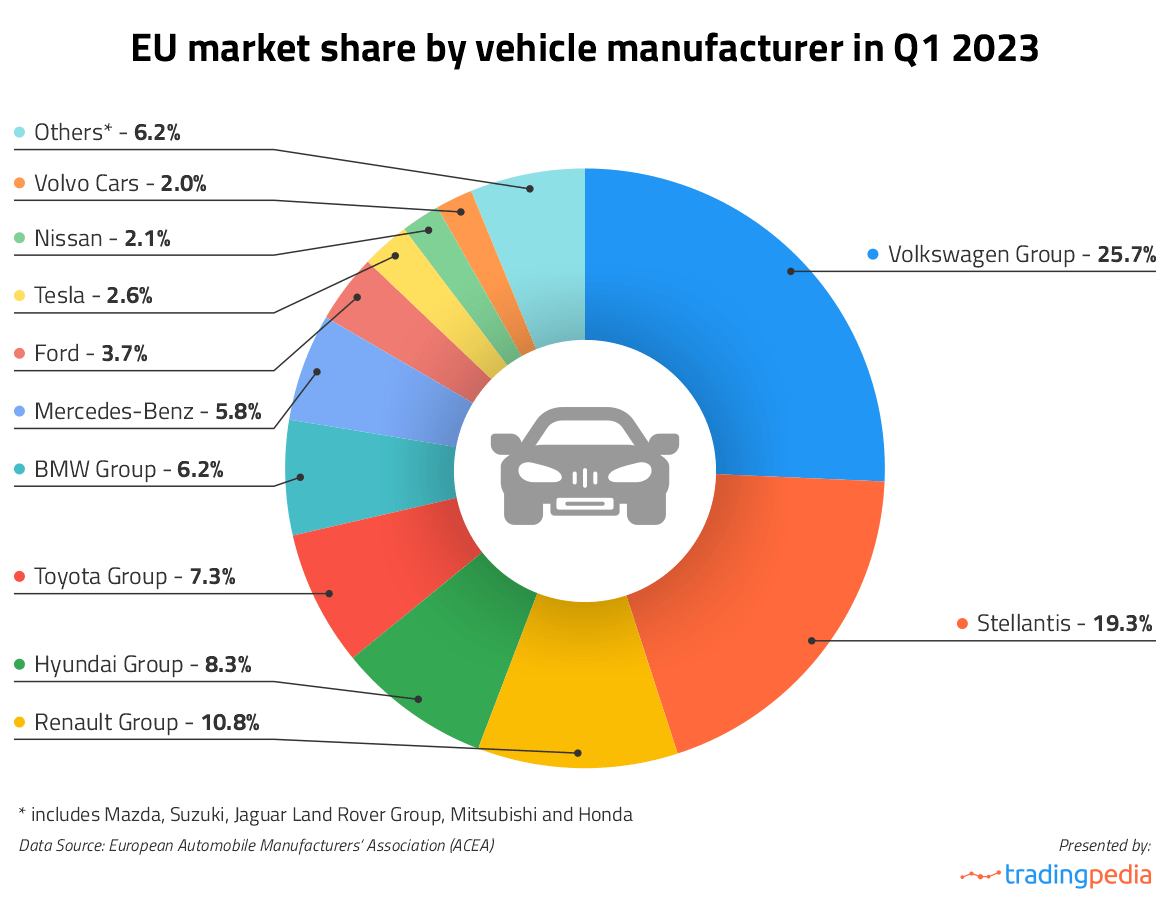

Volkswagen Group has further solidified its position as EU’s leading auto maker, as the company has increased its market share by 1% in the first three months of 2023 compared to the same period a year ago.

Some of Volkswagen Group’s main competitors such as Stellantis, Hyundai Group and BMW Group have lost market share, while others such as Toyota Group and Mercedes-Benz have managed to retain their market positions, data by the European Automobile Manufacturers’ Association (ACEA) showed. TradingPedia analysed this most recent data from ACEA and our team drew charts, breaking down the market shares of the different manufacturers and the fuel types for new registrations in Q1 2023.

