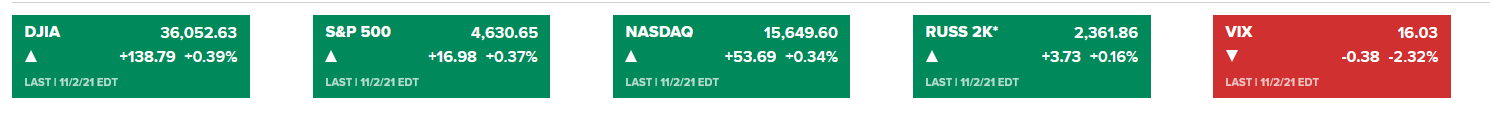

The US stock market reached another portion of records on Tuesday, with all of its three popular benchmarks, with the DJIA crossing the psychological border of 36000. For a third consecutive session the indices reach higher and higher, not bothered by tapering, supply shocks, pandemics or energy prices. The VIX is trending lower, indicative of the stability and non-deviation of positive moods on the market. All this happens after significant 6-7% monthly gains in October, and market participants are not excluding a Christmas rally too.

Today the Fed is ending its 2-day meeting and at 2pm EST, the FOMC statement will be released, together with a Press Conference. Exiting positions at least 30 min around that time is strongly recommended, due to higher market volatility form processing the results of the meeting. As mentioned many times before, the gradual tapering of the monthly USD120B purchases of Treasuries and MBS is already adequately priced in asset classes. Even furthermore, it is considered by reputable stock market analysts as a wise and positive move, so as to leave a flexible room for the base rate increase whenever it is called for. The ISM Services PMI comes out at 10am EST.

The unstoppable rally so far could be definitely cooled down, as there would be no cheap money to pour in the markets after the tapering is in effect, but still on a company-specific or industry-specific level there would be a lot of positive room for speculation. So far 55% companies have reported, with 82% surpassing analysts’ estimates on revenues and profit. Therefore we’re still left with 45% to report, looking for undoubted success or failure in all major segments of operations, as a signal for a clear 5-6% daily price change to ride on. Large m-cap companies to report today include Humana Inc, Metlife Inc, Marriot Inc, Discovery Communications Inc, Continental Resources Inc, Marathon Oils Corp, etc. I strongly recommend trading the company’s reports, wherever there is undoubted market sentiment established, in regular market hours, and on the first round – i.e. if the company reports before market open, active positions should be taken on the first session, and if the company reports after market close, on the next day’s session. In the days after report a lot of unexplained by fundamentals volatility may occur, due to portfolio restructuring of major asset holders.

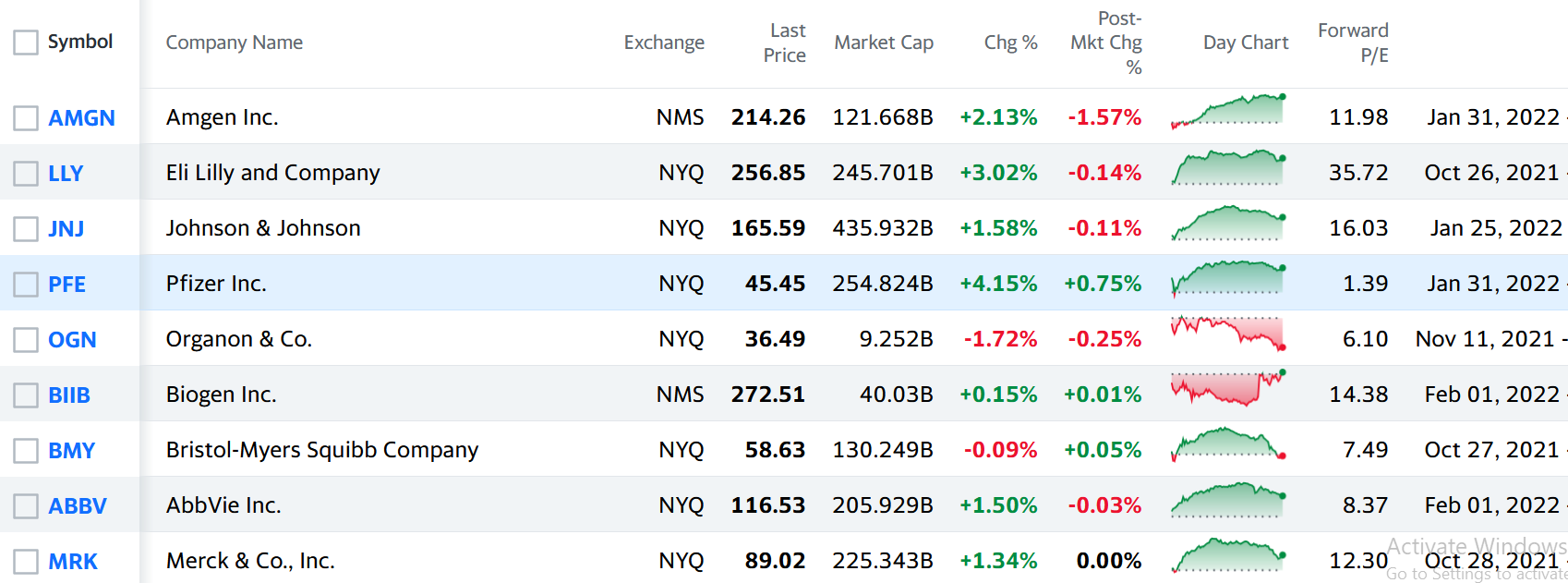

Yesterday’s leading sector undoubtedly was the Health – Drug Manufacturers:

The sector was boosted by Pfizer’s results, which on their turn were boosted by the Pfizer-Biontech Covid-vaccine. The company expects this year’s revenue from the vaccine, constituting 44% of sales, to reach USD36B, surpassing analysts’ estimates of USD35B. For 2022 the company expects the vaccine revenues to reach USD 29B, versus analysts’ expectations for USD22B, as it is contracting many new countries. Pfizer is sharing the vaccine profits on a 50/50% base with Biontech. As could be seen from the table above, the only company, which has not reported yet from the outstanding gainers in the sector, is Organon&Co /OGN/. Its reports are due on November 11th.

Other market movers included FB, stating that it is giving up its face-recognition application due to a questionable regulatory policy and in an attempt to clean its name and image from the ongoing ethical scandals. Under Aromour /UA/ gained a big 13.93% on solid covid-related demand for its sportswear. TSLA lost 3% on an unconfirmed deal with Hertz for the sale of 100,000 electro mobiles, but according to Elon Musk’s words, it is not affecting the company’s bottom-line, as TSLA is running in full capacity already.