The DJIA made a 5.8% growth in October, while the S&P and the Nasdaq added respectively 6.9% and 7.3% gains to their market value – all digits which are enviable for a monthly return of a passive index investor. The bulls ruled in an environment of rising 10year Treasuries’ yield, world supply chain serious issues, firmly higher energy prices, and of course, covid-pandemics restrictions. The optimism was boosted mainly by the historical advances in corporate earnings, with 83% of the more or less 40% companies having reported, surpassing analyst’s boosted estimates.

The US strong consumer sentiment, rising wages and employment rates, and inflation by itself, being able to be transferred to the end user, all supported the historical his in the broad indices. On Monday the ISM PMI also surpassed estimations, showing evidence for the strength of the US industrial sector too. Another positive development it terms of macroeconomic fundamentals is the resolving of the EU-energy crisis problem with Russian Gazprom having consented to substantially increase gas supplies.

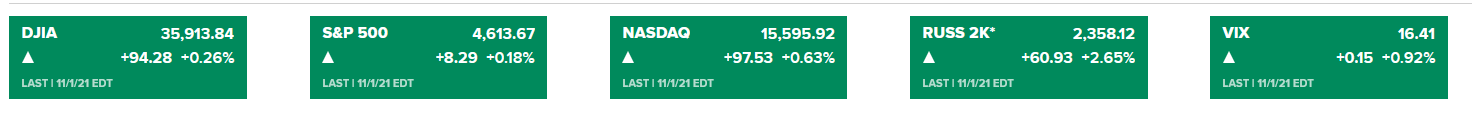

The low-interest rate environment is also a big supporter of market valuations of the mega-superstars listed – future cash-flows are discounted at a lower rate, debt repayment and refinancing is executed at lower rates, and proceeds are also massively used for stock-buybacks. Of course, tapering is ahead but no matter what, it is set to be at soft, gradual paces, and furthermore, it is already priced in asset classes’ quotes. If market bears are waiting for a deep and broad-based correction, they will have to wait a little bit more. The major indices performance from Tuesday is presented below, with the Russel 2000, representative of US small-caps, gaining 2.7%, thus achieving best performance since August 27th:

In the current week, we expect a new portion of corporate financial statements releases, and the big caps due to report today are Pfizer /PFE/, Amgen /AMGN/, T-Mobile US Inc /TMUS/, Conoco Philips /COP/, BP plc. /BP/, Mondelez International, Inc /MDLZ/, representative of the healthcare, energy and consumer retail/consumer defensive sectors.

