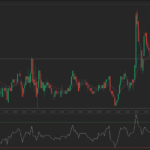

The USD/SEK currency pair surged more than 1% on Wednesday, touching a fresh six-month high of 10.9096, as market players positioned for the prospect of a Donald Trump victory following early results from the US election.

Trump captured 15 states, while Harris won 7 states and Washington, D.C., according to Edison Research. Trump led Harris by 247 electoral votes to 210, with 270 electoral votes required to win the presidency.

Still, critical battleground states, including Pennsylvania, were not likely to be called for hours.

Donald Trump’s tariff and immigration policies are viewed as inflationary, which drove up Treasury yields and the US Dollar.

The Federal Reserve’s monetary policy decision now comes in the spotlight.

The Fed is widely expected to cut its federal funds rate target range by 25 basis points to 4.50%-4.75% at its November meeting.

In September, the Fed began its monetary easing cycle with an out-sized rate cut (by 50 bps), which has been the first reduction in borrowing costs since March 2020.

Meanwhile, SEK traders will also look to the outcome of Riksbank’s November policy meeting on Thursday.

Sweden’s central bank is expected to cut its key policy rate by 50 basis points to 2.75%.

In September, policy makers signaled more rate cuts in the two remaining policy meetings of 2024, in case the outlook for inflation and economic activity remains without change.

As of 9:49 GMT on Wednesday the USD/SEK currency pair was advancing 1.30% to trade at 10.8332.