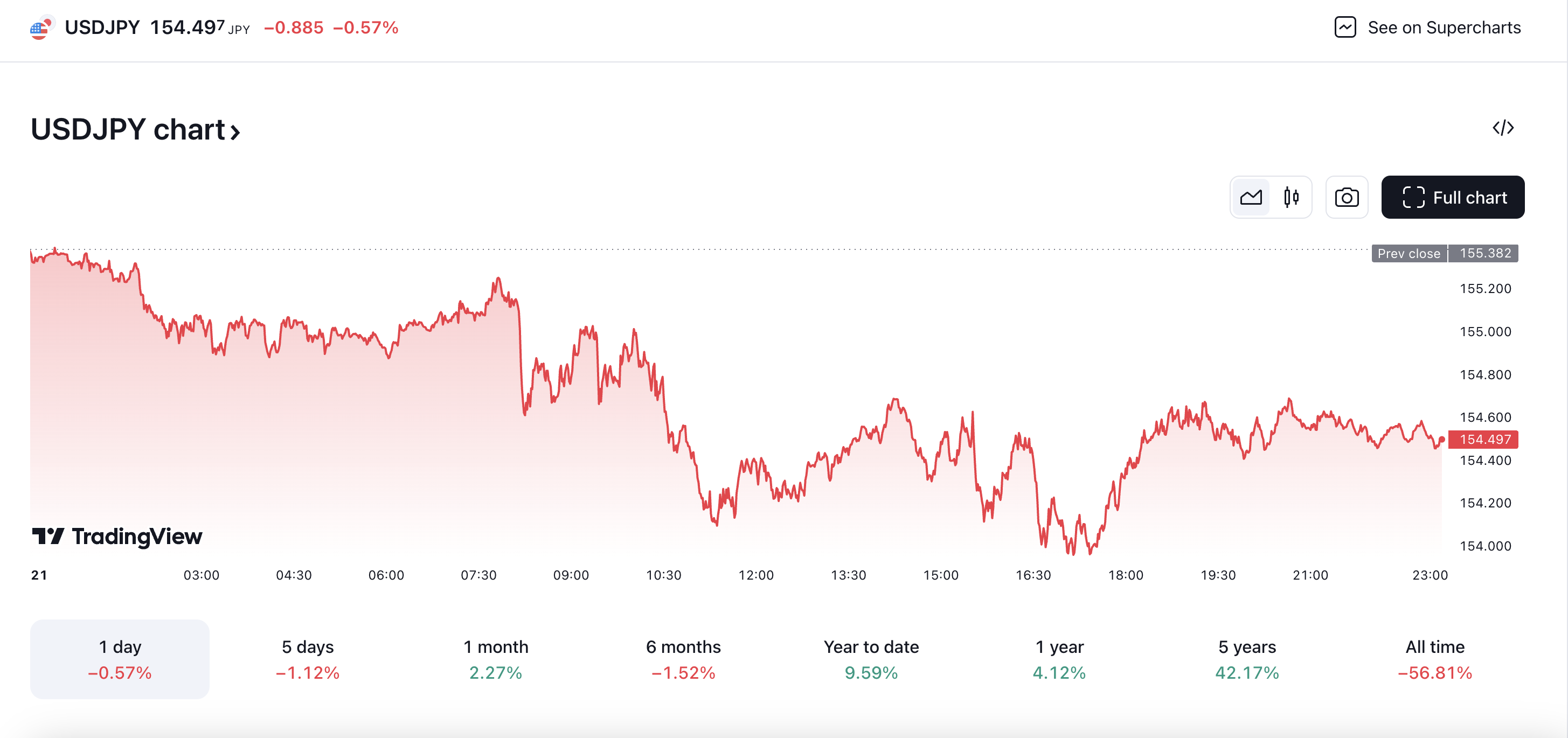

The US dollar’s rally against the Japanese yen appears to be losing steam, with the USD/JPY exchange rate falling towards its weekly low. This decline may reduce the likelihood of a currency intervention, as the initial surge following the US election seems to be unwinding.

Federal Reserve Governor Lisa Cook’s comments suggesting that the central bank is preparing households and businesses for lower interest rates may also weigh on the US dollar. As a result, USD/JPY may struggle to retain its gains from the monthly low, particularly if it fails to defend its weekly low.

The Bank of Japan’s reluctance to pursue a rate-hike cycle may also contribute to a consolidation in USD/JPY over the remainder of the month. However, the exchange rate may attempt to retrace its decline from the yearly high if the Fed moves towards a neutral stance.

The technical outlook for USD/JPY suggests that a close below 153.80 could lead to a move towards 151.95, while a failure to defend the monthly low may push the exchange rate back towards the 148.70-150.30 zone. On the other hand, a close above 156.50 could bring the 1990 high of 160.40 into focus, with the next area of interest coming in around the July high of 161.95.

Overall, the US dollar’s outlook against the Japanese yen appears uncertain, with the exchange rate likely to be influenced by the Fed’s policy decisions and the Bank of Japan’s stance on interest rates.