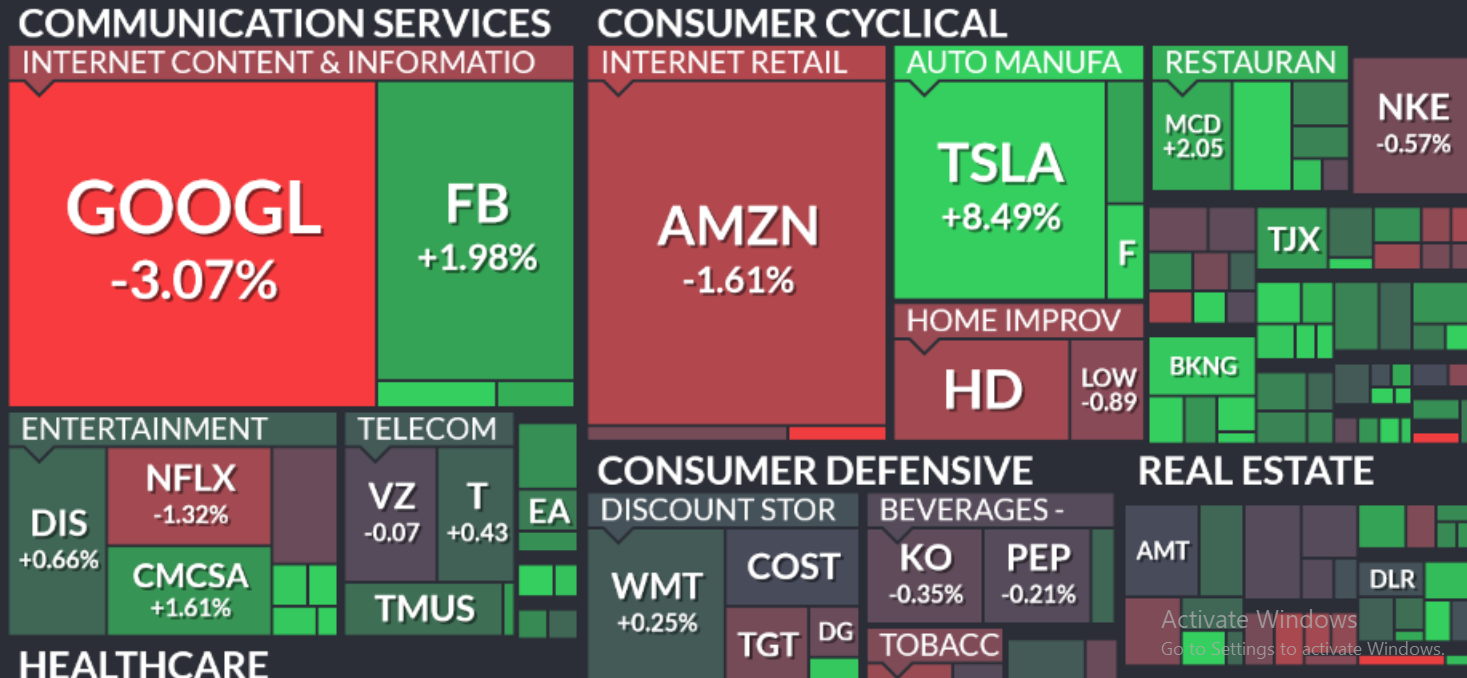

Considering yesterday’s sector performance, the most prominent star was TSLA, together with its industry peers. TSLA’s market cap surpassed USD1T last week and continues its wild rally, adding 8.49% to its market cap just yesterday. Factors to blame are the solid corporate results and favorable industry environment – although the company reported more than 10 days ago, with a 57% y/y growth of revenues, it is still enjoying its favorable market reevaluation. In the field of ever-rising environmental issues and oil-prices, demand for electro-mobiles would naturally explode, and these simple facts are not escaping investors’ minds.

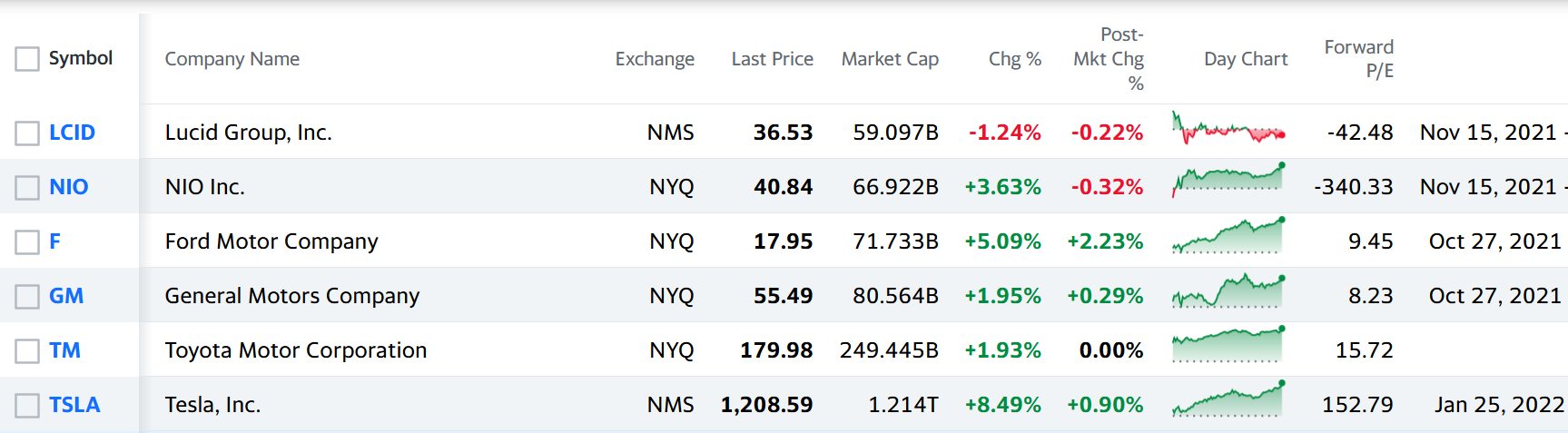

Another interesting company in the electro-mobile research and design industry is Lucid Group /NDAQ: LUCID/. As seen from the industry peers comparative table below, its forward market P/E is negative, but this is not a hurdle for R&D-related companies to attract investors’ attention and reach new market his. Interest towards the company is elevated as it managed to deliver its first custom-configured Lucid Air Dream Edition electric vehicle, with 520 miles of range. Product demand and production rates for such companies are much more important than historical or one-two quarters forward corporate results.

No important macroeconomic news is expected for release today.

Successful trading!