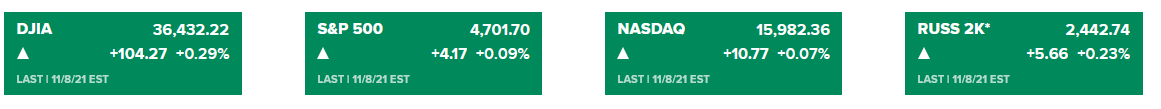

The three basic indices reached new record his yesterday with another encouraging factor, besides the brilliant massive corporate Q3 results and the favorable macroeconomic data released, including the employment situation. The S&P’s 8th consecutive session of record his streak is an event unseen since 1997:

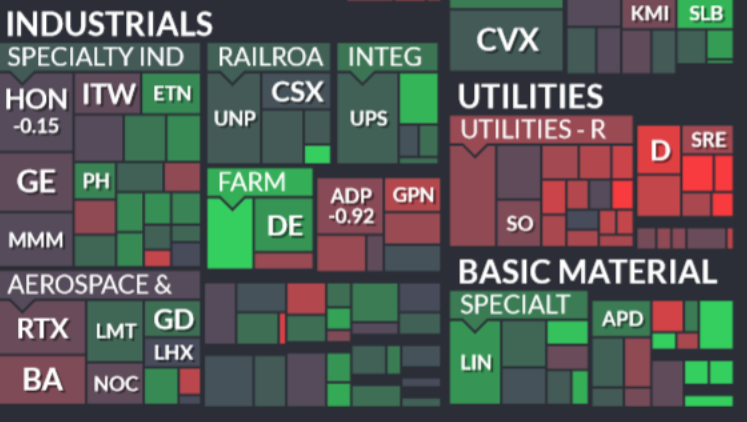

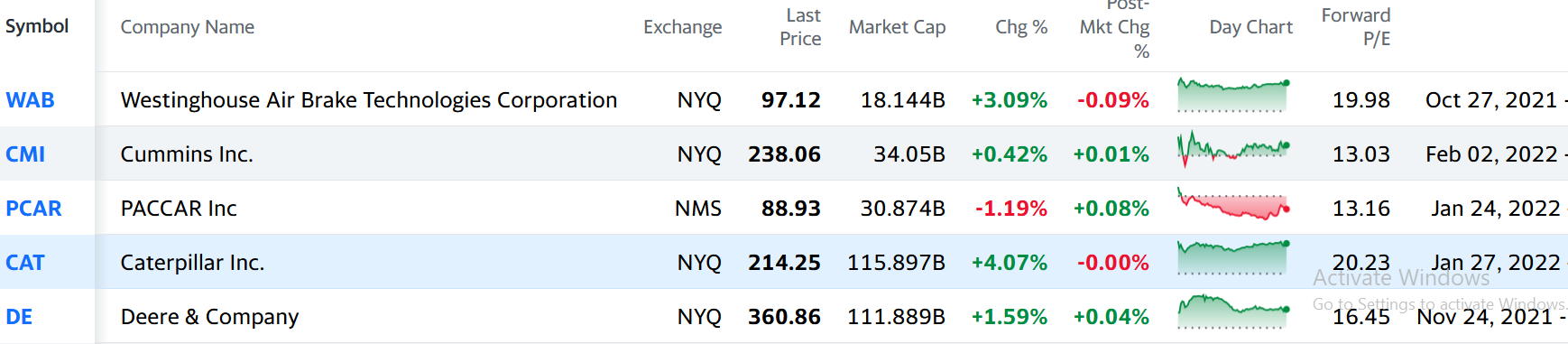

After straining and fluctuating negotiations for months, the USD1T Infrastructure project, proposed by President Biden and his administration was accepted. This huge government spending is supposed to form a big percentage of the GDP growth, and support heavy-construction, basic materials and heavy-trucks companies. A list of industry large-cap leaders is presented below, together with the sector performance from yesterday:

Companies like 3M, Caterpillar and PCAR are included in the Farm and Heavy Construction sector, with DE still to report on November 24th. The company operates in three segments, producing various pieces of equipment worldwide: Agriculture and Turf, Construction and Forestry, together with Financial Services. The forward P/E of the industry is pretty safe, as industrials do not enjoy such dynamic high growth or profit margins like the blue chips. With this 1T package however, heavy equipment and basic materials producers will be in focus of major asset managers’ portfolios. The Biden Project will set the biggest modernization of the American infrastructure for a whole generation – roads, railroads and the whole the concomitant infrastructure will be renewed.

Another piece of news, related with the basic materials sector is that the EU and US have negotiated out their arguing on the steel and aluminum special customs duty. In the future EU producers will be able to import specific amounts of the basic materials customs free, while US producers will import whiskey, jeans and Harley-Davidson motorbikes customs free in the EU.

TSLA endured a contemporary market sinking, due to a Twitter poll as weather Elon Musk should or should not sell 10% of his shareholdings. This event-driven price change is in no ways reflected with fundamentals, market or industry-specific conditions, and I do expect a quick recovery in the short-to mid-term.

Considering oil prices, they reminded of the fact that regardless of daily or weekly fluctuations, we are standing at a 7 year hi, supported by fundamentally restricted supply, as discussed in previous articles. WTI closed at USD 81.9 /a +1% for Monday/, while Brent is trading at USD 83.33 this morning. The OPEC has refused increasing its total supply, and now worldwide energy commissions, led by the US one, are considering releasing state reserves to cushion an oil-price-driven inflation. The OPEC, sticking to only 400K barrels daily production increase, could not be influenced by the world-leaders’ requests, neither could producers be interfered with their production capacity management. Therefore, oil state reserves management is the only means under control by the government. The US Administration would consider latest data on Tuesday.

Today at 8:30 am EST the PPI will be released.

Successful trading!