Over the past couple of years, household budgets across the United Kingdom have shrunk, with the cost-of-living crisis forcing Britons to spend more on food, rent, utilities, and other essentials. According to official statistics, food prices, in particular, have increased to record levels not seen in the past 45 years.

Driven by a combination of factors including high utility prices, global supply chain issues, and the rise of labour costs in food manufacturing, food price inflation peaked in March and April. Food and non-alcoholic beverage prices rose by 19.2% and 19.1%, respectively, compared to the same months of 2022. Food affordability, however, depends not only on prices but also on income, which fluctuates dramatically across different regions and cities. This prompted the team at TradingPedia to compare the cost of food across the UK relative to average pay and identify the towns and cities where food is the most accessible for residents.

Data reveals Northern Ireland’s Craigavon area is the best place in the UK in terms of food affordability. This is where the average weekly pay will buy you the most groceries, whereas the seaside resort of Blackpool has the most expensive food relative to local wages.

Methodology

A wide range of factors affect food affordability but typically, it is considered the ratio of average wages to the price of either an individual food item or a consumption basket containing several foods. Our team took this exact approach when assessing food affordability in the UK. We checked the prices of 14 different foods at the online cost of living comparison website Numbeo, which provides user-contributed data about consumer prices all over the world.

The types and amounts of foods we looked at were calculated to contain 2400 calories or roughly the average recommended daily intake for an adult according to the website:

- Milk (regular), (0.25 litre)

- Loaf of Fresh White Bread (125.00 g)

- Rice (white), (0.10 kg)

- Eggs (regular) (2.40)

- Local Cheese (0.10 kg)

- Chicken Fillets (0.15 kg)

- Beef Round (0.15 kg) (or Equivalent Back Leg Red Meat)

- Apples (0.30 kg)

- Banana (0.25 kg)

- Oranges (0.30 kg)

- Tomato (0.20 kg)

- Potato (0.20 kg)

- Onion (0.10 kg)

- Lettuce (0.20 head)

We calculated the cost of a week’s worth of consumption and compared it to the average pay in different regions and cities in the UK. We used publicly available data from the Office for National Statistics (ONS) published in the Annual Survey of Hours and Earnings 2022. For our calculations, we used the mean pay for all workers (full and part-time). The ONS provides data for the counties and districts in England, Wales, Scotland, and Northern Ireland. This is the most recent edition of the survey.

It is important to note, however, that food prices are not available for these larger regions but for towns and cities, which is why we looked at the foods in the largest settlement of each county or district. Where data was not available, the prices in the county town were taken into consideration. Also, Numbeo does not provide food prices for a total of 34 localities, so these were omitted.

