Breaking new records is no more news for the US stock market – the Fed minutes from yesterday left a general optimism with its small steps for a monthly USD15B decrease of the USD120B asset purchases, in light of the strong economic recovery. The last part of the sentence is very important, as now we have strong demand, strong consumer sentiment, hot labor market conditions with shortage of personnel in the qualified staff sector, strong manufacturing indices, and on top of that the QE is still in place, although with a little bit smaller quantities. The Fed however is leaving a room of flexibility, depending on the current economic conditions, as its members uniformly stated that the policy is not preset and prone to on-demand changes. The Fed is also not in a hurry to increase the base interest rate and it signaled that now it is less optimistic on the “transitory” nature of the inflation, thanks to long term supply chain imbalances. It seems that the new hi levels of inflation are now considered to be the new “normal”.

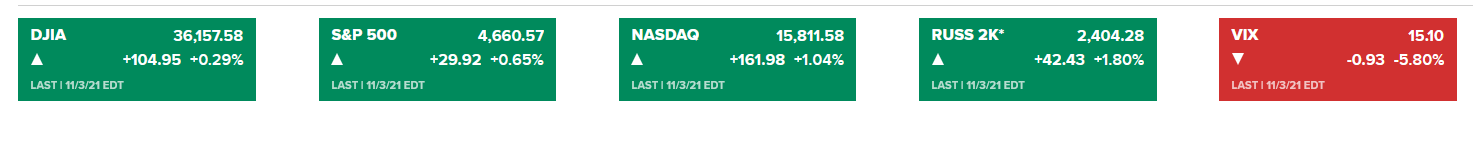

The strength of the US economy was confirmed time and again recently, with yesterday’s ISM PMI Services Index, far away topping estimations. The business activity and new orders indices have reached their historical his since the index was created in 1997 and the delta-variation of the Covid-virus has proven to have a limited impact overall. Household and business demand for products and services continues to explode, further complicating the supply chain problems and inflation – the indicator for orders procrastination has reached a record level last month. Companies are enjoying higher margins, and as long as the consumer does not mind the higher prices, supply chain shocks do not seem too big of a problem. In such an environment, it is no wonder that the market made a fourth consecutive day of record-breaking, with the small-cap representative Russell 200, gaining 4.7% since the beginning of the week. The VIX continues to plunge lower and lower, a firm signal for the stability of the current market moods.

Today at 8:30 EST the New Jobless Claims are coming out, and even a slight disappointment in this indicator may trigger a healthy broad-based correction.

In terms of sector performance, every segment was shining, except the Energy and the Utilities, where there is plenty of regulation for the prevention of rising prices and the oil price has fallen substantially recently to USD 81.77 for the Brent and USD80.36 for the WTI.

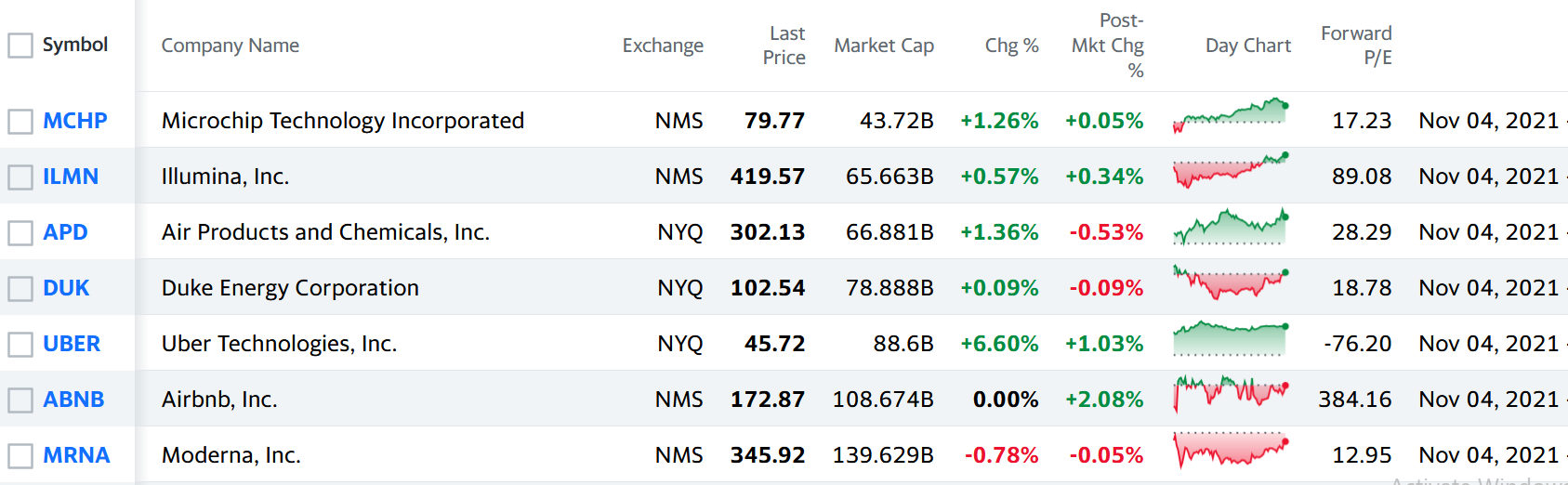

Some of the most popular large-cap stocks with financial statements to be released today are listed below:

It makes a point to pay attention to Moderna’s negative performance yesterday in a highly bullish environment and a leading index indicator with a 4th consecutive historical hi. Analysts do not expect too much of positive surprises on the financial statements obviously, and furthermore, Pfizer’s versus Moderna’s COVID-19 vaccine is recommended from the US Drug Commission for the application on children aged 5-11. Also, the company is relying for revenues too much on its vaccine, and when the population vaccination capacity is over, it runs the risk of receding to irrelevance. Square /SQ/, dealing with card payments processing, analysis and reporting, is releasing its financial statements after market close, and there are some outperformance rating issued on the company recently.

Successful trading!