The major US indices finished North for a third consecutive day, after an extremely volatile September, with the Dow, S&P and Nasdaq deleting .34%, .24% and .14% respectively. This time the IMF downward revised forecast for the world GDP growth twisted the positive moods of investors – the global economy will grow with 5.9% in 2021 and 4.9% in 2022, with 0.1% less from previous estimates published in July. The correction is attributed to supply chain shocks in developed economies and the worsening dynamics in developing countries, especially in the labor market. The energy-prices driven inflation on one hand is good for major world commodity exporters, but on the other hand is posing obstacles to a healthy economic recovery. The 10 year Ts’s yields moved slightly down to 1.57% on Tuesday. There is a little bit of positive news on the supply shock problem with higher rates for container shipping showing signs of easing.

Today, the tone before market open will be set from important financial statements posting – those of JPM and Delta Airlines. Later in the week come BAC, WFC, MS, C and GS.

Merck and Ridgeback Biotherapeutics are seeking emergency approval from US authorities for their molnupiravir, the first oral antiviral treatment for the coronavirus. It is supposed to be applied for adults already infected and suffering from serious complications.

Oil prices moved very slightly down on Tuesday, but still Crude WTI is holding above USD80, at USD80.54 this morning and Brent is USD83.33. The production in the US, on authorities demand is supposed to return to pre-pandemic his within weeks, and major commodity analysts also predict that Joe Biden will ask the OPEC to pump more. Asking, is the only thing which could be applied from Biden and other policy makers, regarding OPEC. As winter approaches and shortages of coal and natural gas occur worldwide, another piece of pressure on energy prices came from China – the thermal coal prices are trading at record his, as key mining regions are hit by flooding.

A ton of aluminum production takes approximately 14megawatt hours of power to produce, and aluminum is used everywhere – from packaging to iPhones. The deepening energy crisis is reflected in the price of aluminum, jumping to its highest since July 2008, and other metals’ prices are also accordingly affected. A major US aluminum producer is Alcoa /NYSE:AA/, adding 1.04% yesterday, despite the general market negativity. The company is worth considering a deeper analysis, since the fundamental sentiment is fresh and supposed for persistency. Another aluminum producer traded on NYSE is the Rio Tinto Group, based in London /NYSE: RIO/. Company specific factors are strong here, since it did not perform well, despite the positive market sentiment for the subsector. A whole Tuesday performance picture of the hot segments, driven by energy prices, is presented here:

The Energy-Regulated sector is deemed to perform good in the near term. Tesla /Nasdaq: TSLA/ and Ford also added 1.45% and 1.69% respectively, after strong September data for electromobile sales in China.

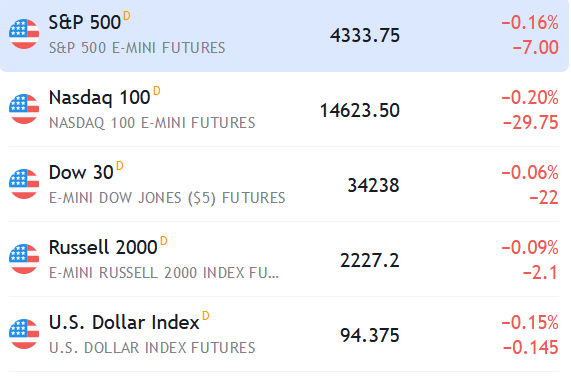

The negative tone for trading continued after-hours in the Asian Session, with MSCI Asia Pacific dropping .8% overnight and Japan’s Nikkei closing .33% lower. China’s equity market is torn down by its financial sector and real-estate bond failures. The rising inflation is also a big negative for countries with smaller GDP per capita, as this means less spending on consumer cyclicals by the average Chinese Consumer. In Europe the Stoxx 600 Index was little changed this morning with traders favoring defensive companies. At about 2am EST the futures continue their decline:

This morning, besides the important earnings mentioned above, at 8:30 EST comes the long expected CPI and Core CPI m/m. Core CPI, which excludes the volatile energy and food prices, is usually taken into more consideration, but at the current state of the environment, the conventional CPI would be closely watched. Alarmingly higher figures on inflation would exacerbate the negative tone for the session set at premarket hours. On the other hand, with positive JPM estimates bulls and bears would beat each other the whole session.