The DJIA reached a new record hi yesterday, up to 35756.88, with a 0.04% gain, the S&P furthered with a .18% gain and the Nasdaq added .06% to its market value. The extremely favorable corporate results on the earnings releases are a logical and indisputable driving factor for the broad indices’ his. So far approximately 30% of listed companies have reported, with 80% of the biggest names with results much better than expected. Q3 total earnings growth is expected to increase with 35.6%q/q, an impressive digit, which is further surpassed by actual releases and future corporate estimates. The US better than expected consumer confidence results released yesterday also sustained the bullish moods on the Street.

Considering some of the market-sentiment defining companies, FB disappointed investors with Q3 revenues of USD26B, below expectations and even a little bit below the base – the previous quarter. The high gross and operating margins of the company, however save its final line – Net income of approximately USD9.1B was reported. As mentioned in previous articles, FB has faced and is recently facing a lot of regulatory issues and legal fines on consumer ethics. The company shed 3.92% from its market value and dragged down the total performance of the Communication Services industry on Wall Street.

On the other hand Alphabet, the mother-company of Google, /GOOGL/ and MSFT advanced during the session even before their earnings release, which was scheduled for after-market hours. MSFT surpassed on revenues expectations thanks to its clouding sub – segment, holding 17% of the world market share, ranking right after the AWS leader. MSFT Q3 revenues of USD45.3B, doubled the expected growth rate q/q, and positive surprises came also in its Azure segment. GOOGL also topped estimated both on quarterly sales and profits but speaking in operational terms, the company remains vulnerable to macroeconomic factors and supply chain issues. The You Tube ads segment disappointed, with gloomy perspectives, and the cloud division also fell short. Considering trading ideas, MSFT would be a stock with much clearer and easy-to-trade market sentiment for today, with high-volume and clear-of-volatility short moves.

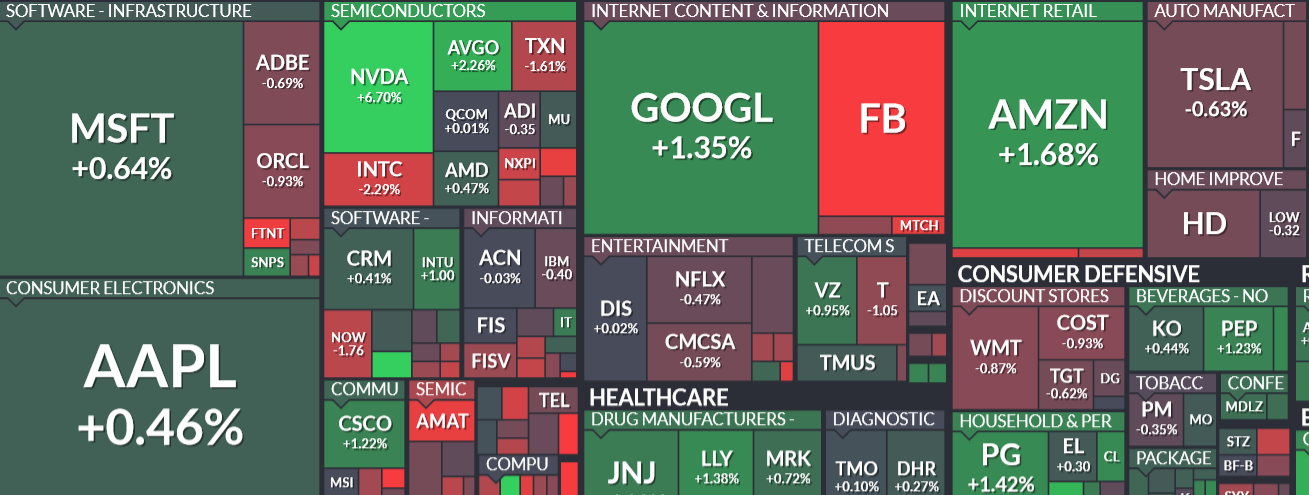

The general market picture from yesterday lacked clear segment favorites or draggers:

In pandemics time, logically enough clouding services providers, together with courier companies profit most from the electronic home shopping and the home-office settings worldwide. United Parcel Service /UPS/ gained the impressive 6.95% on the yesterday session after beating forecasts in all of its segments. However, I would not recommend trading the company today for short term positions, as the big re-estimations in fair market price have already been traded out, and there is a risk of afterwards choppiness. On the other hand, fellow companies in the industry segment could be screened out.

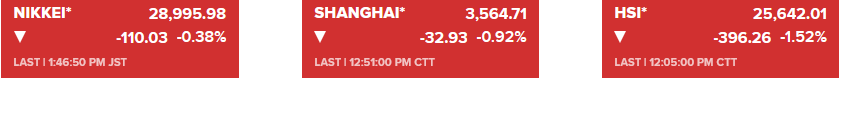

US stock futures are flat in today’s early trade, after big declines and Asian and Japan Indices:

The Chinese Stocks decline could be attributed to coal firms, and more specifically Beijing’s latest regulatory move to cushion skyrocketing coal prices, together with environment-protection issues. As discussed in previous articles, policy makers and ruling sector commissions and authorities worldwide would not easily subside with an energy crisis. Nikkei, on the other hand fell on elections-related uncertainty.

Today at 8:30am EST we have the Durable goods orders release, which is not considered of big market importance.

Successful trading!