In Q1 2023, Volkswagen Group’s new passenger car registrations throughout all 27 EU markets have increased 22.8% YoY to 680,787 vehicles. As a result, the company’s market share has expanded to 25.7% during the quarter from 24.7% in Q1 2022.

Among the 8 brands within Volkswagen Group, the most considerable growth in new vehicle registrations was observed at:

- Cupra, 53.7% YoY to 32,790 vehicles,

- Skoda, 27.4% YoY to 145,379 vehicles,

- Audi, 21.6% YoY to 140,924 vehicles,

- Volkswagen, 21.0% YoY to 283,273 vehicles and

- Porsche, 19.6% YoY to 19,436 vehicles.

In March alone, the Cupra brand had 16,273 new passenger vehicles registered (a 56.6% increase over March 2022), while the Skoda brand had 56,811 new vehicles registered (a 52.5% surge compared to March 2022).

Volkswagen Group is expected to report first-quarter financial results on May 4th, with the median analyst estimate pointing to earnings of EUR 7.12 per share and revenue of EUR 71.98 billion. In Q4 2022, the company reported EPS of EUR 8.62 on revenue of EUR 76.24 billion.

Stellantis, the EU’s second-largest vehicle manufacturer, has lost 1.2% of market share in Q1 2023 compared to the same quarter of 2022, as it now controls 19.3% of the EU auto market. The group’s total new vehicle registrations stood at 511,910 units, or an 11.3% increase over Q1 2022. The Peugeot brand saw 13.0% more vehicles registered to a total of 162,164, Fiat had 8.5% more vehicles registered (96,359), Opel recorded a 9.0% increase in new registrations (92,691), while Citroen – a 5.0% increase to 92,443 vehicles.

Renault Group has been the only Volkswagen rival to increase its market share more notably in Q1 – to 10.8% from 10.0% in the first quarter of 2022. The group saw 27.2% more passenger vehicles registered to a total of 285,688, underpinned by a 41.5% YoY growth at Dacia and a 16.6% YoY increase at Renault.

Hyundai Group has lost 1.0% of market share in Q1, while BMW Group has lost 0.7%. Still, both auto makers saw modest YoY growth in new vehicle registrations – 4.7% for Hyundai and 6.7% for BMW.

Meanwhile, Toyota Group (7.3%) and Mercedes-Benz (5.8%) managed to maintain their EU market shares almost unchanged in Q1.

| New vehicle registrations in the EU by manufacturer | ||

|---|---|---|

| Company | Q1 2023 | Q1 2022 |

| Volkswagen Group | 680,787 | 554,279 |

| Stellantis | 511,91 | 459,822 |

| Renault Group | 285,688 | 224,615 |

| Hyundai Group | 219,464 | 209,659 |

| Toyota Group | 192,869 | 160,977 |

| BMW Group | 164,963 | 154,648 |

| Mercedes-Benz | 153,009 | 131,852 |

| Ford | 99,337 | 101,175 |

| Tesla | 68,699 | 36,508 |

| Nissan | 54,784 | 40,234 |

| Volvo Cars | 53,843 | 51,041 |

New vehicle registrations in key EU markets and by fuel type

The EU auto market as a whole registered a formidable increase in new vehicle registrations during the first three months of 2023. According to the latest ACEA data, a total of 2,650,711 new vehicles were registered between January and March, which translated into a 17.9% YoY surge.

Considering the first four EU economies, vehicle registrations in Spain rose the most in Q1 (44.5% YoY to 237,563 vehicles) followed by registrations in Italy (26.2% YoY growth to 427,067 vehicles). New car registrations in France rose 15.2% YoY to reach 420,887 units and those in Germany grew 6.5% YoY to 666,818 vehicles.

