The US Markets finished on the green yesterday, with the Dow, S&P and Nasdaq adding 0.92%, 0.83% and 1.05% respectively. Two important things cheered the market – the debt ceiling deal and the favorable labor market conditions reported so far. The Senate closed in a deal to avert default right now, increasing the debt ceiling with USD 480B until December 3rd but the fire-issue is not cooled down yet – as the year end approaches, exacerbated clashes on the government balance sheet are expected. Currently the US government debt stands at USD 28T! Last week’s new jobless claims were at the lowest within a month, a proof of the modest but stable job market improvement. Treasuries’ prices continued dropping, with the 10-year yields above 1.57%. Contrary to the general asset class correlations, the dollar mostly fell against the G-10 basket, causing further concern on the dollar-denominated debt. Perhaps worldwide bond investors are now more concerned on US debt default, however impossible it may seem, than the high yields it is offering. Hedge fund managers are building big short positions right now to confront inflation and rising yields risks, and to protect their interest bearing assets. This procedure is known as convexity hedging with, a current most popular target of 1.60% in 10yrs, a key level, which could be reached very soon.

Concerning the delta-variant of the coronavirus wave, seemingly well-managed by now, as holidays approach, the travelling-obsessed Americans are supposed to pose new risks for the economy.

The oil market is headed with a seventh weekly advance, with the Brent finishing with USD82.43 and the WTI with USD78.82 per barrel, with gains extended at the Asian trading. The global energy crunch is supporting the industry, represented on the US stock market, and the US Energy department said that it had no plans to tap the nation’s oil reserves at this time. Also, according to US authorities’ comments on the previous day, “releasing strategic stockpiles was being considered to counter surging gasoline prices”. Oil and gas explorers are supposed to boost drilling budgets by 54% in order to forestall a significant supply deficit in the next few years. No authority would leave oil prices surging indefinitely and thus preventing a consumer-oriented economic recovery. Major US Oil and gas companies were presented in the previous article, and yesterday gains in the sector were floppy.

FB shares contrasted the general tech-sector rally, deleting another 1.32% from the company’s market cap. The social network new products’ launched has been stopped amid ongoing regulatory scandals and reputational inspections. Pfizer and BioNTech applied for approval of their Covid-19 vaccine for children aged 5 to 11, and AAPL is upgrading its CarPlay interface to access functions like climate-control system, speedometer, radio and seats. The product is currently used by millions to control music, to use navigation functions and to make phone calls while driving.