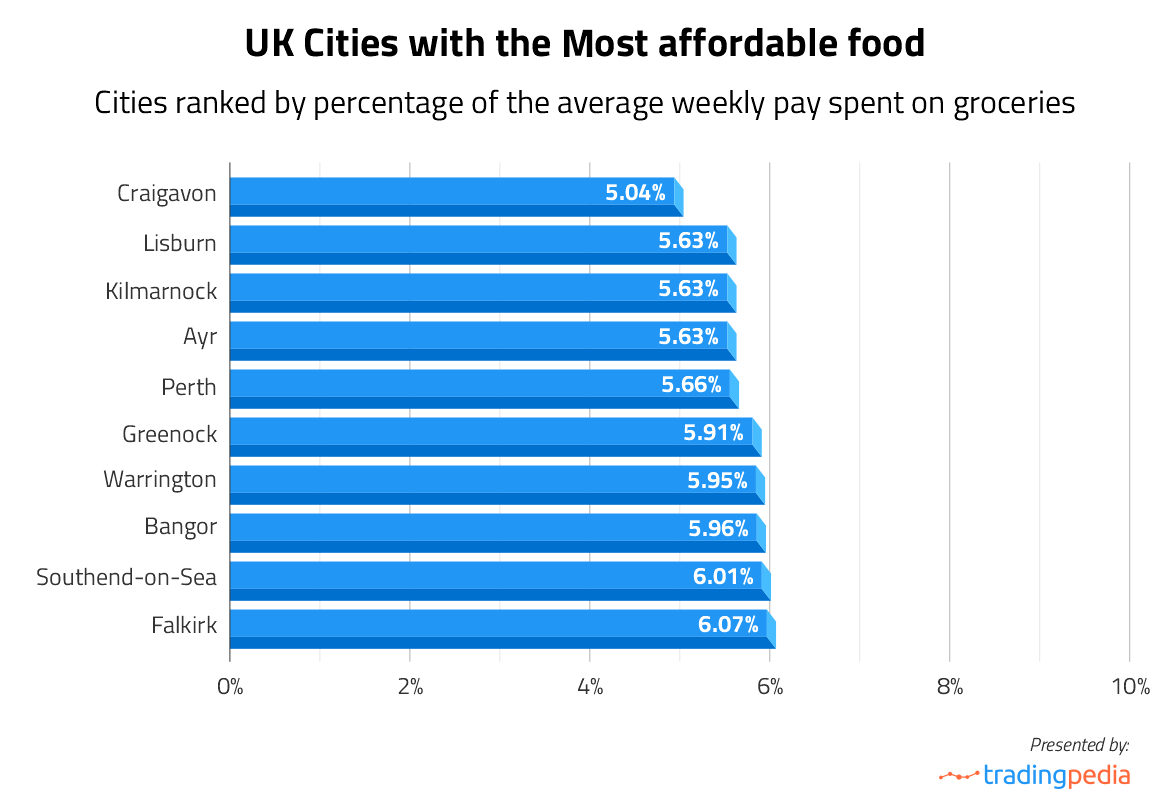

This Is Where Food Is the Most Affordable in the UK

Wages are rising in the United Kingdom but for many people, the increase in pay simply does not align with the rising cost of living. Official statistics from the ONS confirm this: while the average pay rose by 6.9% in March to May compared to the same period last year, real pay dropped by 1.2%. When adjusted for inflation, wages have been slowly falling over the past several months and one of the factors behind this negative trend is food inflation.

However, some towns and cities in the UK saw grocery prices increase more steeply than others. More importantly, average pay in certain places can buy more food compared to others, which is the case with the Northern Irish town of Craigavon.

The town, which was named “the most desirable place to live” in Northern Ireland in a 2017 Royal Mail study, is not particularly developed or highly populated. Yet, Numbeo data shows grocery prices have not increased as much as in other parts of the UK and currently, the cost of groceries for a week (£33.04) is only 5.04% of the average weekly pay of £655.20.

Another city in Northern Ireland ranks second on the list. Unlike Craigavon, which was constructed in the 20th century, Lisburn is a much older town, granted city status in 2002. It ranks second for food affordability; Lisburn residents are paid an average of £626.80 per week and the cost of food is roughly 5.63% of that, or £35.28.

Kilmarnock in East Ayrshire, Scotland, ranks third for food costs also amounting to 5.63% of weekly pay. The average pay according to ONS statistics is £555.90 per week, whereas the overall price of the 14 food items examined is £4.47 per day or £31.29 per week.

Kilmarnock is followed by Ayr, a town located 15 miles away, where residents earn an average of £591.60 a week. The same groceries cost a total of £33.32 or, once again, 5.63% of what they make. Fifth on the ranking is Perth in central Scotland, where we estimate groceries for the week cost roughly 5.66% of the average weekly pay, which is £616.30. It is followed by Greenock, a town in the west central Lowlands of Scotland where residents spend 5.91% of their average weekly pay on groceries.

Ranked 7th in terms of food affordability is the town of Warrington in Cheshire, England. Groceries cost £36.61, which is around 5.95% of the average weekly pay estimated at £615.40. Despite earning significantly less at £497 per week, residents in Bangor, Northern Ireland, spend only slightly more for groceries than those in Warrington. We calculate that 5.96% of their weekly earnings are spent on food. England’s coastal city of Southend-on-Sea ranks 9th with 6.01% of the average weekly pay going to grocery shopping, while Falkirk in the Central Lowlands of Scotland ranks 10th. There, the same food items cost a total of £36.26 per week or 6.07% of the average weekly pay.

