In early 2024, gold’s price reached $2,200 per ounce, with many predictions showing further increases in the price by the end of the year. There are several factors that will affect the precious metal’s value, and we cover different experts’ forecasts to provide an informative guide on the gold price in 2024.

Key Takeaways:

- Gold price reached a historical high on March 20, 2024, trading at $2,204 per ounce

- Experts believe the gold price will continue its surge in the rest of 2024, with forecasts showing a price rate of $2,300 per ounce in 2024

- Analysts predict an upward trend for the gold price between the years 2024 and 2030

- Market instability and increased demand for precious metals are among the factors affecting the gold price

- Experts believe XAU/USD is a preferable investment asset, with optimistic forecasts predicting a price point of over $4,000 per ounce by 2030

With many investors interested in the precious metal and its growing potential as an investment asset, we have made sure to cover the most recent data on the topic. Our analysis is based on a handful of factors that have proven to be key drivers for the recent price surge of the precious metal. The components that have influenced the change in gold’s price include the turmoil in the US economy, the possible weakening of the US dollar, the Federal Reserve’s plans for rate cuts, inflation forecasts, tension in the global geopolitical landscape, and the investors’ sentiments on the gold price.

Out of the aforementioned factors that have a strong impact on the gold price, we can differentiate four main elements that will play a major role in the price increase of the precious metal in the rest of 2024. Those include:

- Geopolitical tensions

- Inflation stabilization

- The questionable future strength of the US dollar

- The US Federal Reserve’s monetary policy as a response to the economic turmoil in the US

Historical Gold Price Fluctuations and Factors that Used to Affect Precious Metals Value

The price of gold used to be influenced mostly by the volume of transactions made between investors in the Western and Eastern markets. While the Western part of the world was responsible for the balance between supply and demand, Eastern markets matched the price and were active actors in the transactions of gold.

Historically speaking, the link between gold and US Treasury real yield was also a factor that had a significant effect on the fluctuations in the gold price. As the real yield declined, bonds were no longer an attractive asset for investors, and as a result, they would focus on gold purchases. Meanwhile, when the real yield experienced an increase, investors would go back to bonds and gold investments would be reduced, affecting the price of the precious metal.

The aforementioned factors, however, have stopped having any significant impact on the gold price since the end of 2022. The 10-year US Treasury Yield gained to 4.33%, exceeding previous 2022 highs. Despite that, the price of gold did not decline, with the precious metal marking a 16% price increase between November 2022 and August 2023, trading at $1,954 by the end of this period.

By the third quarter of 2022, we have noticed that the connection between gold price and transaction volumes has also become insignificant. While the fact that the UK and Switzerland have become Netoo-exporters of gold was supposed to inflict a slump in the gold price, this has not happened, indicating that the Western markets had no real influence on the price point of the precious metal.

Factors Currently Impacting the Gold Price

In 2024, the factors that have a significant impact on the gold price have changed. The ongoing geopolitical tensions have caused an increase in the gold price in 2024. Following the geopolitical conflicts of 2022, the US dollar has transformed into a risky asset for a large number of countries. This has led to the Central Banks of countries in Europe, the Middle East, and the Global South pushing for gold reserve build-up strategies

