The last trading week was torn up between pretty big events such as the FOMC meeting, the Chinese Evergrande giant pending for bankruptcy, and the cryptocurrency transactions ban in China. The fears for world contagion risks from Evergrande are perceived in a pretty calm manner from traders and investors so far, but the Chinese government statement that all cryptocurrency transactions will be deemed illegal definitely had a negative resound on crypto indices and on some technological giants.

The market nevertheless ended the week on positive territory, which is a pretty sound argument for the general strength of US stocks, based on fundamentals, not only on nominal price pump up from the easy liquidity. There is a very positive sentiment situation right now as the 10yr Treasuries yield is rising, reaching 1.41%, and simultaneously the stock market is green for the week – i.e. bears are not buying Ts as a risk hedge. The 5 year Ts are considered the most indicative of future US monetary policy and their yield reached a 2021 hi during the week. The pending tightening of the monetary policy, reflected by the Ts is now perceived as something positive – “the economy is doing quite well, the recovery is surprisingly quick, with US companies adaptable and creative, therefore, the need for QE is wavered and rates are to be risen to avoid higher inflation”.

Powell was also quite enthusiastic and positively surprised on the state of the US economy during a press conference named “Fed is listening”, expressing his impressions on the state of the economy with more or less the same words. With strong economy and rising rates on Treasuries no one needs the zero-interest yielding gold as a risk hedge – it is down to 1747,80. Gold is not perceived as a hedge on inflation fears right now. Brent Oil is slightly up to USD 77.68/barrel, also reflecting the positive moods on the recovery. In summary, taking short US index positions in such an environment would prove quite risky and irrational.

On Sunday were held the Bundestag elections in Germany, sending the 16-year ruling Angela Merkel to a well-deserved retirement. The SPDs, led by Olaf Shulz and CDUs, led by Armin Laschet are competing head to head with almost equal 25% for each party on the updated projected results.

No worldwide panic on the Evergrande case

On Friday the market was mixed, almost flat, with investors resting and waiting for a more clear outcome on the Evergrande case – on one hand the Pekin government may leave the real estate conglomerate with no support or there may be a last-minute resort. However, possibility that debt would be left non-rescaled and the related financial chaos non-handled, is quite low. Evergrande’s debt is overdue with USD 305B and the company missed an interest rate coupon payment. It has a 30 day gratis period to resolve the issue with or without the help of the Chinese government.

More supply shocks expected for the US economy in the future

On the real-economy side, the week in the US was marked by big supply shocks, with shelves being emptied too soon from large-scale buyers. As the pandemic is getting more severe and capacities are closed in big external suppliers of the import-oriented US states, there is overstressed supplying to cushion shortage risks. This in turn leads to a shortage of cargo containers, truck drivers to deliver goods from ports to wholesale and retail centers, and a shortage of warehouse operators. The new supply shock is very similar to the one at the beginning of the pandemics, causing rescheduling, restructuring and redesign of operations for the majority of US publicly traded companies. With this uncertainty in operations and future pricing and expenses for restructuring and renegotiation of alternative suppliers, many US retailers are to be negatively affected. For example, WMT, AMZN are worth to be closely watched in the following weeks for clear downtrends, together with tech companies, getting parts supplies from pandemic-distressed countries.

The crypto-currency related stocks and US-listed Chinese techs – Stocks to trade now

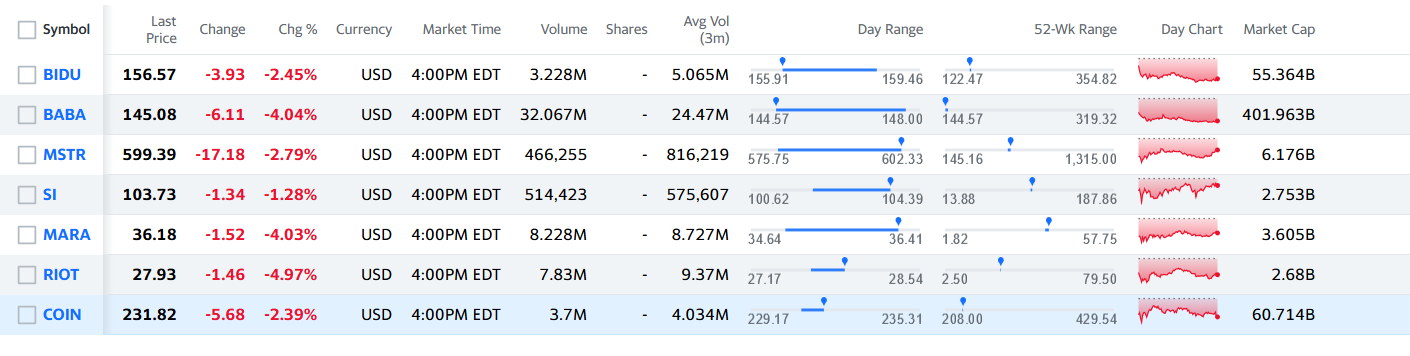

The Chinese techs, listed on NYSE were clearly negatively affected from the cryptocurrency ban in China, and the sentiment behind the move is pretty strong, with no bulls ahead at least for the next several days. What happened last week will affect the below-listed companies’ operations for a long time ahead. The Bitcoin and the Ether were down 7% and 10% respectively. The Nasdaq Golden Dragon China Index, tracking some of the Asian largest firms listed in the U.S. sank. The top cryptocurrency trading exchange stock, Coinbase /Nasdaq: COIN/ was down 2.39% on Friday, the crypto-related stocks like Riot Blockchain /Nasdaq: RIOT/, Marathon Digital Holdings /Nasdaq: MARA/, and Silvergrate Capital Corporation /NYSE:SI/ sank with 4.97%, 4.03, 1.28% respectively. Shares of Microstrategy Incorporated /Nasdaq: MSTR/, investing billions in bitcoin technologies sank with 2.79%.

In addition to the terror on cryptocurrency transactions, the Chinese government continues to press big Chinese tech companies like the Alibaba /NYSE: BABA/ online retailer. BABA is the Chinese equivalent of AMZN – it had to give up its stake in Mango Excellent Media on an officials’ decree and respectively shed off 4.04% from its market cap. The government is also set to prohibit Baidu /Nasdaq: BIDU/, the biggest Chinese search engine, from taking on the streaming services company Joyy. The Pekin officials are doing everything that could be done to turn off both Chinese and worldwide investors from both Chinese-tech and crypto-currency stocks.

Stocks with positive sentiment

On the other side, we have some pretty big gainers showing firm positive sentiment in the past week, and the tradable players with proper market cap, daily trading volumes and low standard deviation will be worth considering in the next sections.