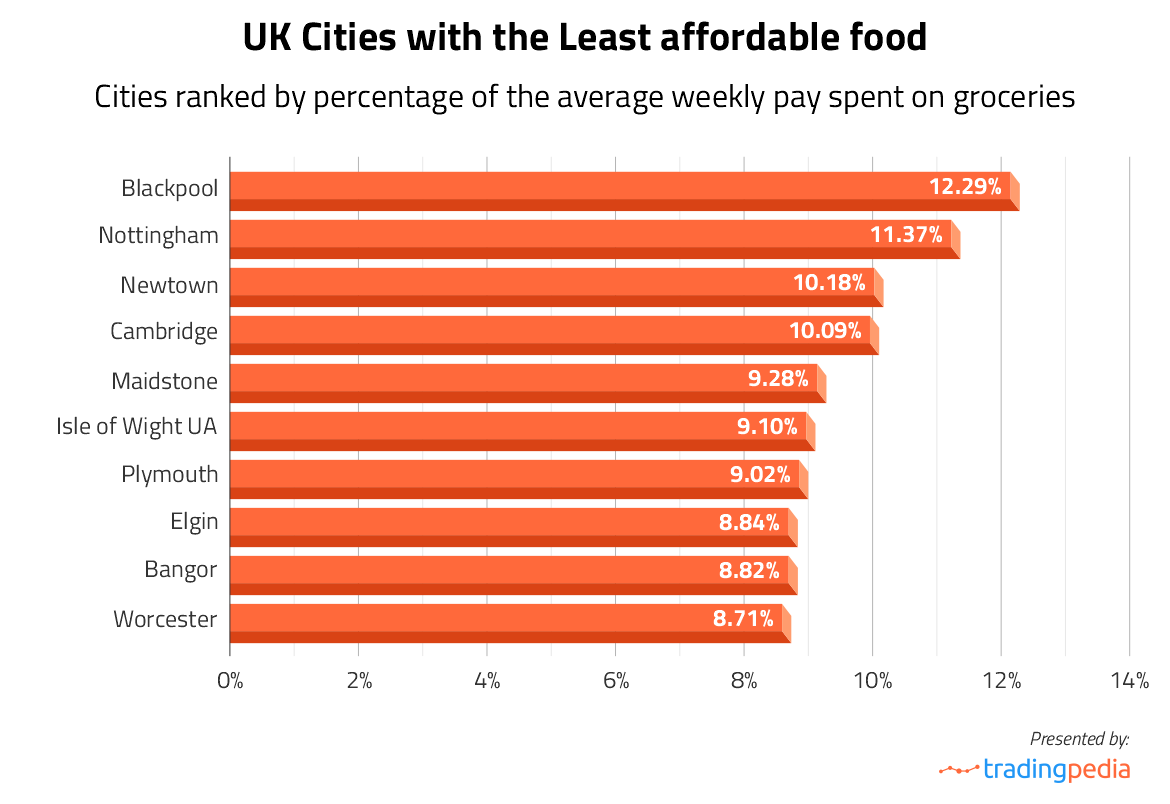

Cities with the Least Affordable Groceries in the UK

Of course, holiday destinations tend to be more expensive for both visitors and locals so it is hardly a surprise that the least affordable place on our ranking is Blackpool. The seaside resort, which sits by the Irish Sea, is often considered a cheaper alternative to more popular holiday destinations such as Brighton. However, with an average weekly pay of only £440.30, the town is not a particularly cheap place to live and buy groceries.

Our calculations show that residents spend approximately 12.3% of their weekly earnings on food. This makes Blackpool the worst place in the UK when it comes to food affordability. In fact, those living within the Blackpool urban area earn the lowest wages in the UK according to ONS statistics.

The second-worst city for grocery shopping is Nottingham where the 14 food items we looked at cost £53.97. Despite boasting the largest economy in the East Midlands, employees are not paid particularly well; they earn an average of £474.80 per week, according to the latest ONS data. This means that they need to spend 11.4% of this on groceries each week.

The third-least affordable place for food is Newtown in Powys, Wales. The price of groceries for one week is roughly 10.2% of the average weekly pay of £522.60. Next on the list is Cambridge where around 10.1% of weekly pay is spent on food. The average weekly pay in the university city is £572.90, while the price of groceries for the week totals £57.82. At £59.85, food is slightly more expensive in Maidstone, the largest town in Kent. However, wages are higher, according to ONS data, with an average weekly pay of £645. This means that groceries cost roughly 9.3% of the average pay.

