The American stocks’ session dipped down on Thursday with the DJIA, S&P500, Nasdaq, shedding off 1.59%, 1.19% and 0.44% from their market values, respectively. The weak performance is sending the September results with a 4% drop, the worst month since March 2020 when the pandemics economic concerns were just reflected in the markets. As mentioned many times before, now we have not only the employment figures and ongoing COVID contagion and death rate risks, but also the hardly tamable inflation figures, stemming partly from the higher food and energy prices and mostly from the burdensome supply shocks worldwide. A supply shock is a new negative event to the economy and could not be handled with any monetary or fiscal policy instrument worldwide. This is perhaps the worst consequence COVID-19 brought to us. Brent Oil and WTI, Nov delivery future prices continued to behave stable with slight appreciation at USD78.85 and 75.15 respectively. Even the noninterest bearing Gold gained 2%, serving as an inflation hedge.

The negative mood was boosted from all kind of data and from several big economies worldwide. First the Unemployment claims in the US largely surpassed the market consensus figure, standing at 362K for the week ending on September 25th, a third consecutive increase, quite in contrast with the Powell’s optimistic tone on the job market. Second, the Manufacturing PMI in world’s second economics unexpectedly shrank in September on broader limitations of electricity usage and higher commodity prices. The PMI in China stood at 49.6 in September versus a 50.1 in August, shrinking for the first time since the pandemics start in February 2020! The 50 level is considered an important and watch-alert borderline dividing negative and positive prospects for the future. Third, we have a 4.1% September inflation in Germany, reaching 4.1%, well above the 2% ECB target! Again, in officials’ explanations, as in the US, this would be attributed to a one time VAT decrease event, and “temporary” energy and food prices increase.

In response to the biggest supply risk for US automobiles, blue chips and other producers with capacities in the country and worldwide, the White House has demanded an explanatory report for the semiconductor insufficiencies, deriving from countries like Tawian. Such important parts’ suppliers are severely disrupted by local pandemic measures right now and explanations and forecasts are also demanded on their side.

Yesterday all market sectors were affected by the bears-ruling mood, with even the recently good performing financials and energy companies being affected:

The Technology sector continues to add losses, coming both from profit-taking in the recent rally and from the surging Ts yields which prevent debt-financed growth in the market leaders. A good company to short in the sector is Facebook /Nasdaq: FB/, and a company trading in inverse correlation to the market is Netflix /Nasdaq: NFLX/. Other consumer cyclicals to short, boosted by negative sector-specific sentiment are real estate companies like Home Depot /NYSE:HD/, ending 2.57% on negative territory yesterday. In times of rising interest rates, uncertainties on the job market, and a boosting inflation for necessities like fuel and food, buying or improving a house is the last thing a general US consumer would do.

The company-specific negative sentiment on Facebook is based on several important issues. It no longer used to be a favorite analyst “buy” rating and its presence in most professional portfolios is now questioned. Intense competition on the social network ruling is imposed by companies like Tik-Tok, ByteDance, and even the streaming and social services of Apple. FB is subject to investments corresponding to the ESG standards /based on certain economic, social and management factors/, and recently fails to comply. The advertising business of the giant is now in a mature stage, and its innovations in the virtual reality or intelligence glasses fields are not supposed to mirror the ads field success. The worst, however comes from regulator issues: The Federal Trading Commission is now demanding Facebook to divest of Instagram and Whatsapp due to monopolizing issues.

Moreover, Facebook is demanded to change its algorithms and inner systems, concerning privacy of information, which is related to a big amount of non-profit yielding R&D/Restructuring expense. Only yesterday the Russian authorities warned FB that it could fine it with 10% of its country-related turnover in case a certain content, deemed illegal, is not deleted. Social platforms often face legal battles like this, and most often are supposed to pay or divest of a country’s business.

Netflix, on the contrary is offering a stable positive performance, regardless of the general market moves:

The fundamentals of the company are worth considering, as it usually offers very clear moves for short term momentum trading, moving in a trend with almost no corrections. Netflix is a major provider of internet-connected TV and video-streaming business in the US and worldwide. It gained 1.88% yesterday, hitting an all-time hi, in spite of the dipping market. The company is expected to report EPS of USD2.54, up 45.98% from Q32020, and revenues of USD7.48B, up 16.25% from Q3 2020. The company is also set to grow multi-sector, acquiring Night School, a gaming-business company.

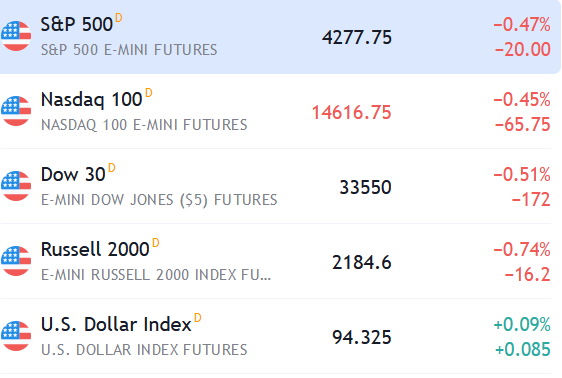

This morning, in after-hours trading, the negative moods are prevailing in the US market and the dollar gaining further as a hedging asset class:

The Senate has finally approved a Federal expense budget, thus preventing the US administration for work stop. The Core PCE Price Index is important to watch at 8.30am EST and the ISM Manufacturing at 10:00 am. Short-term trading should be stopped at about that time and at least 15 minutes after.