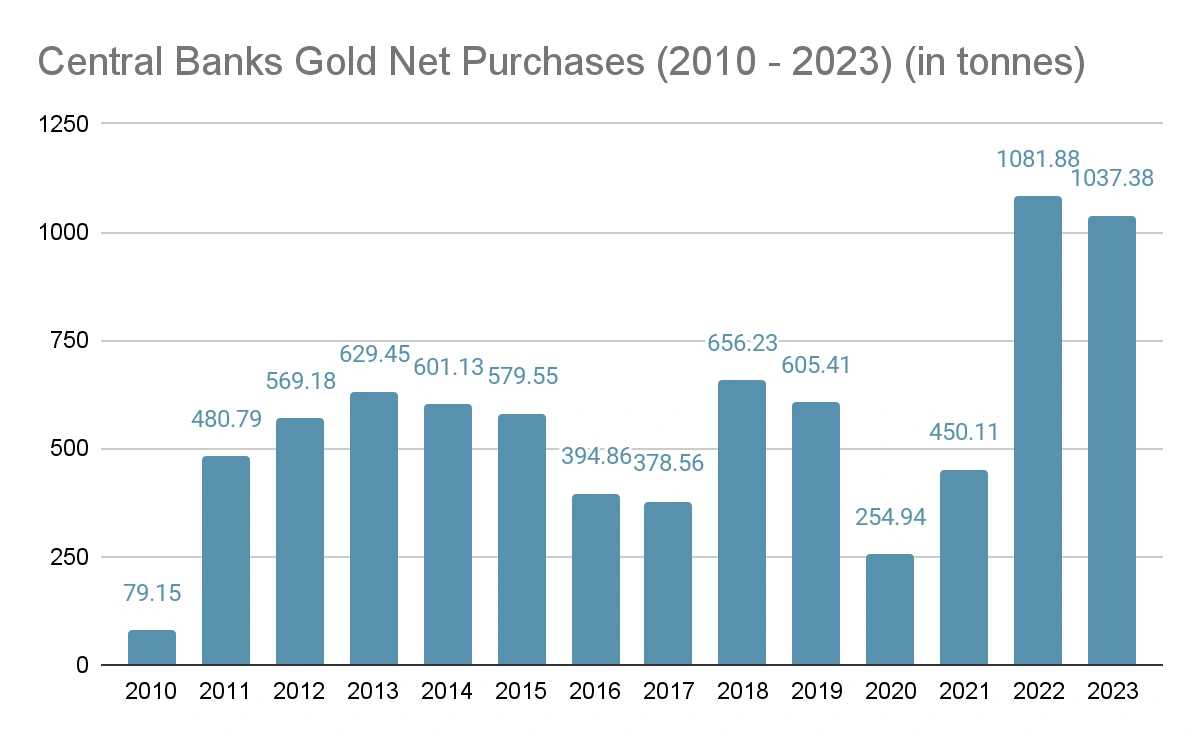

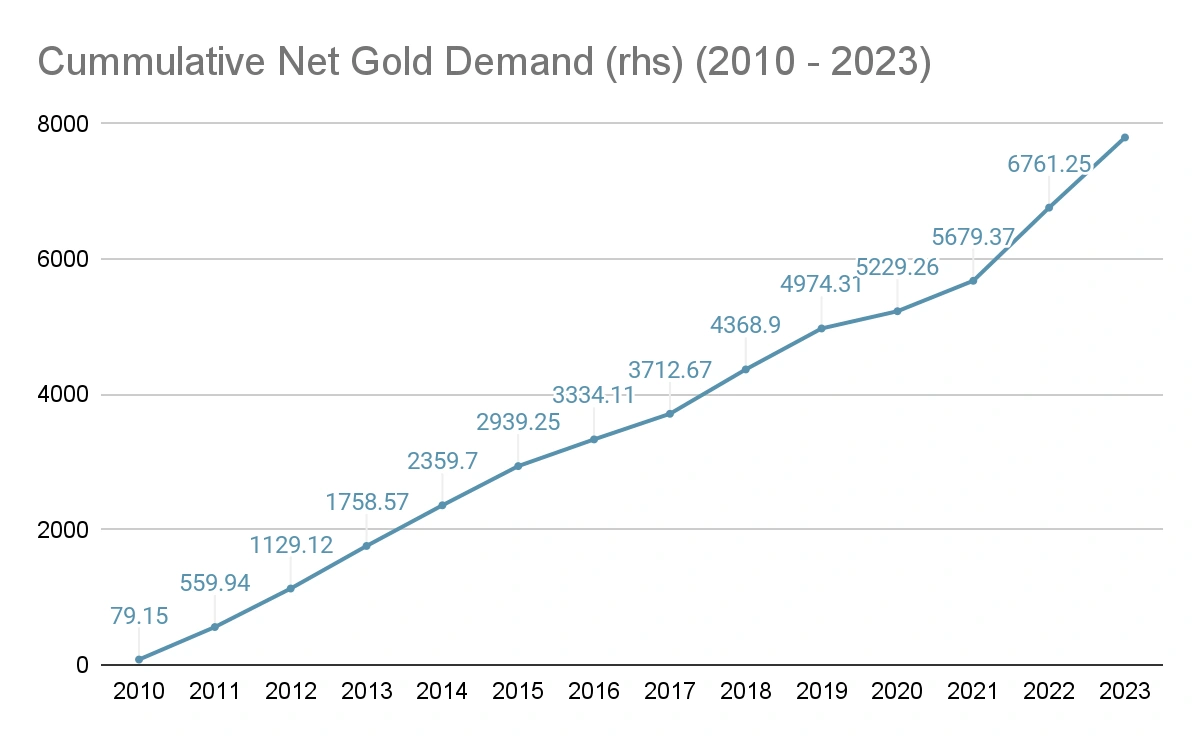

Data shared in a World Gold Council (WGC) report revealed that in the first nine months of 2023, central banks bought 800 tonnes of golf, making a 14% year-over-year increase in demand. By the end of 2023, the total amount of gold that central banks have added to their assets amounted to 1,037 tonnes.

The conflict between Palestine and Israel has also affected the value of gold, with its price gaining over 8% since October 2023. This further proves that any geopolitical conflict is currently increasing the value of the precious metal.

As inflation’s peak has passed at the end of 2023, a more stabilized inflation rate will also have an impact on the current price of gold. Most analysts predict that inflation will keep on easing in 2024, which will most likely affect the interest rates on government bonds. The lower the inflation rate, the fewer investors will show interest in bonds. As a result, the focus will be shifted to gold, ultimately boosting its price point by the end of 2024.

The shaky strength of the US dollar is yet another factor that has a direct impact on the demand for gold, and hence, its price increase. Investors from the global market have recognized the value of gold, putting their investments into the precious metal as a means of amassing savings and preventing significant losses from inflation and currency risks. As countries like China, Russia, Brazil, and India are looking for ways to stabilize their currencies, the demand for gold in said BRICKS members has increased significantly.

As investors are focused on the US Federal Reserve’s response to inflation, this has also become a key factor playing a role in the increasing value of gold in 2024. The Fed had plans for introducing rate cuts in Q3 of fiscal 2024, which can turn out to attract a large number of investors enjoying high-risk assets. Currently, the US interest rate is 5.5%, with inflation declining to 3.1% in the first month of 2024. According to Jerome Powell, Federal Reserve Chairman, interest rates may be cut most likely in June. That said, the Fed chairman confirmed that interest rate cuts are possible only if the Central Bank can ensure a steady inflation decline, expected to maintain a low rate of around 2%.

Analysts’ Forecasts on Gold Price in 2024

