The market pullback that began in September and brought the S&P 500 down more than 5% from its record did not prove to be a “bubble burst”. For the week ended, the S&P 500 added back 0.8% and is again just 3.4% away from its record. Even the relatively disappointing employment figures on Friday did not seem to widely activate the bears. The non-farm employment change was only 194k versus 490k expected, with a figure below 200k deemed to be really worrisome. Wage growth was a positive aspect, but this is related with inflation and demands inevitable tapering in the near term. However expected these measures by the Fed are, once active, they will act like a cold shower to the broad market indices. The CPI and core CPI figures are to be released on Wednesday, an important insight to future Fed measures to observe.

Besides the fluctuating job market, the rising yields on Treasuries, the permanently higher inflation, which was considered to be “temporary”, the delta-variation worries, the multiyear his on crude oil prices, we also have the Washington deal on the debt ceiling, alleviating stock and bond markets pressure for some time, and an extremely positive earnings season expectations. At a certain point in time a number of factors, both positive and negative influence the market sentiment, and it seems that bad news has been systematically shrugged off by investors. Despite the supply chain worries and higher producer and end-consumer prices, Q3 earnings are expected to have risen with 27.6% YOY, an impressive growth rate indicative of the stamina and flexibility of American companies, as well as of the efficiency of both fiscal and monetary supportive programs. With so many important figures beating one another, it is not expected that the rosy glasses will stay on investors’ and traders’ side by all means, historical earnings by themselves are not indicative of the future strength of corporations. Just a quick check at Worldometers shows that the US is still the leading developed country in the black statistics – coronavirus cases per million of capita – 135k with a number of other leading economies, like Germany, Austria, Italy, at about twice less that number.

Another point of market uncertainty, besides the conflicting employment and inflation figures, comes from an arising geopolitical conflict between the two major military superpowers in the world – China and the US. The hot issue is again Taiwan’s independence. China was not benevolent on US troops training local forces for defense in Taiwan, in case the communist country attacks. Most probably the news next week will broadly follow the matter and even the slightest official warnings or comments on the US side might trigger big selloffs on the markets. The matter is extremely sensitive for China, which is deemed to be usually a pacific country. The Chinese President Si Dzi Pin promised on Saturday to implement a “pacific unification” with Taiwan, regardless of the fact that a sovereign country will fight by all means for its independence. The international communities are deeply worried on the pending war. Taiwan reacted sharply stating that “only the Taiwan people may decide its future”. Si Dzi Pin continued that “the Chinese people has glorious traditions on fighting separation”, “the historical task for completing the Chinese country unification has to be finished and will be finished”. In case the conflict exacerbates the insurance sector is a good one to short with companies like MMC, AON, WLTW, BRK-B, HIG.

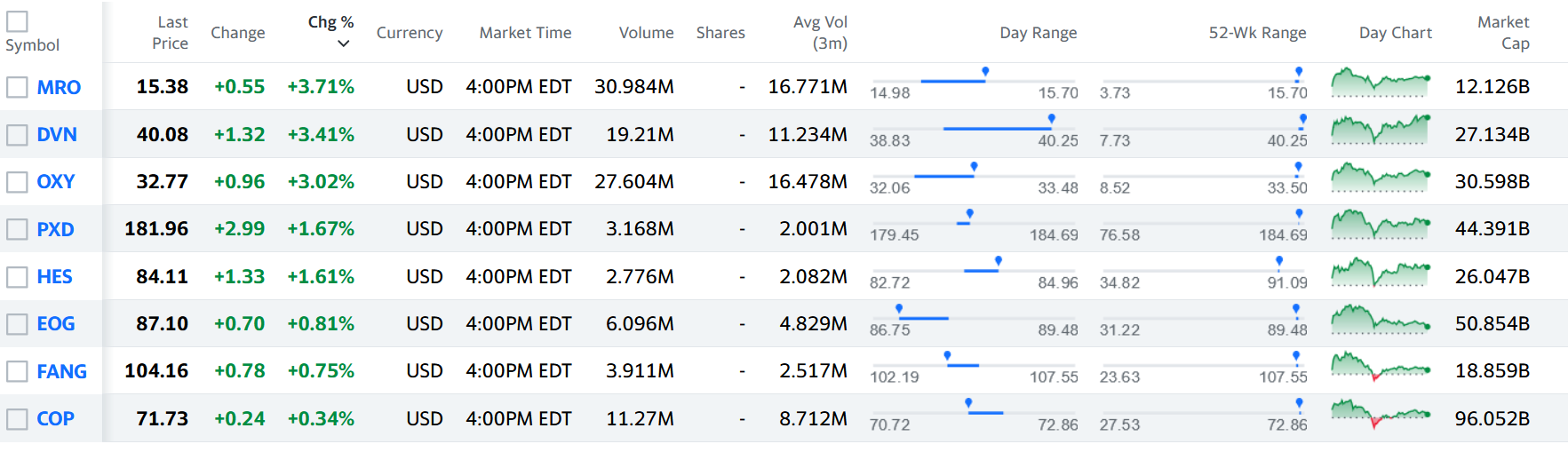

Last week was stellar for the Oil and Gas sector broadly outperforming the market on the high Brent and WTI prices. This morning Brent is continuing further at USD83.71! and WTI at USD80.92, with а succession gain of 1.6 and 2% respectively. Investors are supposed to continue buying energy shares, as well as the biggest winners in the bank/financial sector with profits and managerial estimates rolling as expected or better. By mid-week we observed some of the best performers in the Oil and Gas sector with companies, which were close to their 52 – week hi:

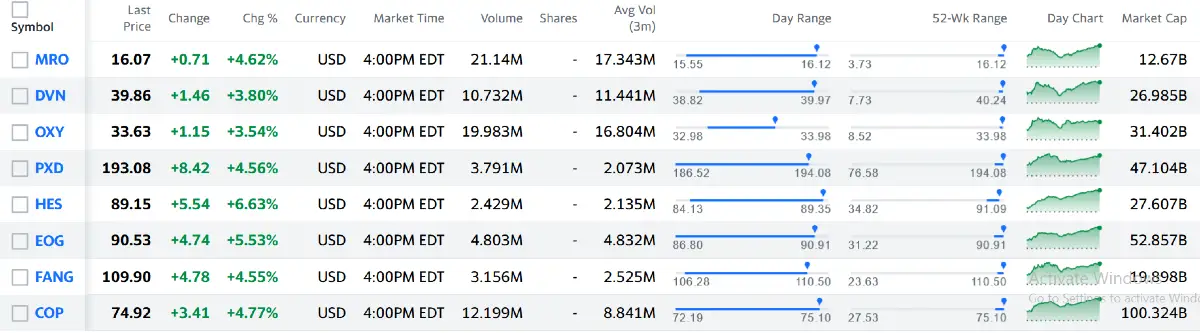

At the end of the week, they keep up with the stellar performance with most of them even exceeding their 52 week hi:

With such huge profits, which supposed entering into a position at the beginning/mid-week, while the sentiment was quite strong, now it is risky to explore a long position again, unless a company-specific extremely favorable event occurs. The financial statements should be watched closely for risks and uncertainties, surrounding future estimates, capacities, drilling difficulties, and together with the first correction in oil prices, shorting in the first round would be considered quite safe.