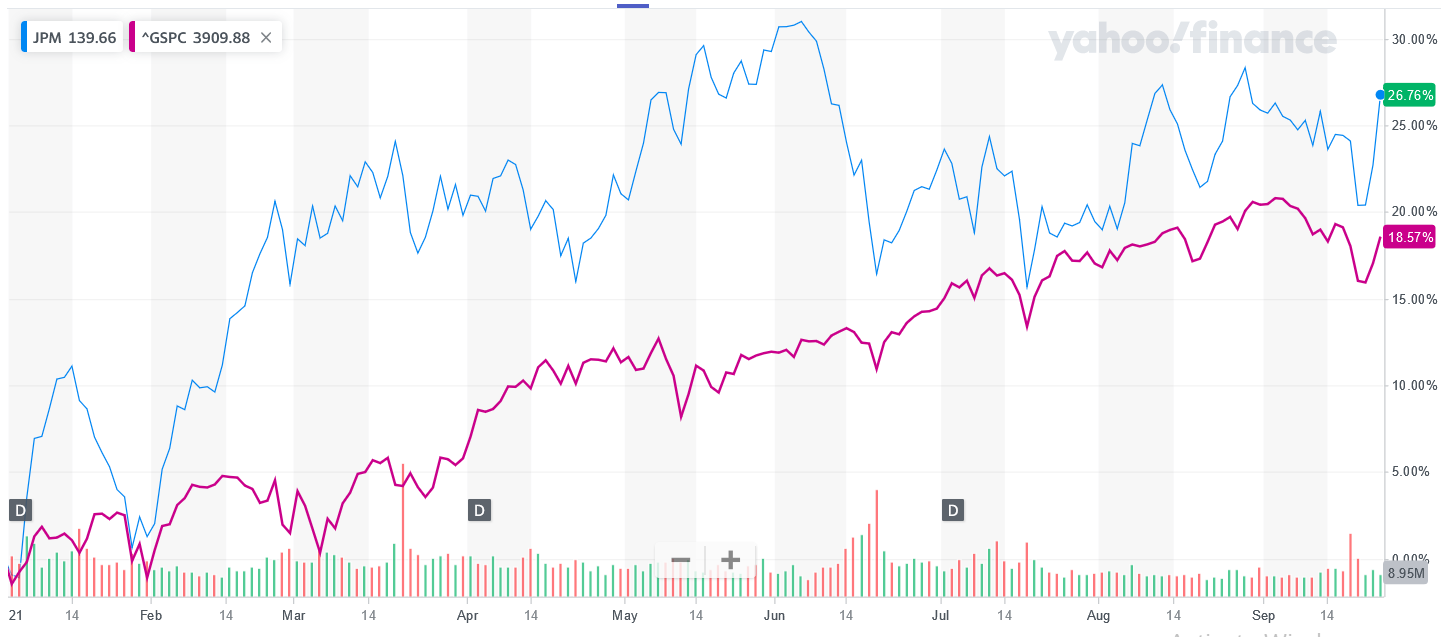

Considering JPM, a liquid hot financial stock in context of the Fed-buoyed rally, it has been outperforming the broad index YTD, gaining 26.8% with respect to 18.61% on side of the SPY.

JPM has a relatively small market cap of USD 481B but average daily trading volume of 11m shares. Stocks with average trading volume above 5m are considered liquid, and therefore safe for day trading. The TTM P/E ratio is 10.75 only and its forward P/E is 13.67 – both quite low market multiples, rendering a solid fundamental potential for an upside price increase. The YoY company revenue growth is 32.3%, surpassing the sector median of 17.05%, and net income margin stands at 37.18%, again above the sector median of 29.77%. ROE is also higher than the industry average – 18.88% versus 12.59%. These nice digits are positively skewed from the most recent quarterly results.

The other good news is that the highly popular investment bank has also resumed share buybacks, again translated as a stock price increase. With such favorable fundamental picture, share buybacks, truly positive market sector sentiment, and quite acceptable liquidity, JPM is most probably set for future price growth. In September strong buy and buy ratings for the stock are more or less equal to the hold rating. Of course, a potential unexpected shift in Fed policy on the negative direction will adversely affect JPM and its fellow-companies just in the way it positively affected them today.