Yesterday, buoyed by the better than expected ISM Services PMI report, and stimulated by dip-buying, US stocks rebounded from recent lows. The Dow Jones, S&P500 and the Nasdaq ended on the green territory with 0.92, 1.05 and 1.25% respectively. The big tech-stocks representing the Nasdaq are outperforming the broad indices by its higher beta – a market correlation measure, deepening losses when they occur and heightening gains when positive moods prevail. The Nasdaq appeared above its 100-day moving average. Treasuries’ prices dropped, sending the 10-year yield above 1.53%, hitting a four-month high of 1.5670% during the session. The primary concern of the market since late September has been set around inflation – consumers’ and investors’ demand is elevated, propping up the real economy, but the supply chain constraints continue to limit the goods and services offered. In her latest hearings, Janet Yellen is expecting the supply shock-produced inflation to persist in the next several months. Supply issues are transitory, but persistent in nature.

It will be interesting to see whether the supply setback will drag on the corporate profits in the third quarter, with the earnings season being already active right now. Next week, the financial statements and estimates of banks will put a clearer picture on the economic perspectives, and respectively financial institutions’ profits. For the time being, the recent batch of US economic data has been largely upbeat, with durable goods orders, retail sales, PMIs surpassing expectations and stimulating inflation at the same time.

Another reason for the US Ts yield spike is the ongoing mess around the US debt ceiling – no one could expect a US default on sovereigns because of a lack on officials’ agreement, purely a political problem, but at the same time every month end, during the debates, yields are usually going higher. The US finance minister and former Fed chairman, Janet Yellen, has multiple times warned on catastrophic consequences on bond and stock markets, as well as the real economy, if the debt ceiling is not to be raised. The Senate will vote on Wednesday on a Democratic-backed measure to suspend the U.S. debt ceiling.

Inflation, and therefore Ts’ rates are also boosted by rising oil and gas prices, which could threaten the global economic recovery. Global oil demand is growing as economies re opened on the back of rising vaccination rates.

Looking at the market, all of the negatively affected tech-stocks, considered yesterday, gained their grounds on portfolio adding at corrections. These are considered must-have companies, and managers are waiting for proper levels to reenter positions. Even the recently notorious FB gained some 2.06% to its value. The former employee leaking internal information in front of the media, yesterday testified in front of the Senate, which added to the further tarnishing of FB’s reputation and called for a hearing of Mark Zuckerberg in front of the Committee. Last year the company has spent USD1.6B on legal fees, settlements, and fines. The rally on the Big Techs is considered short term because of the issues considered in the previous article.

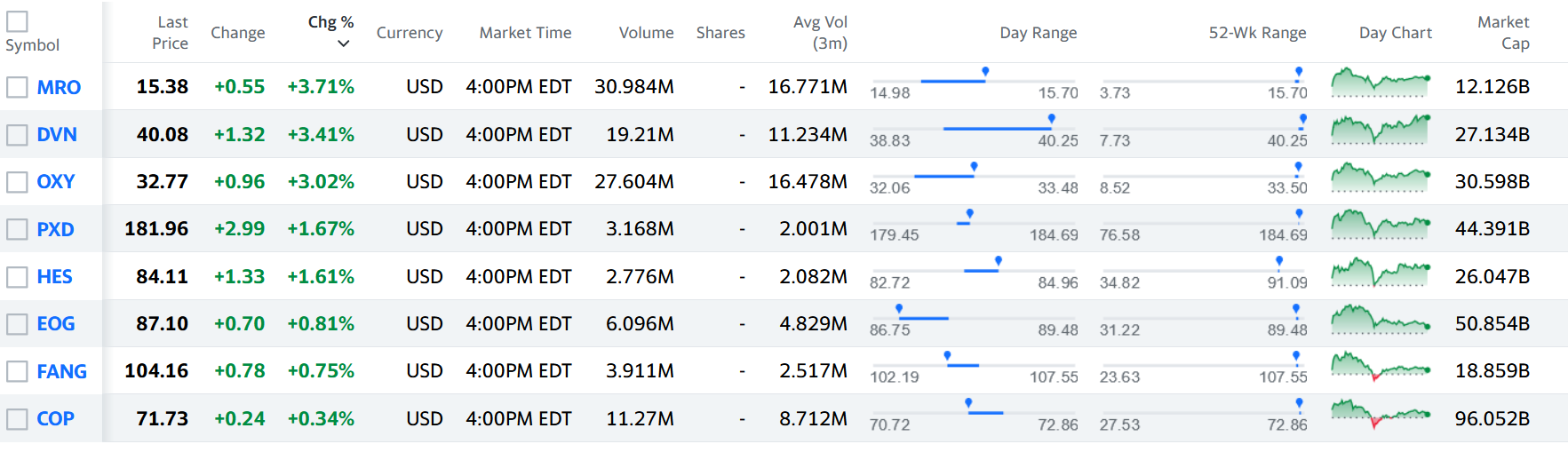

The oil and gas sector has much more favorable and stable fundamental picture to support the positive market sentiment and stress-relieved trading. U.S. crude rose to its highest level since 2014 on Wednesday at USD78.87 per barrel and Brent crude finished at USD82.49 per barrel, after hitting a three-year high in the previous session. Natural gas futures are also spiking based on global gas-supply shortages. Moreover, the OPEC’s outlook suggests further reductions in global oil stockpiles, given that oil inventories are already low. Here is a broadened picture of the Oil&Gas sector from yesterday, represented by the most liquid US stocks:

Another fashionable asset to trade right now is the volatility index – VXX ETF /BATs exchange/. The market is changing every day, red or green, fluctuating between a number of important and mutually contrasting factors. Some fund managers are even offering a leveraged VXX, which usually tops market performance in days of volatility. Now we have the markets jittering, with the economic recovery, the Chinese real estate scandals, and the pending base interest rate rise as an extremely complex picture to assess. The only thing that could be estimated for sure is that volatility will prevail.

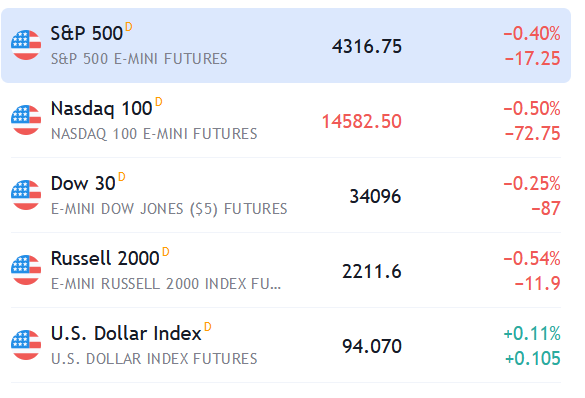

Chinese markets remained closed on Tuesday, due to a holiday and Asian shares dropped on Wednesday. The premarket moods at about 12:20pm EST looked like this:

Today, the important pieces on the US Economic Calendar come at 8:15 am EST: the ADP Non-Farm Employment change and at 10:30am EST – the Crude Oil inventories change. The market expects a considerable destocking from the last report – inventories to stand at 0.8m versus 4.6m before. A big divergence with market consensus estimates will definitely affect the session performance of the oil and gas companies listed above.

Successful trading!