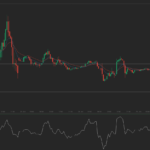

Having retreated more than 0.8% last week following policy decisions by the Bank of England and the Bank of Japan, the GBP/JPY currency pair was mostly steady on Monday, but not far from recent 1 1/2-month trough.

The Bank of England left its benchmark interest rate without change at 5.25% at its September meeting, with borrowing costs staying at their highest level since 2008.

BoE policy makers chose a wait-and-see approach after the latest inflation and employment data implied that the accumulated impacts of prior policy tightening might be coming into effect.

BoE’s Monetary Policy Committee voted 5-4 in favor of keeping interest rates on hold, as four members supported an additional 25 basis point hike.

This has been the first pause in the central bank’s rate-hiking cycle in almost 2 years, which drove the GBP/JPY pair as low as 180.714 – its weakest level since August 7th.

The BoE’s decision came one day after official data showed that UK’s annual consumer inflation had surprisingly decelerated to 6.7% in August from 6.8% in July.

Meanwhile, the Japanese Yen came under pressure after the Bank of Japan maintained its ultra-accommodative policy and again pledged to keep monetary support until Japan’s inflation sustainably reaches the 2% target.

The BoJ Board again said that it would patiently continue with monetary easing and respond to macroeconomic developments amid extremely high uncertainty domestically and abroad.

The monetary policy committee reiterated it would take extra easing measures if necessary, while being mindful of rising inflation expectations.

“Central banks in the UK, the Euro area, and Japan have ‘turned tail’. They’re now testing the thesis that their slowing economies portend a defeat of the inflation impulse, or that the slowdowns are serious enough to no longer wish to tempt the fates with more tightening,” Thierry Wizman, global Forex and interest rates strategist at Macquarie Group, was quoted as saying by Reuters.

As of 7:54 GMT on Monday GBP/JPY was edging up 0.10% to trade at 181.670.