Analysts believe the aforementioned four factors are to have a great impact on the gold price in the following months, with positive forecasts predicting the gold price of $2,300 by the end of 2024. To give a better analysis of the precious metal and its value in the months and years to come, we have compiled the section below, offering the forecasts of expert analysts in the trading and financial sectors. A common sentiment among all trading experts is that gold’s value will continue to surge, with several factors showing clear indications for a significant increase in gold’s price in 2024.

According to Kar Yong Ang, financial market analyst at Octa, the increased gold purchase by central banks will be one of the biggest factors that will lead to gold price growth in 2024. The analyst believes that if the demand in major markets continues to grow, reaching an average of 40% of the gold composition in reserves, the asset will enjoy another $3.2 trillion added to its value. Predictions for 2024 reveal an average price per ounce of gold of $2,170, with different factors contributing to the gains predicted by the Octo analyst. If gold continues to enjoy high demand, the expert forecasts a 25% year-over-year increase in 2025, with predictions for the gold price in 2025 reaching $2,500 per ounce.

According to Kar Yong Ang, inflation rates will also contribute to the gold price increase, indicating that the price of the precious metal is traditionally in a negative correlation to the inflation rate. The financial analyst believes that the steadily declining inflation rate will reduce the interest rates on government bonds. On the contrary, the appeal of non-interest assets will increase, boosting the value of gold in 2024.

In a note published on February 16, analysts Daniel Hynes and Soni Kumari also gave their predictions for a surge in gold price in 2024. According to the experts, the recent gain in value will be an ongoing trend in Q1 2024 as well. Their forecast for the precious metal is to reach a price point of $2,200 per ounce towards the end of the year. The two financial market analysts believe that upcoming US elections as well as Fed’s rate cuts will be the most prominent drivers of the increase in gold’s price by the end of 2024.

Analysts from ANZ Research have also seen great potential in the gold price increase in 2024, with analysis from March 6 showing an upgrade of ANZ Research gold demand estimates to 1,050 tonnes from 750 tonnes for 2023 and 800 tonnes for 2024. If it is assumed that the current buying pace continues to grow, market analysts predict the gold price to average above $2,000 per ounce in 2024.