Raw Data

| Rank | City | County/District | Region/Country | Average weekly pay in 2022 | Shopping basket price (daily min. food cost) | Weekly min. amount of money for food | Cost of food as a percentage of the average weekly pay |

|---|---|---|---|---|---|---|---|

| 1 | Craigavon | Armagh City, Banbridge and Craigavon | Northern Ireland | £655.20 | £4.72 | £33.04 | 5.04% |

| 2 | Lisburn | Lisburn and Castlereagh | Northern Ireland | £626.80 | £5.04 | £35.28 | 5.63% |

| 3 | Kilmarnock | East Ayrshire | Scotland | £555.90 | £4.47 | £31.29 | 5.63% |

| 4 | Ayr | South Ayrshire | Scotland | £591.60 | £4.76 | £33.32 | 5.63% |

| 5 | Perth | Perth and Kinross | Scotland | £616.30 | £4.98 | £34.86 | 5.66% |

| 6 | Greenock | Inverclyde | Scotland | £550.80 | £4.65 | £32.55 | 5.91% |

| 7 | Warrington | Cheshire | North West England | £615.40 | £5.23 | £36.61 | 5.95% |

| 8 | Bangor | Ards and North Down | Northern Ireland | £497.00 | £4.23 | £29.61 | 5.96% |

| 9 | Southend-on-Sea | Essex | East of England | £675.20 | £5.80 | £40.60 | 6.01% |

| 10 | Falkirk | Falkirk | Scotland | £597.10 | £5.18 | £36.26 | 6.07% |

| 11 | London | London | England | £844.40 | £7.43 | £52.01 | 6.16% |

| 12 | Nuneaton | Warwickshire | West Midlands | £576.00 | £5.09 | £35.63 | 6.19% |

| 13 | Belfast | Belfast | Northern Ireland | £717.00 | £6.44 | £45.08 | 6.29% |

| 14 | Newry | Newry, Mourne and Down | Northern Ireland | £634.40 | £5.70 | £39.90 | 6.29% |

| 15 | Milton Keynes | Buckinghamshire | South East England | £693.20 | £6.33 | £44.31 | 6.39% |

| 16 | Aberdeen | Aberdeenshire | Scotland | £617.90 | £5.70 | £39.90 | 6.46% |

| 17 | Woking | Surrey | South East England | £725.40 | £6.75 | £47.25 | 6.51% |

| 18 | Wrexham | Wrexham | Wales | £589.10 | £5.49 | £38.43 | 6.52% |

| 19 | Edinburgh | Edinburgh | Scotland | £668.80 | £6.38 | £44.66 | 6.68% |

| 20 | Gloucester | Gloucestershire | South West England | £574.80 | £5.49 | £38.43 | 6.69% |

| 21 | Reading | Berkshire | South East England | £696.30 | £6.70 | £46.90 | 6.74% |

| 22 | Telford | Shropshire | West Midlands | £559.60 | £5.40 | £37.80 | 6.75% |

| 23 | Hereford | Herefordshire | West Midlands | £531.50 | £5.20 | £36.40 | 6.85% |

| 24 | Stirling | Stirling | Scotland | £657.80 | £6.46 | £45.22 | 6.87% |

| 25 | Southampton | Hampshire | South East England | £586.70 | £5.80 | £40.60 | 6.92% |

| 26 | Bristol | Bristol | South West England | £616.00 | £6.11 | £42.77 | 6.94% |

| 27 | Inverness | Highland | Scotland | £576.60 | £5.78 | £40.46 | 7.02% |

| 28 | Birmingham | West Midlands Met County | West Midlands | £569.10 | £5.77 | £40.39 | 7.10% |

| 29 | Middlesbrough | North Yorkshire | North East England | £524.50 | £5.32 | £37.24 | 7.10% |

| 30 | Cardiff | Cardiff | Wales | £582.40 | £5.95 | £41.65 | 7.15% |

| 31 | Derry (Londonderry) | Derry City and Strabane | Northern Ireland | £559.70 | £5.74 | £40.18 | 7.18% |

| 32 | Carmarthen | Carmarthenshire | Wales | £559.80 | £5.78 | £40.46 | 7.23% |

| 33 | Darlington | Durham | North East England | £562.80 | £5.87 | £41.09 | 7.30% |

| 34 | Bournemouth | Dorset | South West England | £587.40 | £6.21 | £43.47 | 7.40% |

| 35 | Stoke-on-Trent | Staffordshire | West Midlands | £514.10 | £5.51 | £38.57 | 7.50% |

| 36 | Northampton | Northamptonshire | East Midlands | £642.70 | £6.89 | £48.23 | 7.50% |

| 37 | Worthing | West Sussex | South East England | £599.60 | £6.52 | £45.64 | 7.61% |

| 38 | Norwich | Norfolk | East of England | £552.40 | £6.01 | £42.07 | 7.62% |

| 39 | Swindon UA | Wiltshire | South West England | £646.30 | £7.04 | £49.28 | 7.62% |

| 40 | Enniskilllen | Fermanagh and Omagh | Northern Ireland | £601.20 | £6.55 | £45.85 | 7.63% |