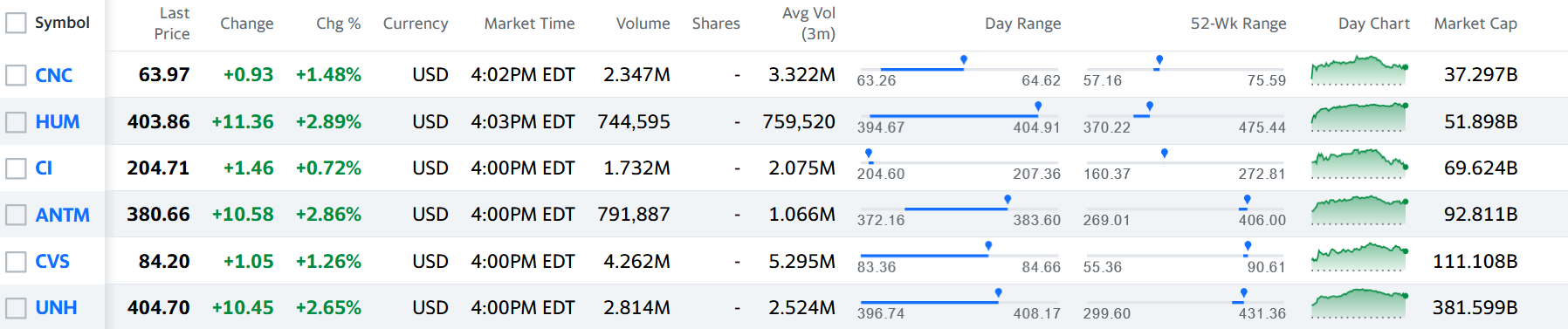

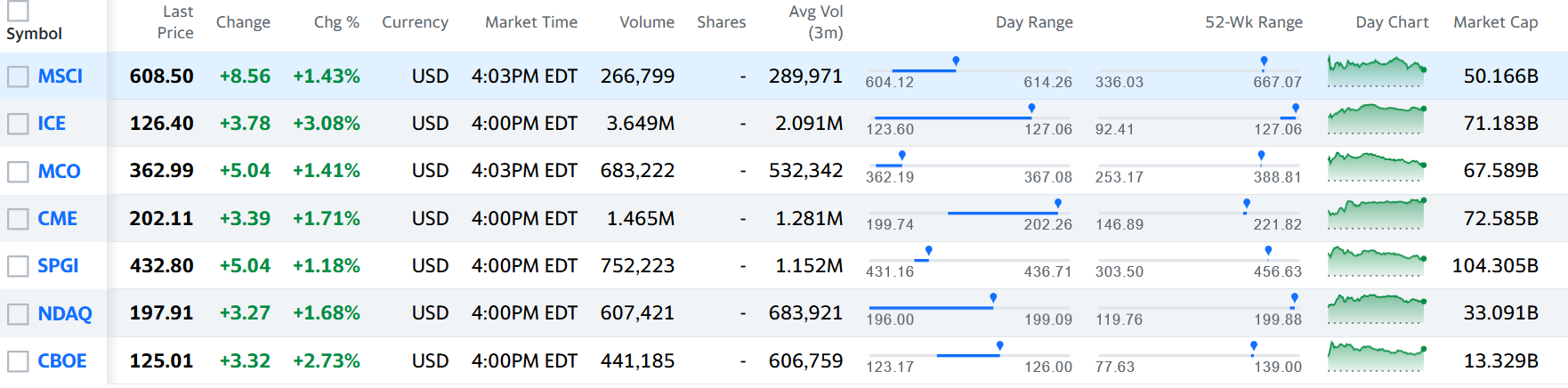

The best performing sectors yesterday were those related with profits immune to economic cycles. Examples are the Healthcare sector /Healthcare plans/ and the Financial data and stock exchange sector.

It is interesting to see huge gains of companies like the exchanges themselves /Bats, Nasdaq, ICE/, as well as ratings and benchmarks agencies, indices providers, etc. They largely outperformed the market.

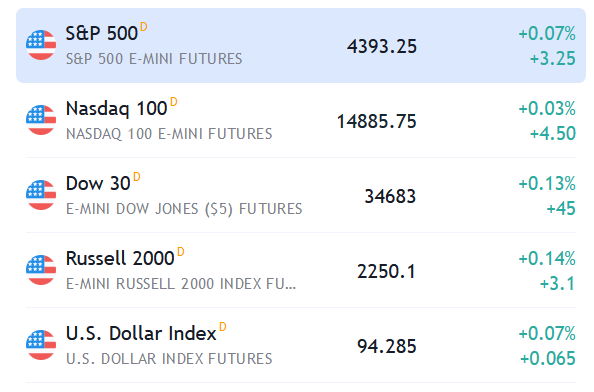

Japan’s Nikkei jumped on Friday, tracking gains on Wall Street but Chinese bonds and shares issued by Chinese property firms slumped after a return from a week-long holiday. The Chinese authorities do not have many clues on how to contain the debt contagion from the two injured country property giants, at least for now. The premarket picture at around 1 am EST looks like this:

Today at 8:30 am EST, the second important Economic calendar item, after the FOMC meeting, is expected – the non-farm Employment change report. Economists expect the report to show 590,000 jobs added in September. With a reading below 200K, the economic health would be seriously questioned by investors.