In the last US trading session the bears ruled, sending the Dow with 1.66% to 34292.21, the S&P down with 2.05% to 4352.03 and the Nasdaq Composite down to 422.27, shedding off 2.82% from its market value. The 10 year Ts are continuing to climb to a 3 month hi, reaching 1.558%. All sectors and market leaders were affected negatively, with an extent depending on whether they are in a growth or mature phase, consumer cyclicals or defensives. As mentioned in the previous articles, the moods prevailing the markets are quite mixed and nervous, right now, with one and the same set of economic data being viewed from different angles every day.

The Fed polemics is also changing quite often, depending on the current prevailing trend – a central banker could never state something against the rational and the obvious. The turning stone yesterday was the U.S. consumer confidence index dipping to a seven-month low for September – it was a very bad sign that shoppers are more optimistic about the overall economy than they are about their own finances. As Powell and its crew were pretty confident about the “temporary” energy-price and supply shock driven inflation, just several days ago at the FOMC meeting, now with ongoing world depleting inventories and rising Ts yields, Powell explains the current 5% inflation with supply difficulties after the economics reopening and stated that these effects were underestimated before, in length and strength. He also significantly changed the tapering polemic tone stating that if the higher inflation persists, Fed would react with all of its instruments.

Another bid disappointment came from a lack of Congress agreement on the budget – Republicans blocked a Democratic move in the Senate to raise the debt limit, and during a Senate hearing both Powell and Janet Yellen warned that a US default from failure to raise the debt ceiling would have catastrophic consequences. We could be pretty assured that the market rally is over and time for a correction, or which is worse – a prolonged volatility is coming. We have the still ongoing pandemic, the supply chain bottlenecks, affecting all sorts of prices, rising yields and inflation, pending and now widely expected QE tapering and a sooner than expected base interest rate increase.

Japanese stocks continued the US moods, dropping over 2% on Wednesday after heightened inflation worries hit Wall Street shares overnight, and a prime minister election is pending there.

The Brent oil pulled back from a 3 year hi of USD 80 to USD 78.59 per barrel, while WTI crude retreated toward $74 a barrel, with 1.73%. The pullback may well be deemed a healthy correction, and in part due to the strength of the dollar index, now at 10-month hi. As all commodities are traded in dollars, a rise in the dollar, translates into a price weakness on the dollar-denominated commodity. The other reason for the retreat is purely fundamental – with the number of uncertainties for the economic recovery listed above, demand for the commodity may be negatively fluctuating.

In relation to rising Ts yields, the Gold was down with 0.8% to USD 1737,5/ounce. Gold prices are now at 7 week low, quite logically as safe-havens like Treasuries are now yielding higher. The commodity’s price is also negatively affected by the dollar strength.

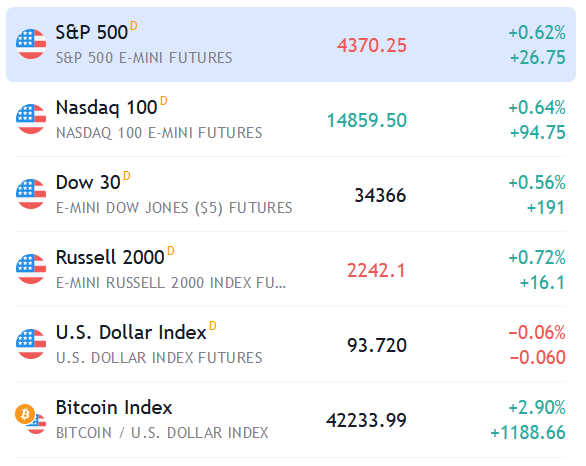

In after-market trading and in the Asian session, there has been some recovery on the futures, so yesterday’s pullback may not prove to be pretty prolonged and severe:

Another piece of good news is that Chinese Evergrande plans to sell a USD1.5B stake in Shengjing Bank Co Ltd to a state-owned asset management company in order to avoid default. All the net proceeds from the disposal will be used to settle the financial liabilities of the property developer due to the lender.

Also, the world’s largest electric-vehicle battery maker, Contemporary Amperex Technology Co Ltd. /CATL/, has agreed to acquire Millennial Lithium Corp. CATL is pursuing a strong supply of a key battery-making mineral with this deal, a clear insight of how key producers have begun handling raw material supply shocks.

The safe asset classes right now may be deemed farm commodities – the wheat and corn contracts added to their prices 0.4 and 0.6% respectively /CBOT /. Corn shipments were the highest in a month as terminals were recovered from the Hurricane Ida. The prospect of strong demand underpinned prices, although a rapidly advancing U.S. harvest season curbed gains. Farm product companies are much better for individual trading than the commodities futures themselves, as the price of the contracts is too high. Below are listed some mid and small companies in the sector, traded on NYSE, with TSN, ADM, BG being the most popular. If fundamentals are good they are supposed to trade inversely correlated to the market, in bear-ruling days. Now there are also good prospects on the demand side for farm products. In the current market situation, growth stocks like tech companies are edging lower and if one needs to hedge, consumer defensives are a pretty good option.

Today at 11:45 am EST the Fed Chair Powell speaks, so it is highly recommended to exit short term positions at least 30 min after and 5 min before that time. At 10 comes the pending Home sales index, which has a limited impact on US markets and also the Crude Oil Inventories in the US, which in normal course of events used to be ignored but right now, in case of much bigger than expected depletion of stocks, is supposed to boost oil prices, and respective oil and gas companies’ prices higher.