| 41 | Newcastle upon Tyne | Tyne and Wear | North East | £588.20 | £6.43 | £45.01 | 7.65% |

| 42 | Watford | Hertfordshire | East of England | £684.20 | £7.56 | £52.92 | 7.73% |

| 43 | Newport | Newport | Wales | £556.50 | £6.18 | £43.26 | 7.77% |

| 44 | Sheffield | South Yorkshire | Yorkshire and the Humber | £557.00 | £6.19 | £43.33 | 7.78% |

| 45 | Dunfermline | Fife | Scotland | £552.90 | £6.19 | £43.33 | 7.84% |

| 46 | Livingston | West Lothian | Scotland | £588.40 | £6.59 | £46.13 | 7.84% |

| 47 | Swansea | Swansea | Wales | £539.10 | £6.10 | £42.70 | 7.92% |

| 48 | Glasgow | Glasgow | Scotland | £585.60 | £6.64 | £46.48 | 7.94% |

| 49 | Leeds | West Yorkshire | Yorkshire and the Humber | £608.10 | £6.94 | £48.58 | 7.99% |

| 50 | Brighton | East Sussex | South East England | £599.00 | £6.85 | £47.95 | 8.01% |

| 51 | Leicester | Leicestershire | East Midlands | £490.90 | £5.66 | £39.62 | 8.07% |

| 52 | Bath | Somerset | South West England | £652.80 | £7.54 | £52.78 | 8.09% |

| 53 | Kirkwall | Orkney Islands | Scotland | £553.20 | £6.39 | £44.73 | 8.09% |

| 54 | Aberystwyth | Ceredigion | Wales | £552.30 | £6.38 | £44.66 | 8.09% |

| 55 | Kingston upon Hull | East Riding of Yorkshire | Yorkshire and the Humber | £489.70 | £5.67 | £39.69 | 8.10% |

| 56 | Liverpool | Merseyside | North West England | £568.90 | £6.62 | £46.34 | 8.15% |

| 57 | Manchester | Greater Manchester | North West England | £540.10 | £6.29 | £44.03 | 8.15% |

| 58 | Luton | Bedfordshire | East of England | £557.20 | £6.49 | £45.43 | 8.15% |

| 59 | Falmouth | Cornwall | South West England | £518.90 | £6.06 | £42.42 | 8.17% |

| 60 | Ipswich | Suffolk | East of England | £562.90 | £6.61 | £46.27 | 8.22% |

| 61 | Lincoln | Lincolnshire | East Midlands | £600.40 | £7.11 | £49.77 | 8.29% |

| 62 | Dundee | Dundee | Scotland | £537.00 | £6.46 | £45.22 | 8.42% |

| 63 | Oxford | Oxfordshire | South East England | £608.40 | £7.38 | £51.66 | 8.49% |

| 64 | Carlisle | Cumbria | North West England | £503.60 | £6.14 | £42.98 | 8.53% |

| 65 | Rhyl | Denbighshire | Wales | £472.30 | £5.76 | £40.32 | 8.54% |

| 66 | Derby | Derbyshire | East Midlands | £553.60 | £6.82 | £47.74 | 8.62% |

| 67 | Dumfries | Dumfries and Galloway | Scotland | £506.60 | £6.30 | £44.10 | 8.71% |

| 68 | Worcester | Worcestershire | West Midlands | £610.50 | £7.60 | £53.20 | 8.71% |

| 69 | Bangor | Gwynedd | Northern Ireland | £500.70 | £6.31 | £44.17 | 8.82% |

| 70 | Elgin | Moray | Scotland | £518.40 | £6.55 | £45.85 | 8.84% |

| 71 | Plymouth | Devon | South West England | £501.30 | £6.46 | £45.22 | 9.02% |

| 72 | Isle of Wight UA | Isle of Wight | South East England | £489.90 | £6.37 | £44.59 | 9.10% |

| 73 | Maidstone | Kent | South East England | £645.00 | £8.55 | £59.85 | 9.28% |

| 74 | Cambridge | Cambridgeshire | East of England | £572.90 | £8.26 | £57.82 | 10.09% |

| 75 | Newtown | Powys | Wales | £522.60 | £7.60 | £53.20 | 10.18% |

| 76 | Nottingham | Nottinghamshire | East Midlands | £474.80 | £7.71 | £53.97 | 11.37% |

| 77 | Blackpool | Lancashire | North West England | £440.30 | £7.73 | £54.11 | 12.29% |