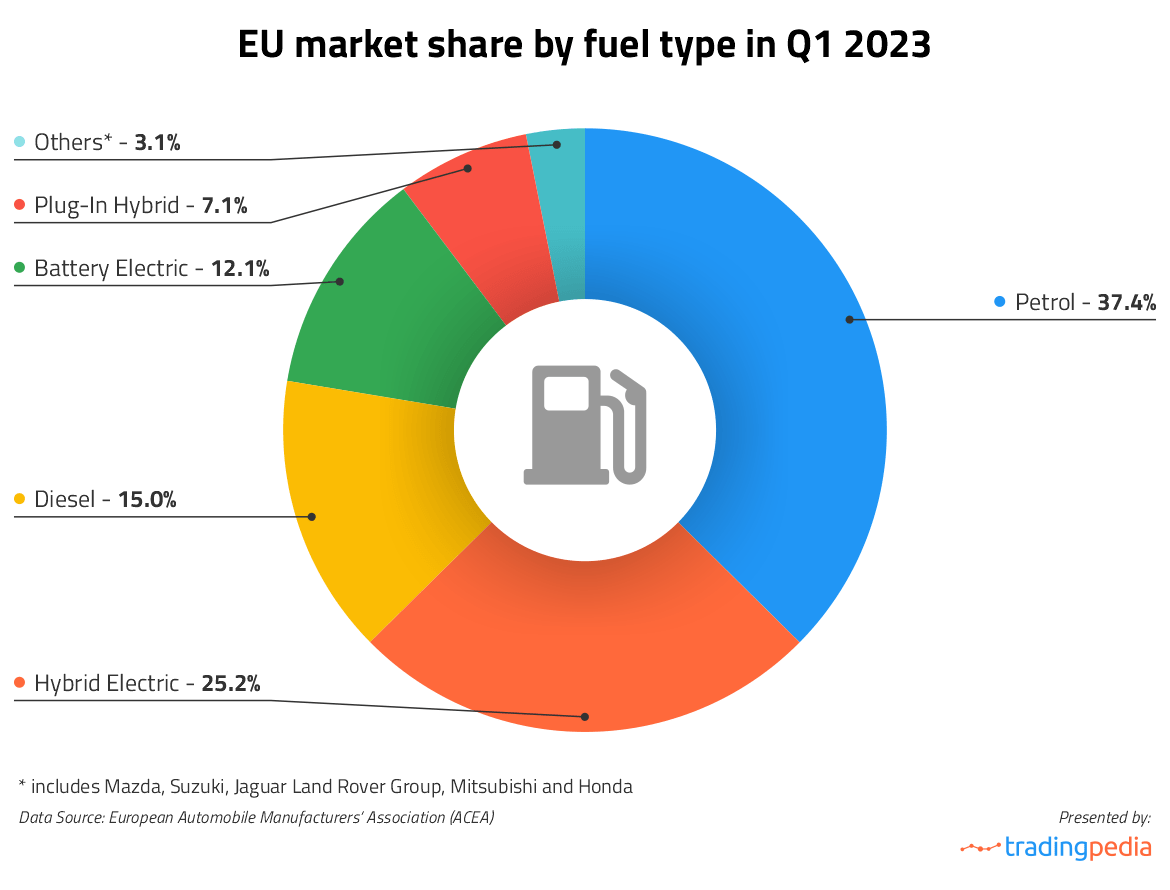

Taking into account the vehicles’ fuel type, new EU registrations of battery electric vehicles recorded the most sizeable growth during the first three months, 43.2% YoY to reach 320,987 vehicles, followed by new registrations of hybrid electric cars (up 28.1% YoY to 668,028 vehicles). New registrations of petrol-based vehicles went up 18.6% YoY to a total of 991,742 units and those of diesel-based vehicles rose 0.8% YoY to 397,562 units.

Despite the transition to more environment-friendly models, petrol-based vehicles still remained dominant in the EU in terms of market share – 37.41%.