The market ended mixed yesterday with Dow Jones, S&P500, Nasdaq, Gold, Crude Oil and Bitcoin with 0.20%, -.28%, -.52%, flat, 0.9%, -3.1% respectively and a multy-colored picture in the stock sectors. The VIX , volatility index, which can be traded as VXX ETF on BATs exchange, has gained almost 1%. In the forthcoming days, as there are a lot of diverse factors impacting the market sentiment, the volatility itself is a good ETF asset to trade.

Techs /Nasdaq Composite 100: NDXT/ and yields /10 year Treasuries/ correlation has been firmly negative in the past few months but recently, since September 21 it has turned out positive. Just a quick note for beginners: when yields on Ts are going up, market prices of Ts are actually going down, as the the rate of discounting future coupon and the terminal principal payment is higher. On Monday Treasury yields were spiking, amid expectations for firm economic recovery, higher inflation and tightening monetary policy. Earlier in the day yields on 10 year Ts surpassed 1.5%, the highest level since June.

Tech companies are deemed extremely sensitive to higher interest rates as their ongoing geographical expansion, heavy investment in R&D and new solutions’ development are financed with debt. Future growth obstacles are thus turning the tech sector less attractive to investors. Sometimes, a single tech giant market move may impact the whole sector sentiment, both from market capitalization weighting and sentiment contagion factors. In yeseterday’s case the red color in the segment was perhaps to a large extent attributed to AMZN with a number of reasons and pressures. The company has the supply and transportation issues, as it was discussed in the previous article, new leadership, and intense competition. Recent supply shocks for components and end-consumer products coming from intense COVID crisis countries heavily affect the other tech giants too, as new product launches are impeded.

Companies which are good performers no matter what are for example 3M /NYSE: MMM/, with thousands of consumer defensive products, Ingredion Inc. /NYSE: INGR/ with a really high dividend yield, selling starches and sweeteners for a number of industries. The Financial sector was also on positive territory as growing yields are turning into higher interest rate differential for commercial and investment banking institutions. Fed is not tapering the QE any time sooner than November, providing the almost free liquidity for the fin sector, which is again backing up the positive moods. JPM, GS, BAC, C are the traditional sector leaders with solid fundamental picture as well. The other good performer was the energy sector, with Crude oil prices surpassing the 75USD, adding another .83% both on quick world economic post-covid resurge and inventories depletion. The OPEC is now opened to gradually increase production. The US natural gas was also 6.24% higher on global shortage shock. Exxon Mobil /NYSE: XOM/ has gained 2.97% and Oxxydental Petroleum /NYSE: OXY/ the tremendous 7.44%. When trading energy stocks versus indices or futures, one should also take into account the intercorporate factors affecting the fundamental indicators, which could either overboost or overshadow performance with respect to the index.

The Asian stocks slipped on the higher Treasury yields, forecasting a pending tapering, which is again indicative on the mixed world investor feelings on Fed proceeding right now. Particularly for China, we should have in mind that it is the major holder of US government securities, usually held to maturity – i.e. the losses from the now higher yields are multiplied by trillions.

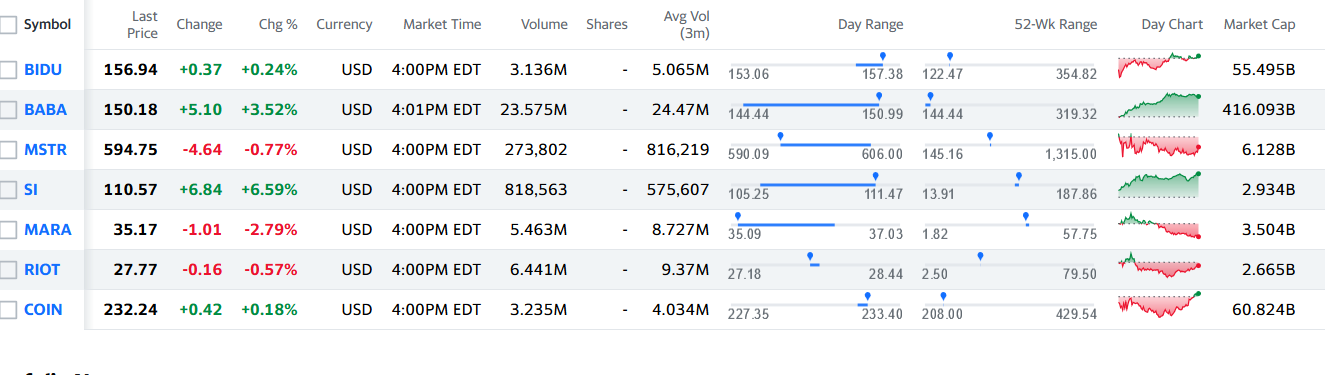

Bitcoin USD has again shed off 3.07% from its value in after-hour sessions. The CMC Crypto is down 4.03% this morning, although it showed firm resistance to future sinking on the weekend. More or less the Chinese authorities decision to ban all cryptocurrency transactions could be already taken into account in pricing, as the government has issued multiple warnings beforehand. Below is the continuation of the Friday picture for the mostly affected companies. BABA and BIDU have recovered from the severe Chinese government interaction in their operations, prohibiting buyouts in the streaming and entertaining sectors. The crypto-related stocks however continue to show weaknesses with SI as an exception – its digital currency related business is only a small part of the overall banking portfolio for individual clients in the US and internationally.

The US Congress is supposed to pass a new budget by the end of September, and if otherwise the the whole administration is supposed to stop work – a situation which has been exhibited many times before, so this may not be considered big news.

Today at 10:00 am EST the Fed Chair Powell testifies, so it is highly recommended to exit short term positions at around that time. The CB Consumer Confidence index, which has a limited impact on US markets is also coming out at 10:00, but it truly depends on the deviation from the market consensus estimate.