Analysts from one of the biggest banks in America, JP Morgan, also predict a gold price surge in 2024, with estimates showing a value of about $2,175 per ounce by the end of the year. Experts believe that the surge in the precious metal’s value may be attributed to declining US real yield and the Federal Reserve’s plans for rate cuts in Q3.

Financial experts of the bank believe the geopolitical landscape will have a serious impact on gold’s price in 2024. Bank analysts predict that a surge in oil prices amid the tensions in the Middle East that can lead to disastrous outcomes and weakening of the energy infrastructure in the Middle East can drive the price of gold even higher. Forecasts for the end of 2024 predict oil prices of $150 per barrel and gold trading at $2,400 per ounce.

Highlighting factors like the ongoing global conflicts and macroeconomic risks linked to inflation and regulator’s policies, experts from the UBS Group AG predict gold price growth of 10% by the end of 2024. Analysts expect the precious metal’s value to reach about $2,250 per ounce towards the last months of 2024. UBS experts also advise gold investors to consider hedging as well as diversifying investments based on the risk levels.

Another group of financial experts that predict a surge above the $2,000 mark for the gold price include analysts from Wallet Investor. According to them, the asset’s value will range somewhere between $2,133.79 and $2,167.39 throughout the year, reaching $2,150 by the end of 2024. Experts from Wallet Investor also predict a gold price of around $2,154.47 and $2,201.41 for the initial three months of 2025.

| Analysts Predictions for Gold Price in 2024 | |

|---|---|

| Analysts/Agency | Forecast for 2024 Gold Price (per ounce) |

| Octa | $2,170.00 |

| Hynes and Kumari | $2,200.00 |

| ANZ Research | Above $2,000 |

| JP Morgan | $2,175.00 |

| Bank of America | $2,400.00 |

| UBS | $2,250.00 |

| Wallet Investor | $2,150.00 |

Long Forecast for Gold Price in 2024

The Economy Forecast Agency (EFA), which specializes in long-period financial forecasts, has also published its predictions for the increase in gold price in 2024. Analysts of the agency believe that by the end of March, the precious metal will trade at $2,135, indicating a 4% change. Meanwhile, the April forecast predicts the gold price per ounce to reach $2,109, recording a -2.7% change. By the end of the year, the prognosis of experts of EFA shows a closing price of $2,232 per ounce of gold, which is still above the $2,000 mark.

| Long Forecast for Gold Price in 2024 | ||||

|---|---|---|---|---|

| Month | Open | Low-High | Close | Total,% |

| Mar | 2053 | 2025-2270 | 2135 | 4.00% |

| Apr | 2135 | 2004-2444 | 2109 | 2.70% |

| May | 2109 | 1999-2209 | 2104 | 2.50% |

| Jun | 2104 | 1986-2195 | 2090 | 1.80% |

| Jul | 2090 | 2019-2231 | 2125 | 3.50% |

| Aug | 2125 | 2064-2282 | 2173 | 5.80% |

| Sep | 2173 | 2173-2423 | 2308 | 12.40% |

| Oct | 2308 | 2079-2308 | 2188 | 6.60% |

| Nov | 2188 | 2040-2254 | 2147 | 4.60% |

| Dec | 2147 | 2120-2344 | 2232 | 8.70% |

Source: The Economy Forecast Agency

As for the long forecast for the period between 2024 and 2030, some analysts predict that the gold price may surpass $4,000 per ounce by the end of 2030. According to Coin Price Forecast, another agency focusing on providing long-term financial forecasts, the closing price of gold will be $2,369 per ounce by the end of 2024. Experts predict an upward trend at the beginning of 2025 as well, reaching about $2,769 per ounce at the end of the year. In the next few years, the gold price is expected to surpass the $3,000 mark, with estimates for 2030 revealing a closing price of $4,192 per ounce.

| Long Forecast for Gold Price 2024 – 2030 | |

|---|---|

| Year | Closing Price |

| 2025 | $2,769.00 |

| 2026 | $2,809.00 |

| 2027 | $3,130.00 |

| 2028 | $3,560.00 |

| 2029 | $3,865.00 |

| 2030 | $4,192.00 |

Source: Coin Price Forecast